Sell S19 - December 2013 Peerless (C) 2013 William Schmidt, Ph.D.

-------------------------------------------------------------------------------------------------------------------------------------------------

P-Indicator Turns Negative for the First Time in 105 Trading Days.

There have been only 7 S19s since 1928. If they were used to go short the

DJI, the gain would have been only 3.5%. Still, this signal provides a good way

to take profits after a long bull market, especially from late April to June,

when 5 of the 7 signals occurred.

Gain on LA/MA

Shorts

19430607 S9 141.8 .039 1.016

19450515 S9 164 -.002 .998

19710506 S9 937.39 .093 .999

19860429 S9 1825.89 .036 1.01

20040220 S9 10619.03 .036 1.002

20070105 S9 12398.01 .015 1.00

20130604 S9 15177.54 .027 .997

-----------------------------------------------------------------------

No - 7 Avg.= .035

=====================================================================================

These S19s were formerly called "Sell S9Bs"

=====================================================================================

#1 Sell S19 or S9<B> 6/7/1943 141.8 +3.9%

LA/MA ANNROC P IP21 V-I Opct

1.016 .248 -11 .012 -113 .055

This is called an S9<B>. It is differerent from typical S9s.

It occurs when P-Indicator finally turns positive after

being negative after being positive for more than 100 straight

days. The DJI must also be above the 21-dma.

---------------------------------------------------------------------------

#2 Sell S19 or S9<B> 5/15/1945 141.8 -0.2%

LA/MA ANNROC P IP21 V-I Opct

.998 .116 -2 .013 -87 .151

---------------------------------------------------------------------------

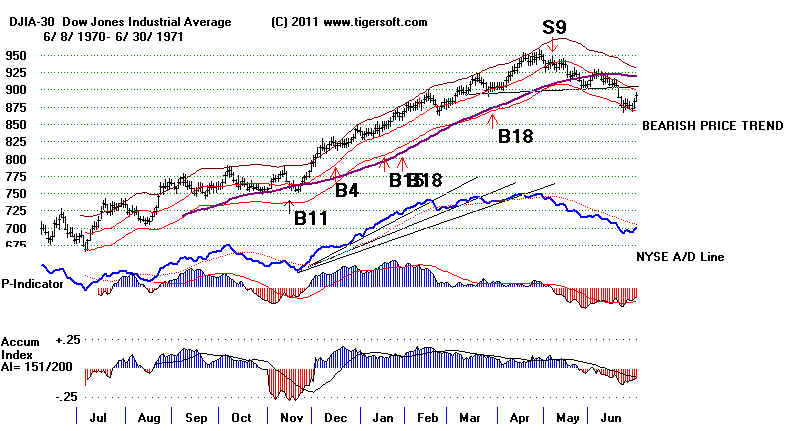

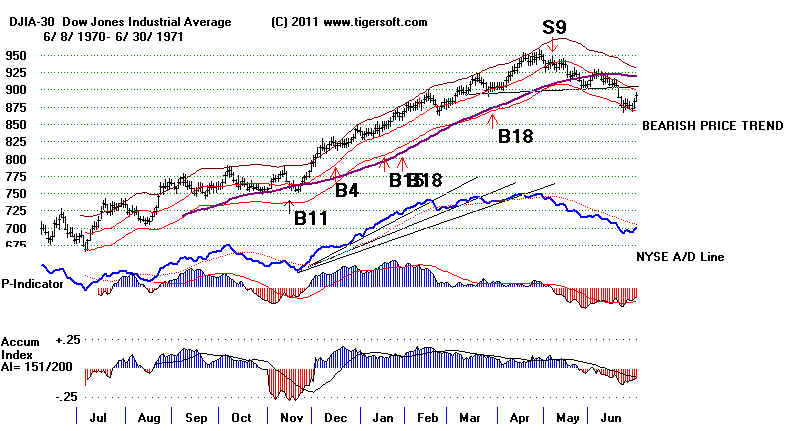

#3 Sell S19 or S9<B> 5/6/1971 937.39 +9.3% No Paper loss.

LA/MA ANNROC P P^^ IP21 V-I Opct

.999 .313 -15 -34 -32 .076 -1 .279

Head and shoulders breakdown followed this S9B. DJi fell below the lower band. No Paper loss.

888.95 8/16/71 B13

There have been only 7 S19s since 1928. If they were used to go short the

DJI, the gain would have been only 3.5%. Still, this signal provides a good way

to take profits after a long bull market, especially from late April to June,

when 5 of the 7 signals occurred.

Gain on LA/MA

Shorts

19430607 S9 141.8 .039 1.016

19450515 S9 164 -.002 .998

19710506 S9 937.39 .093 .999

19860429 S9 1825.89 .036 1.01

20040220 S9 10619.03 .036 1.002

20070105 S9 12398.01 .015 1.00

20130604 S9 15177.54 .027 .997

-----------------------------------------------------------------------

No - 7 Avg.= .035

=====================================================================================

These S19s were formerly called "Sell S9Bs"

=====================================================================================

#1 Sell S19 or S9<B> 6/7/1943 141.8 +3.9%

LA/MA ANNROC P IP21 V-I Opct

1.016 .248 -11 .012 -113 .055

This is called an S9<B>. It is differerent from typical S9s.

It occurs when P-Indicator finally turns positive after

being negative after being positive for more than 100 straight

days. The DJI must also be above the 21-dma.

---------------------------------------------------------------------------

#2 Sell S19 or S9<B> 5/15/1945 141.8 -0.2%

LA/MA ANNROC P IP21 V-I Opct

.998 .116 -2 .013 -87 .151

---------------------------------------------------------------------------

#3 Sell S19 or S9<B> 5/6/1971 937.39 +9.3% No Paper loss.

LA/MA ANNROC P P^^ IP21 V-I Opct

.999 .313 -15 -34 -32 .076 -1 .279

Head and shoulders breakdown followed this S9B. DJi fell below the lower band. No Paper loss.

888.95 8/16/71 B13

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#4 Sell S19 /older S9<B> 4/29/1986 1825.89 +3.6% No Paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.01 .048 -1 .049 -9 .112

Reversed: 1826.07 7/9/86

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#5 Sell S19 / older S9<B> 2/20/2004 10619.03 +3.6% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.028 .175 -9 .018 -148 .079

Reversed: 9968.51 5/18/04 B2

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#6 Sell S19 / older S9<B> 1/ 5/ 2007 12398.01 +1.5% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.021 .11 -8 .017 -119 .112

Reversed: 12207.59 3/6/07 B19

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 7/2007 13625.58 +3.4% Paper Loss = 0.7%

#7 Sell S19 / older S9<B> 6/ 4/ 2013 15177.54 +2.7% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct 65-day pct ch

.977 .159 -66 .076 -50 .022 .077

Reversed: 14760.31 6/4/2013 B19

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#4 Sell S19 /older S9<B> 4/29/1986 1825.89 +3.6% No Paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.01 .048 -1 .049 -9 .112

Reversed: 1826.07 7/9/86

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#5 Sell S19 / older S9<B> 2/20/2004 10619.03 +3.6% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.028 .175 -9 .018 -148 .079

Reversed: 9968.51 5/18/04 B2

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#6 Sell S19 / older S9<B> 1/ 5/ 2007 12398.01 +1.5% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.021 .11 -8 .017 -119 .112

Reversed: 12207.59 3/6/07 B19

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 7/2007 13625.58 +3.4% Paper Loss = 0.7%

#7 Sell S19 / older S9<B> 6/ 4/ 2013 15177.54 +2.7% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct 65-day pct ch

.977 .159 -66 .076 -50 .022 .077

Reversed: 14760.31 6/4/2013 B19

===========================================================================

There have been only 7 S19s since 1928. If they were used to go short the

DJI, the gain would have been only 3.5%. Still, this signal provides a good way

to take profits after a long bull market, especially from late April to June,

when 5 of the 7 signals occurred.

Gain on LA/MA

Shorts

19430607 S9 141.8 .039 1.016

19450515 S9 164 -.002 .998

19710506 S9 937.39 .093 .999

19860429 S9 1825.89 .036 1.01

20040220 S9 10619.03 .036 1.002

20070105 S9 12398.01 .015 1.00

20130604 S9 15177.54 .027 .997

-----------------------------------------------------------------------

No - 7 Avg.= .035

=====================================================================================

These S19s were formerly called "Sell S9Bs"

=====================================================================================

#1 Sell S19 or S9<B> 6/7/1943 141.8 +3.9%

LA/MA ANNROC P IP21 V-I Opct

1.016 .248 -11 .012 -113 .055

This is called an S9<B>. It is differerent from typical S9s.

It occurs when P-Indicator finally turns positive after

being negative after being positive for more than 100 straight

days. The DJI must also be above the 21-dma.

---------------------------------------------------------------------------

#2 Sell S19 or S9<B> 5/15/1945 141.8 -0.2%

LA/MA ANNROC P IP21 V-I Opct

.998 .116 -2 .013 -87 .151

---------------------------------------------------------------------------

#3 Sell S19 or S9<B> 5/6/1971 937.39 +9.3% No Paper loss.

LA/MA ANNROC P P^^ IP21 V-I Opct

.999 .313 -15 -34 -32 .076 -1 .279

Head and shoulders breakdown followed this S9B. DJi fell below the lower band. No Paper loss.

888.95 8/16/71 B13

There have been only 7 S19s since 1928. If they were used to go short the

DJI, the gain would have been only 3.5%. Still, this signal provides a good way

to take profits after a long bull market, especially from late April to June,

when 5 of the 7 signals occurred.

Gain on LA/MA

Shorts

19430607 S9 141.8 .039 1.016

19450515 S9 164 -.002 .998

19710506 S9 937.39 .093 .999

19860429 S9 1825.89 .036 1.01

20040220 S9 10619.03 .036 1.002

20070105 S9 12398.01 .015 1.00

20130604 S9 15177.54 .027 .997

-----------------------------------------------------------------------

No - 7 Avg.= .035

=====================================================================================

These S19s were formerly called "Sell S9Bs"

=====================================================================================

#1 Sell S19 or S9<B> 6/7/1943 141.8 +3.9%

LA/MA ANNROC P IP21 V-I Opct

1.016 .248 -11 .012 -113 .055

This is called an S9<B>. It is differerent from typical S9s.

It occurs when P-Indicator finally turns positive after

being negative after being positive for more than 100 straight

days. The DJI must also be above the 21-dma.

---------------------------------------------------------------------------

#2 Sell S19 or S9<B> 5/15/1945 141.8 -0.2%

LA/MA ANNROC P IP21 V-I Opct

.998 .116 -2 .013 -87 .151

---------------------------------------------------------------------------

#3 Sell S19 or S9<B> 5/6/1971 937.39 +9.3% No Paper loss.

LA/MA ANNROC P P^^ IP21 V-I Opct

.999 .313 -15 -34 -32 .076 -1 .279

Head and shoulders breakdown followed this S9B. DJi fell below the lower band. No Paper loss.

888.95 8/16/71 B13

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#4 Sell S19 /older S9<B> 4/29/1986 1825.89 +3.6% No Paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.01 .048 -1 .049 -9 .112

Reversed: 1826.07 7/9/86

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#5 Sell S19 / older S9<B> 2/20/2004 10619.03 +3.6% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.028 .175 -9 .018 -148 .079

Reversed: 9968.51 5/18/04 B2

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#6 Sell S19 / older S9<B> 1/ 5/ 2007 12398.01 +1.5% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.021 .11 -8 .017 -119 .112

Reversed: 12207.59 3/6/07 B19

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 7/2007 13625.58 +3.4% Paper Loss = 0.7%

#7 Sell S19 / older S9<B> 6/ 4/ 2013 15177.54 +2.7% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct 65-day pct ch

.977 .159 -66 .076 -50 .022 .077

Reversed: 14760.31 6/4/2013 B19

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#4 Sell S19 /older S9<B> 4/29/1986 1825.89 +3.6% No Paper loss.

LA/MA ANNROC P IP21 V-I Opct

1.01 .048 -1 .049 -9 .112

Reversed: 1826.07 7/9/86

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#5 Sell S19 / older S9<B> 2/20/2004 10619.03 +3.6% No Paper Loss

LA/MA ANNROC P IP21 V-I Opct

1.028 .175 -9 .018 -148 .079

Reversed: 9968.51 5/18/04 B2

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

#6 Sell S19 / older S9<B> 1/ 5/ 2007 12398.01 +1.5% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct

1.021 .11 -8 .017 -119 .112

Reversed: 12207.59 3/6/07 B19

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 7/2007 13625.58 +3.4% Paper Loss = 0.7%

#7 Sell S19 / older S9<B> 6/ 4/ 2013 15177.54 +2.7% No Paper Loss.

LA/MA ANNROC P IP21 V-I Opct 65-day pct ch

.977 .159 -66 .076 -50 .022 .077

Reversed: 14760.31 6/4/2013 B19