TigerSoft News Service 7/1/2010 www.tigersoft.com

TigerSoft News Service 7/1/2010 www.tigersoft.com

FOUR SCENARIOS THAT HEAD and

SHOULDER PATTERNS CAN PLAY OUT

AND HOW TO PREDICT THEM IN ADVANCE.

By William Schmidt, Ph.D.

All Rights Reserved (C) 2010 www.tigersoft.com

See

also - Head and Shoulders S10

SHOULDER PATTERNS CAN PLAY OUT

AND HOW TO PREDICT THEM IN ADVANCE.

1) They can Close Decisively below Their Neckline and Start

A Very Big Decline. Apart from how over-valued the market is

fundamentally, the extent of the decline seems to depend

upon:

(1) how far the stock market has rallied without a

significant decline.

(2) how weak the internal strength indicators are.

This is the most important.

(3) the length of the pattern,

(4) the height of the pattern and

(5) whether the neckline is falling (this tends to show

more weakness).

H&S patterns that took more than 40 days to form and

complete are much more bearish than shorter and smaller

patterns, though the appearance of smaller H&S patterns

within larger ones or multiple H&S patterns add extra bearishness.

Since the height of the pattern is used to calculate the MINIMUM

downside potential once the neckline is broken, the higher

the pattern, the greater the downside risk.

1929 shows the most bearish case. Notice how weak the

internals were before the decline: falling A/D Line, mostly

negative P-Indicator and Accumulation. Index. The pattern

lasted more than 40 days and the neckline was declining.

1946 and 1961-62 H&S patterns show the importance of

the length of the pattern. Notice also how internal strength

weakness develops as the right shoulder is formed.

Usually prices break below the neckline and then quickly erode.

In 1946, there was a brief rally back up to the falling 65-dma, a new

smaller head and shoulders pattern and then began the serious

decline.

1961-1962

The Coming of the Cuban Missile Crisis.

1971 shows an initial pattern of more than 40 days'

duration and then additional head and shoulders patterns.

Neckline and Start Modest Decline That

Fulfills Their Minimum Price Objective

and Then Rallies.

1979 shows a smaller pattern. The market was not

over-extended. Its downside minimum objective was

quickly reached.

without Breaking It and Then Advance.

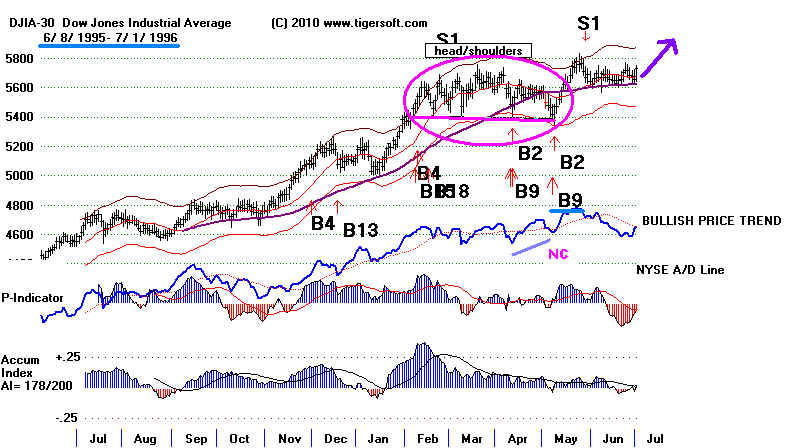

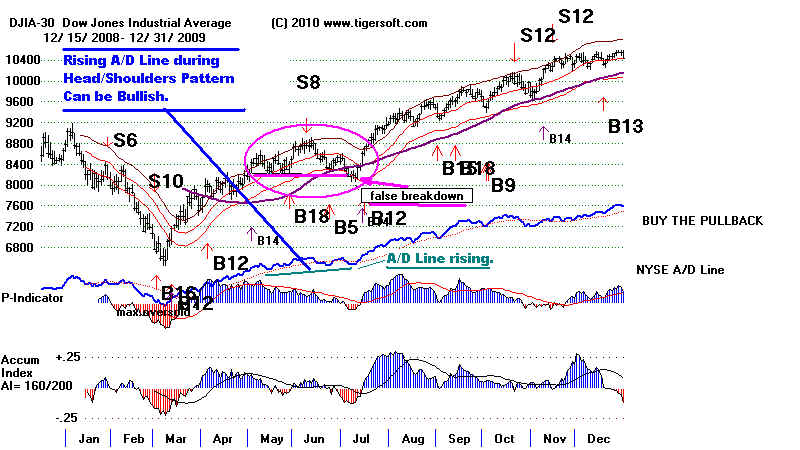

The 1996 case shows an uncompleted H&S pattern. The

neckline was never closed below. Here the rising A/D Line

was a bullish sign and a clue that the pattern would not

be complete. It was a trap for unwary bears, whose later

short-covering fueled the steep rise from 1995 to 2000.