WHEN TO SELL ON WEAKNESS

A HIGH ACCUMULATION "BUBBLE" STOCK

THAT HAS ALREADY MOVED UP 50%

FROM ITS 6-MONTH LOWS

by William Schmidt, Ph.D.

Author of TigerSoft and Peerless

(C) 2010 www.tigersoft.com

See also: TigerSoft's When and What To Sell

8/7/09 Red Warning Flags in Over-Extended Low-Priced Stock

7/17/2009 When to Sell Explosive Super Stocks

7/22/2009 Apple Computer at Its 9 Previous Significant Tops.

Here we are talking about stocks that have previous shown high levels of

Accumulation and now have moved up more than 50% from their 6 months lows.

This is a topic that we have discussed before. It "bears" repeating

because the market is now up so much since the bottom and because we know

it is always hard psychologically to sell at a loss in a strong market, Yet that

is the exactly what we must do. This is the safest way to guard your

investment capital. You must do that.

The stocks that typically are run up in a speculative market very often

do not have lasting power. First they are accumulated, which we spot.

They they make new highs and are pumped with glowing stories and

by their exciting price action. Our research shows that most such stocks

reach their peaks a little after a year from the first bulge of "insider buying",

when the Accumulation Index surpasses +.45. But this is only a general

guideline

As sure as night follows day, at some point, most of these stocks

are dumped or subjected to lots of heavy-handed profit-taking...

unless, of course, they found great riches in mineral wealth or

created something truly unique or are bought out. Maybe a quarter

of the very high Accumulation stocks escape Newton's laws of

gravity. Three quarters of these stocks are "piffle" stocks that have

their moment in the sun and then settle back, sometimes for years.

If you look at long-term charts of a sample of low priced stocks, you

will quickly see how long they languish. They are like 10-year locusts.

You do not want to wait that long for such a stock to recover and

again fly high. Many never do.

So, if you're going to play with the hottest and most volatile stocks,

it is especially important to follow some rules to preserve capital and

sanity. (We would also sugsest using these rules with high caps stocks

and blue chips. But that is another subject.)

Remember the adage "time is money". Bull markets like the one we are

in now occur for a limited time only. If a stock is not doing well and others

show high Accumulation and make new highs, move your money, we would

advise, to the more powerful stock from the weaker one. At the same time,

do not be in a hurry to sell a stock that is rising, say, 10% to 20% a month.

That price action will draw hot performace money into your stock each time

it makes a new high. Stocks that do not break their rising 65-day ma for

a long time have probably trapped lots of short sellers. Each new high

will cause some of them to panic and cover on strength. So, keep your

money in stocks that look and act like the "explosive super stocks" we

show on this website. Buy more of the best, as long as they are not up

more than 30% above their rising 65-day ma or unless they are

breaking out above an obvious horizontal consolidation pattern.

So, we must take up the subject of when to sell on weakness to insure

against a bigger loss and maximize net portfolio gains.

Normally, general market sell signals from Peerless would allow us

to sell on strength. Usually, we would be selling when Tiger's Professional

Closing Power breaks a long uptrend or after there is a big divergence

between it and apparently strong price action. If a stock becomes

hyperbolic, we have also suggested simply using a French Curve to

draw an accelerating price support line; or using a 10-day ma for a

stop loss, or using a sell stop 10% below its recent highs.

But let's say, you chose to ignore Peerless Sell signals, that you

do not pay attention to signs that an explosive super stock is weakening

internally, that you decide not to put a Sell stop in or Sell on a break

in an over-extended Closing Power uptrendline. What should you do then?

Here are our suggestions for when to sell on weakness thin, volatile

"pump and dump" bubble stocks that have already risen 50% in the

last six months.

RULES FOR SELLING STOCKS ON WEAKNESS

IF THE STOCK IS UP MORE THAN 50% IN THE LAST 6 MONTHS.

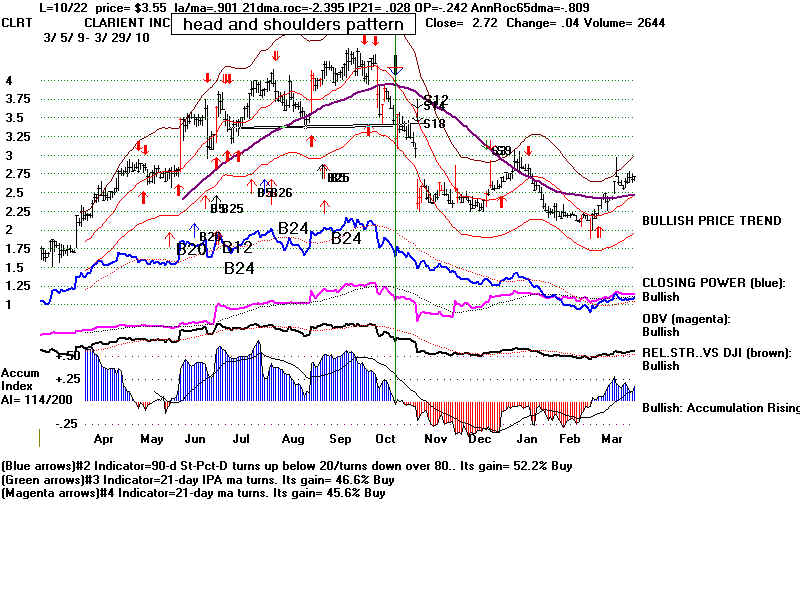

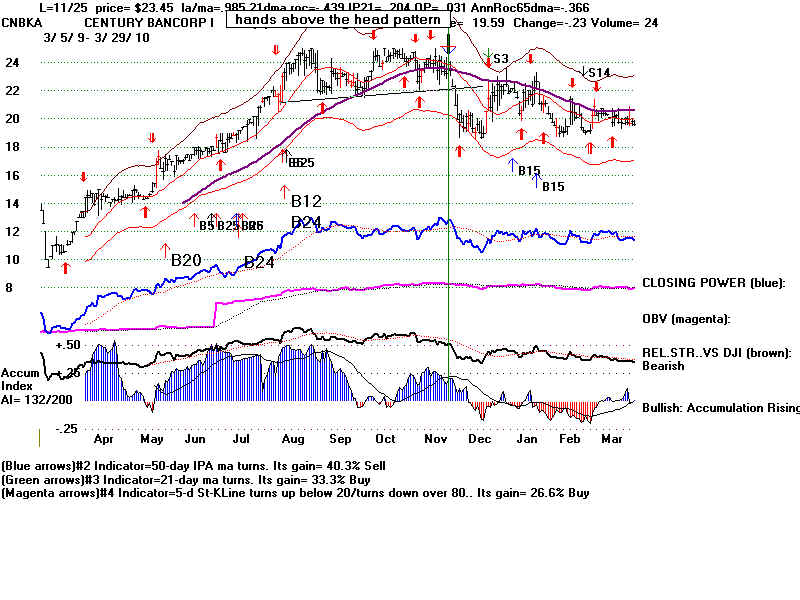

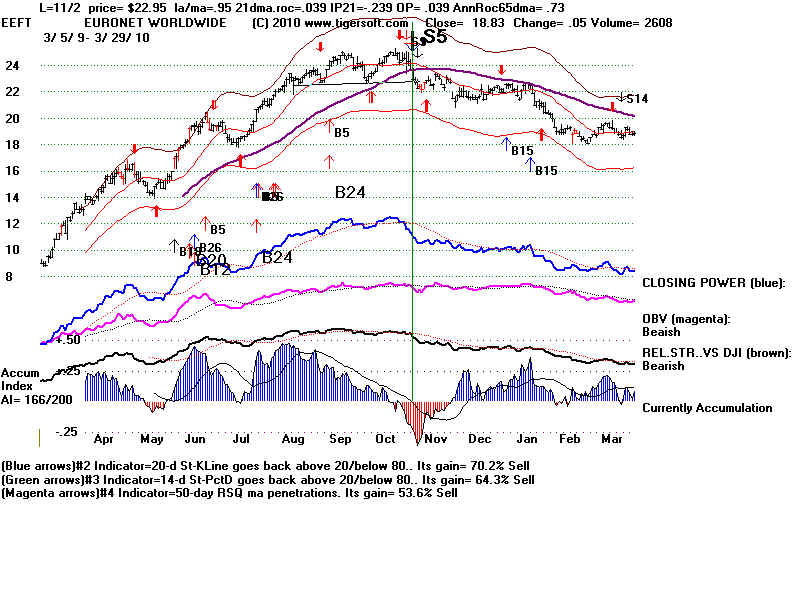

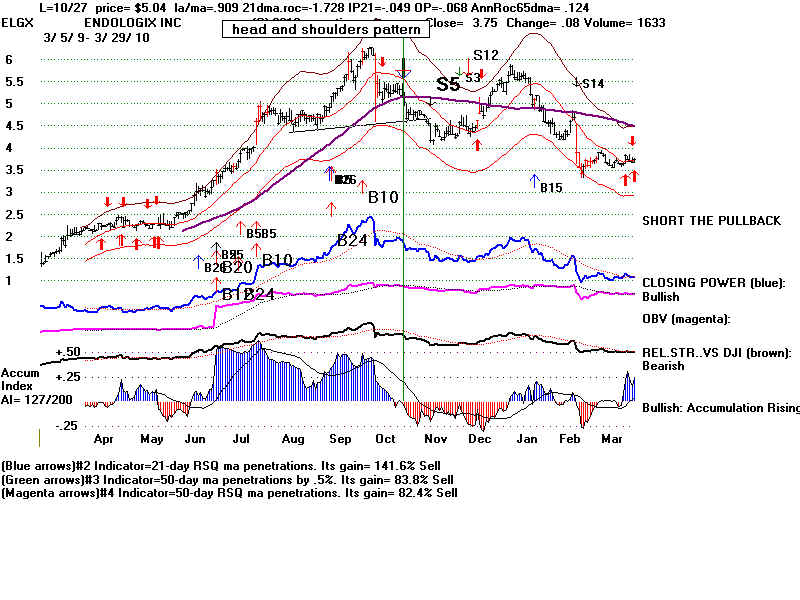

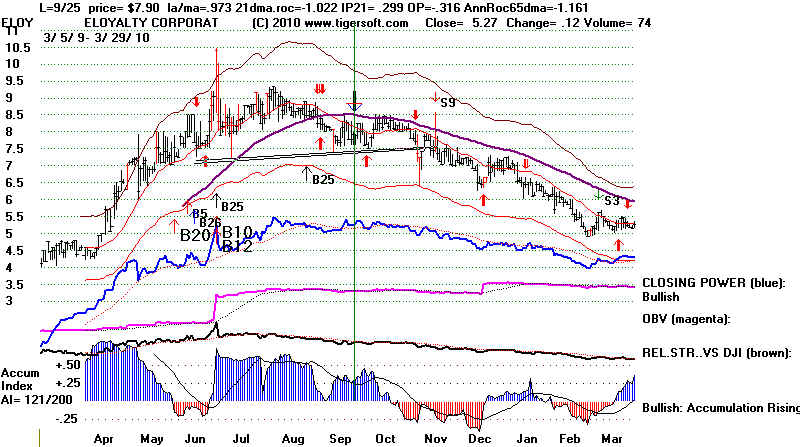

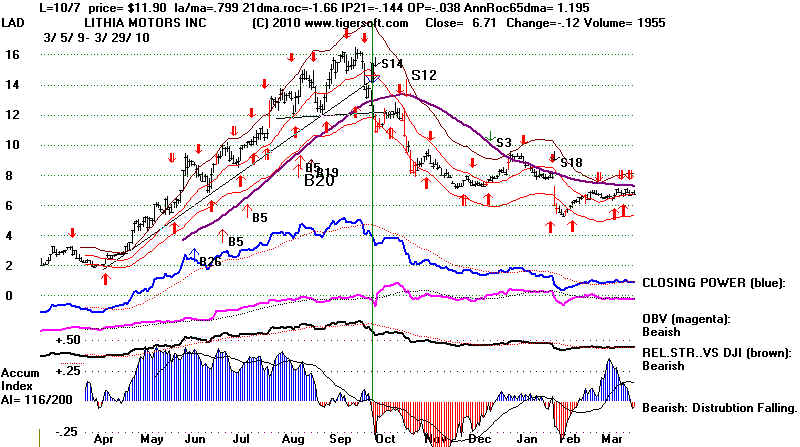

Sell when the stock closes 2% below the 65-day ma if the Accumulation Index

is negative if:

the stock is up more than 200% in 6 months,

shows a head and shoulders pattern or

displays a bearish "hands above the head pattern"

Alternatively, Sell when the 65-day Closing Power turns down even if the

Accumulation Index is positive if the stock is up more than 50% in the

last 6 months.

(This revises our earlier counsel to use a 50-day ma for this purpose.)

Whipsaws are inevitable. Sooner or later you will sell a stock only

to have it quickly turn right back up from a support level, a trendline

or the 30-wk ma. See LPSN below. If it helps keep you disciplined,

Sell and be prepared to buy the stock back if the stockt gets right back

above a rsing 65-day ma with a positive Accumulation Index and a

rising CLosing Power. In the long run, using these rules will preserve

capital and pevent debilitating losses to your count and your psyche.