TigerSoft's Elite Stock Professional Report

10/19/2007 -

(C) 2007 Wm. Schmidt, Ph.D.

===========================================================

---- BUYS:----

AI/200 Close

IMA INVERNESS MEDICAL INNOVATIONS, INC) 59.45 194

Buy - IP21=.45 OBV confirming.

CYCL Centennial Cellular Corp. 9.77 192

Trade with 5-day Stochastic K vs PctD 81.2% gain

ARTL 15.00 +.25 B12... At new high.

MNG 6.55 +.01 B12 ... At new high.

==============================================================================

---- SHORT SALES: ----

Symbol Close AI/200 IP21 OBV confirming weakness.

------ --------- ------ ---- ------------------------

BLG 9.67 -.20 50 -.25 yes

BKNUNA 10.24 -.64 75 -.40 yes

CBON 19.64 -1.73 72 -.20 yes

CHIC 13.91 -.53 66 -.20 yes

CMA 46.53 -.83 83 -.40 yes

CWTR 7.70 -.48 90 -.20 yes

DHI 11.95 -.25 65 -.15 yes

MTG 21.59 -2.36 114 -.40 yes

MU 10.08 -.45 47 -.12 yes

NKTR 6.54 -.13 47 -.50 yes

__________________________________________________________________

Abbreviations:

price versus 50 day ma

AR = Above rising (Bullish)

BF = Below Falling

Current Accum. Index = IP21

TISI = 21-day ma of IP21

A = above

U = Under (Bearish)

SS = Sell Short

BO = Breakout

..........................................

======== AI/200>190 LONG-TME ACCUMULATION =====================

Based on Positive Consistency for the last year.

Performance: Days back= 202

12 / 29 / 2006 - 10 / 19 / 2007

Rank Symbol Name Price Pct.Gain % over 50dma Accum Index Open% Closing%

--------- ----------------------------------- ---------- ------------ ----------- ----------- ------ --------

1 NBG --- 12.25 31% .8% 199 45% 53%

2 BBNK --- 22.28 9% .3% 198 41% 52%

Trade this with a 14-day Stochastic. Wait for a Buy.

3 EWZ ISHARES MSCI BRAZIL INDEX 75.67 61% 13.4% 197 58% 58%

Violated 10-day ma. Needs to consolidate.

4 HEW --- 34.94 35% 2.6% 197 31% 60%

Buy at 33.

5 BBL --- 74.3 99% 17% 196 41% 52%

65 is support. Buy there.

6 ASG Liberty All Star Growth Fund 5.82 8% 1.4% 195 25% 60%

Slow moving...

7 MTMD --- 6.26 36% 1.6% 195 34% 50%

Takeover...

8 ZCO M - too thin.

9 BCF Burlington Coat Factory 16.78 12% 5.1% 194 46% 49%

retail sector is generally too weak.

10 IMA --- 59.45 53% 16.6% 194 47% 51%

Buy - IP21=.45 OBV confirming.

11 CYCL Centennial Cellular Corp. 9.77 35% 1.6% 192 42% 59%

Trade with 5-day Stochastic K vs PctD 81.2% gain

12 ILE --- 3.1 5% 16.9% 192 36% 51%

6 is 12 mo high.

13 ILF ISHARES S&P LATIN AMERICA 40 245.8 44% 10 % 192 57% 58%

Buy at 233 - previous peak.

14 MCZ --- 1.18 110% 10.4% 192 24% 43%

15 GGB Gerdau S.A. 28.3 76% 13.5% 192 56% 52%

IP21=.27 28 is recent support. Buy at 28.

16 OME Omega Protein Corporation 9.99 29% 7.8% 191 38% 48%

IP21<.03

17 RIO --- 33.26 123% 17.6% 191 58% 55%

18 FMS Fresenius Medical Care AG 50.57 13% .3% 190 46% 58%

======== New Highs ========-

Best have an AI/200>140 with

IP21

(Current Accum.)>.25 and

AI/200=>140

and confirming OBV and Itrs>.05

There should not be

a head and shoulders pattern developing as in BBD.

Bearish = NNC - S9 - IP21 on new Stock

high closing.

IP21 bulge - over 45Symbol Close AI/200 IP21 OBV Confirm

------ ----- ------ ---- -----------

APOL 65.20 -2.73 146 .37 yes

ASYS 15.05 -.55 159 .26 yes

ATRI 120.36 -2.62 148 .45 yes. ATRION CORP - looks good.

ATRO 38.94 -.79 147 .24 yes 14-day Stoch Buy +165$/year

AXYS 31.84 -.79 129 .36 yes Axsys Techn - looks good.

AZS 15.20 +.29 184 .30 yes very good.

BBD 29.65

BBL 74.30 -2.90 196 .26 yes

**BIOS 7.94 +.41 134 .50 no Buy B12

BZP 9.80 -.59 153 .25 yes

CEO 178.50 -14.54 172 ,24 yes

CFW 8.26 -.10 178 .40 yes

CLDA 25.59 -.71 171 .25 no

CRN 26.39 -1.01 149 .46 yes

***CVGW 20.50 _.01 170 .50 yes B12 at 17.

DRYS 114.93 -11.23 149 .24 yes

EEB 51.23 -2.99 173 ,35 yes

EQIX 98.19 -2.88 157 .25 yes

EWP 64.01 -1.20 153 .30 yes Spain

EWZ 75.67 04.36 194 .30 no Brazil

EXM 76.63 -4.14 163 .25 no Excel Maritime

FDG 39.82 -.28 172 .25 yes

FXI 199.30 -18.90 180 .25 yes

GLD 75.70 -.23 140 .25 yes Gold Bullion

HEW 34.94 -.77 197 .45 yes

HINT 10.01 -.11 144 .25 yes

IGN 37.31 -.93 143 .30 yes

ILE 245.80 -12.81 192 .35 yes Latin Amer 40 - red sell.

***IMA 55.45 -.55 194 .40 yes

***IMNY 3.01` +.04 185 .30 yes

***IXC 139.54 -5.22 155 .25 no

***KTEC 31.22 171 .50 yes

LFC 96.54 -6.74 150 .25 no

NEOG 25.19 -.22 146 .25 yes

PAC 56.30 -1.33 166 .40 yes

PEO 41.15 -1.28 177 .30 yes

PGJ 35.86 -2.11 188 .30 yes

***PMFG 28.26 181 .30 yes

RIMM 114.97 -2.14 173 .25 yes

SDA 63.24 -3.34 165 .30 yes

SVT 14.80 -.20 187 .12 yes

VE 86.36 -2.54 157 .35 yes

Recent NHs

========================================================================

BUY B12 at 12 mo highs

BUY ARTL 136 15.00 +.25 At new high.

BUY MNG 126 6.55 +.01 At new high. Gap.

|

|

===============================================================================================

------------------------ "BEARISH STOCKS" ------------------------------------------------------------

===============================================================================================

Best - short Only Stocks also with an IP21<-.09 and over $5.

AI/200

================= "Bearish" stocks among new lows. ===================

Stock Close AI/200 IP21 OBV Confirming

--------------------- ------- ----- --------------

FLML 8.41 -.46 10 -.30 yes

MTH 13.28 -.12 18 -.25

SBKC 9.82 -.22 36 -.25 yes

TWP 10.77 +.04 30 -.20 yes

TIBB 10.13 -.09 38 -.30 yes

======================= New Lows ============================

Stock Close AI/200 IP21 OBV Confirming

--------------------- ------- ----- ----------------

BC 20.00 -.60 68 -,07 no

BGG 22.75 -.74 117 -.30 no

BLG 9.67 -.20 50 -.25 yes

BKNUNA 10.24 -.64 75 -.40 yes

CBON 19.64 -1.73 72 -.20 yes

CHIC 13.91 -.53 66 -.20 yes

CHS 12.08 -.65 69 -.20 no

CMA 46.53 -.83 83 -.40 yes

CWTR 7.70 -.48 90 -.20 yes

DHI 11.95 -.25 65 -.15 yes

DSI 41.66 -2.64 83 -.35 no

ETM 17.49 -.53 78 -.25 yes

FLML 8.41 -.46 10 -.30 yes

GCA 10.17 -.44 106 -.33 no

GCT 7.12 -.28 53 -.35 yes

GGC 11.58 -.45 63 -.35 no

GHS 11.16 -.65 83 -.20 yes

GPI 30.77 -.93 87 -.20 yes

HD 30.76 -.92 66 -.25 yes Home Depot in DJI-30

HW 13.91 -.60 63 -.10 yes

IMN 23.54 -1.36 54 -.07 yes

IMP 22.76 -1.56 74 -.25 yes

KRO 17.44 -.65 37 -.15 no

LIZ 28.76 -1.16 101 -.40 no

MTG 21.59 -2.36 114 -.40 yes

MU 10.08 -.45 47 -.12 yes

NKTR 6.54 -.13 47 -.50 yes

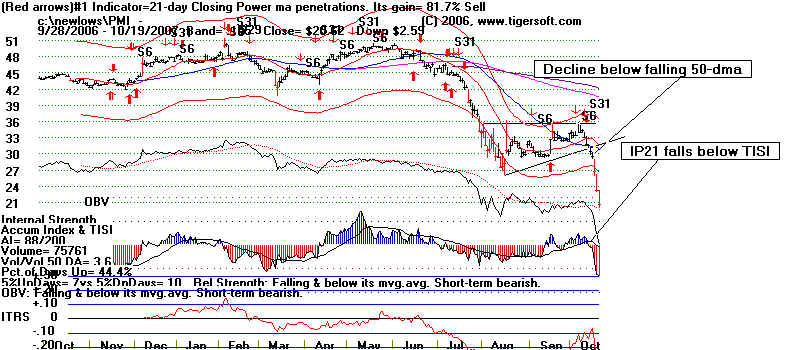

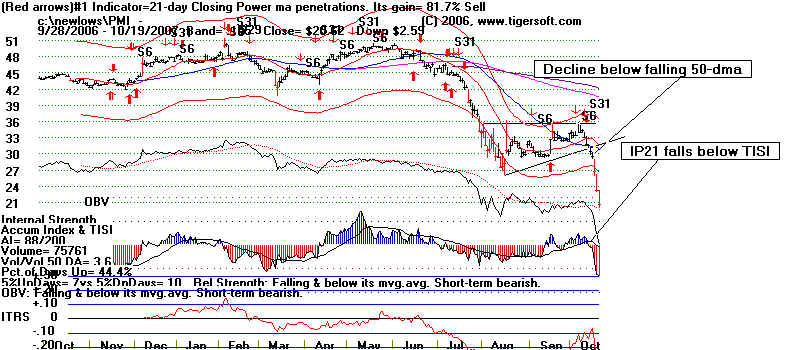

PMI 20.62 -2.59 88 -2.59 yes - steep decline from 30 in 3 days.

This worth studying. Here is the chart.

Note decline below falling 50-day ma.

RDN 14.01 -2.15 61 -.28 no

RF 26.40 -.54 102 -.45 yes

SNV 25.53 -.70 70 -.25 yes

SOV 14.52 -.10 58 -.32 yes

TIBB 10.13 -.09 38 -.35 yes

TRGL 26.40 - .54 102 -.45 yes

TRY 11.55 -1.09 78 -.35 yes

VRX 14.62 -.29 63 -.20 no

VVTV 6.63 -.32 63 -.25 no

JCP 55.35 -1.56 57 -.30 yes

RDN 14.01 -2.15 61 -.28 no

RF 26.40 -.54 102 -.45 yes

SNV 25.53 -.70 70 -.25 yes

SOV 14.52 -.10 58 -.32 yes

TIBB 10.13 -.09 38 -.35 yes

TRGL 26.40 - .54 102 -.45 yes

TRY 11.55 -1.09 78 -.35 yes

VRX 14.62 -.29 63 -.20 no

VVTV 6.63 -.32 63 -.25 no

JCP 55.35 -1.56 57 -.30 yes

|

___________________________________________________________________

....... END OF REPORT .....................

|

RDN 14.01 -2.15 61 -.28 no

RF 26.40 -.54 102 -.45 yes

SNV 25.53 -.70 70 -.25 yes

SOV 14.52 -.10 58 -.32 yes

TIBB 10.13 -.09 38 -.35 yes

TRGL 26.40 - .54 102 -.45 yes

TRY 11.55 -1.09 78 -.35 yes

VRX 14.62 -.29 63 -.20 no

VVTV 6.63 -.32 63 -.25 no

JCP 55.35 -1.56 57 -.30 yes

RDN 14.01 -2.15 61 -.28 no

RF 26.40 -.54 102 -.45 yes

SNV 25.53 -.70 70 -.25 yes

SOV 14.52 -.10 58 -.32 yes

TIBB 10.13 -.09 38 -.35 yes

TRGL 26.40 - .54 102 -.45 yes

TRY 11.55 -1.09 78 -.35 yes

VRX 14.62 -.29 63 -.20 no

VVTV 6.63 -.32 63 -.25 no

JCP 55.35 -1.56 57 -.30 yes