Here I present new research on S9V Sell signals. Below are all the cases when

the V-Indicator was negative and the P-Indicator was above 0 for the dangerous time

period May to September. The DJI must close at least 2.4% over the 21-day ma.

No exclusion is made because of the level of ANNROC or any other key value.

The data below show that we want to better refine the S9V by:

1) excluding cases after 9/16

2) excluding cases where ANROC is below .170

3) excluding case where ANROC is above .648

When we make these adjustments to Sell S9Vs, we get a total of 22 cases since 1965.

There are only 2 failures. In both cases, the DJI went sidewise for a month or more

before making a bullish breakout. So losses here would have been limited.

Date of Unrefined LA/MA ANNROC P-I P-I IP21 V-I OBV-Pct 65-day

S9V Change Pct Change

--------------------------------------------------------------------------------------------------------------------------------------------

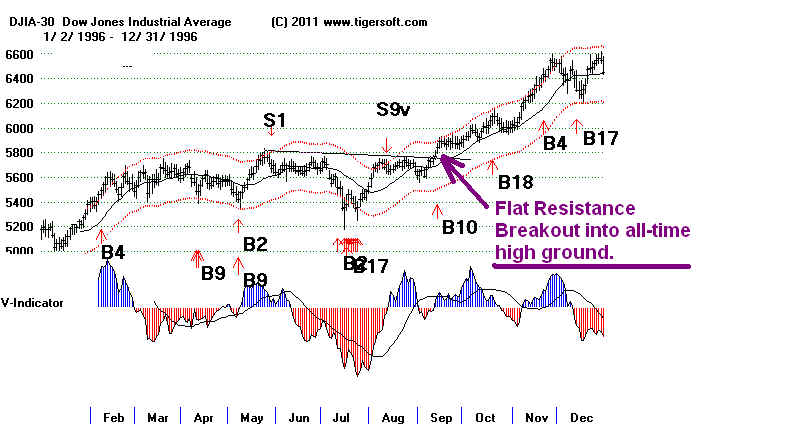

#8 8/9/1996 1.031 .348 68 81 .107 -10 .243 .037

Failed - DJI went sidewise for a month and then broke out above flat resistance and ran upwards.

---------------------------------------------------------------------------------------------------------------------------------------

#20 5/18/2009 1.033 .54 334 63 -.005 -11 .047 .072

Failed - Premature... DJI went sidewise for a month and then resumed new bull market.

------------------------------------------------------------------------------------------------------------------------------------------

All these charts are shown just below.

Date of Unrefined LA/MA ANNROC P-I P-I IP21 V-I OBV-Pct 65-day

S9V Change Pct Change

--------------------------------------------------------------------------------------------------------------------------------------------

9/17/1965 (late) 1.026 .455 95 -8 .065 -8 .282 .057

Failed - DJI rallied.

-------------------------------------------------------------------------------------------------------------------------------------------

#1 6/19/1970 1.042 .954 11 63 .057 -1 .050 -.059

Success - DJI fell to lower band

--------------------------------------------------------------------------------------------------------------------------------------------

#2 7/24/1970 1.039 .644 46 38 .024 -1 .326 -.026

Success - DJI fell to lower band

--------------------------------------------------------------------------------------------------------------------------------------------

8/24/1970 1.029 -.143 (too low) 43 44 .111 -1 .109 .147

Failed to bring decline. DJI went sidewise for 3 months.

-------------------------------------------------------------------------------------------------------------------------------------------

#3 8/26/1971 1.041 .467 24 33 -.105 -1 .183 -.001

Success - DJI declined from 906 to 790 in 3 months.

-------------------------------------------------------------------------------------------------------------------------------------------

#4 5/26/1972 1.026 .318 0 9 .021 -1 .333 .064

Success - DJI declined almost to lower band.

------------------------------------------------------------------------------------------------------------------------------------------

8/14/1972 1.039 .653 (too high) 48 8 .109 -1 .121 .041

Success - DJI declined almost to lower band.

------------------------------------------------------------------------------------------------------------------------------------------

#5 8/7/1974 1.025 .387 32 48 -.043 -1 -.004 -.057

Success - DJI fell from 800 to 580 in 2 months.

------------------------------------------------------------------------------------------------------------------------------------------

#6 8/16/1982 1.025 .469 1 16 .119 -2 .174 -.012

Success - DJI fell slightly below lower band.

-----------------------------------------------------------------------------------------------------------------------------------------

#7 7/18/1990 1.024 .408 15 15 .049 -4 .339 .075

Success - DJI fell from 3000 to 2360 in 3 months.

----------------------------------------------------------------------------------------------------------------------------------------

#8 8/9/1996 1.031 .348 68 81 .107 -10 .243 .037

Failed - DJI went sidewise for a month and then broke out above flat resistance and ran upwards.

---------------------------------------------------------------------------------------------------------------------------------------

#9 7/8/1998 - 1.03 .141 2 7 -.025 -17 .061 .021

Success - DJI briefly rose 2% and then fell nearly 20% in 2 months.

---------------------------------------------------------------------------------------------------------------------------------------

#10 6/30/1999 1.024 .417 64 44 .059 -2 .180 .096

Success - DJI briefly rose 2% and then fell to lower band.

---------------------------------------------------------------------------------------------------------------------------------------

#11 8/11/2000 1.026 .265 14 55 -.023 -62 .238 .063

Success - DJI briefly rose 2%-3% and then fell below lower band.

---------------------------------------------------------------------------------------------------------------------------------------

#12 5/17/2002 1.028 .175 51 15 -.014 -149 .081 .036

Success - DJI fell from 10200 to 7800 in 10 weeks.

---------------------------------------------------------------------------------------------------------------------------------------

#13 8/16/2002 1.042 .522 2 73 .134 -180 -.069 -.144

Success - DJI fell from 8700 to 7250 in 2 months.

--------------------------------------------------------------------------------------------------------------------------------------

#14 6/7/2004 1.03 .177 351 188 .034 -22 .028 -.019

Success - DJI fell to lower band.

-------------------------------------------------------------------------------------------------------------------------------------

#15 9/2/2004 1.025 .194 396 70 .088 -5 .029 .008

Success - DJI fell to lower band.

------------------------------------------------------------------------------------------------------------------------------------

#16 5/8/2006 1.025 .388 15 25 .034 -56 .256 .067

Success - DJI fell to lower band.

------------------------------------------------------------------------------------------------------------------------------------

5/16/2007 1.025 .648 (too high) 90 45 .149 -7 .627 .074

Limited Success - DJI fell to lower band, but it had risen considerably since this S9V.

-----------------------------------------------------------------------------------------------------------------------------------

#17 7/13/2007 1.026 .374 192 -91 .005 -15 .090 .113

Success - DJI fell back 10% in a month.

-----------------------------------------------------------------------------------------------------------------------------------

9/25/2007 (late) 1.025 .355 47 -117 .027 -39 .192 .031

Success - DJI did rise 4% before falling10% and marking bull market high.

-----------------------------------------------------------------------------------------------------------------------------------

#18 5/1/2008 1.029 .405 178 36 .047 -28 .082 .044

Success - Perfect Sell before beginning of bear market.

-----------------------------------------------------------------------------------------------------------------------------------

#19 8/5/2008 1.024 .403 91 136 .073 -87 .093 -.111

Success - Perfect Sell as bear market continued and DJI fell rapidly.

-----------------------------------------------------------------------------------------------------------------------------------

#20 5/18/2009 1.033 .54 334 63 -.005 -11 .047 .072

Failed - Premature... DJI went sidewise for a month and then resumed new bull market.

----------------------------------------------------------------------------------------------------------------------------------

#21 6/3/2009 1.027 .351 221 169 .008 -96 -.018 .282

Success - DJI quickly fell slightly below lower band.

----------------------------------------------------------------------------------------------------------------------------------

7/15/2009 1.028 .006 (too low) 177 221 .001 -50 -.11 .069

Failed - DJI began resumed powerful new bull market.

----------------------------------------------------------------------------------------------------------------------------------

6/16/2010 1.025 -.253 (too low) 12 2 -.013 -150 -.203 -.022

Success - DJI quickly fell below lower band.

----------------------------------------------------------------------------------------------------------------------------------

7/23/2011 1.031 .149 (too low) 272 96 .101 -90 .045 -.063

Success - DJI did rise 4% but then it fell below slightly lower band.

---------------------------------------------------------------------------------------------------------------------------------

6/15/2012 1.026 .161 (too low) 112 106 .058 -40 -,073 -.033

Failed - DJI fell only to 21-dma and then rose for 3 months

--------------------------------------------------------------------------------------------------------------------------------

#22 7/11/2013 1.028 .268 258 217 -.044 -25 .188 .053

Success - DJI fell to lower band.

-------------------------------------------------------------------------------------------------------------------------------

9/13/2013 1.025 .030 (too low) 31 84 -.035 -37 .016 .025

Success - DJI fell to lower band.

-------------------------------------------------------------------------------------------------------------------------------

Current internals 1.022 .095 (too low) 216 60 .054 -59 -.094 .024

===================================================

(C) 2011 William Schmidt, Ph.D.

7/27/2011

S9vs here occur when the DJI is above the 2.45% over the

21-dma with the

V-Indicator 0 or less and the annualized

rate of change of the

21-dma is between .40 and .60.

The level of the

P-Indicator, IP21 or ObvPct are not

factored in here.

Seasonality, however, is very important in

making this signal

useful for profitable short sales and

taking profits.

----------------------------------------------------------------------------------------------------------

Sell S9vs cannot be properly studied for the period

1929-1965.

This is because the necessary data before 1966 is not

available. NYSE Up and Down volume can only be estimated,

as I have for all the data before 1966, by employing the

ratio of NYSE advances to NYSE declines and total NYSE volume.

S9v Sell signals, as presented here, do duplicate many of

other, more regular S9s which are based on negative divergences

by the P-Indicator and IP21 from the DJI when it is at the

upper band. Many of the dates of these signals are the same

for our regular S9s.

The lesson here is that S9vs have an independent potency

in their own right, despite levels of the P-Indicator or the

V-Indicator, when used advisedly, as shown below, only in the

period from June to Septembers. In addition, S9vs have to be

mistrusted when the DJI is more than 5% over the 21-day ma,

as this often shows the market is taking off after a bear

market. See in the last table how each Sell S9v has all the

key values for the date of the signal shown:

DJI daily closing price

Last Price/21-dma of DJI closing prices

Annualized Rate of Change for 21-day ma

P-Indicator

P-Indicator Daily Change

IP21

V-Indicator

ObvPct

There were 59 "RAW" S9Vs. There were 21 instances

of the

DJI subsequently falling below the lower band in 3 months.

In 13 more cases, the DJI fell to the lower band and in

3 more cases it fell half way between the 21-dma and the

lower band. If short sales in these cases were all profitable,

Sell S9vs succeeded in 37 of 59 cases.

Subsequent declines to the 21-day ma would also have generated

profitable short-term trades in 4 more cases. So for a trader,

the success rate of an S9v would have been 41/59

In 18 cases, the DJI kept rising and a loss on a short sale

taken with the S9v would have occurred.

We can improve the success rate by taking only the

Sell S9vs in February and from May to September. In these

months there were 26 S9vs and only 2 losses. 12 of the

26 produced DJI declines below the lower band. In 8 cases

the

DJI fell to the lower band.

SEASONAL SELL S9vs:

1965-2011

There

were 19 S9Vs from May to September. Only 1

produced a loss, if one's minimum target was half way

between the 21-day ma and the 3.5% lower band.

9 of these 20 led to declines below the lower band.

7 resulted in declines to the lower band.

RAW SELL S9vs By Month and Subsequent

Action

----------------- Decline to -------------------

Loss

MA (MA+LB)/2 LB Below LB

N (total)

Jan 3

2

5

1996,1987,

1975

2000, 1997

Feb

1

1 3

5

1999

2011 (2002, 1997, 1980)

March 3

3

(2003, 1999, 1995)

April 2

1 3

6

1999, 1995

1992 (2011, 2008, 2001)

-------------------------------------------------------------------------------------------------

May

1

2

3

2009

(2008, 2006)

June

1

1

2009

July

1

4 1

6

2011

(2010,1999, 1982,1970) 1990

August 2

1

1 6

10

1982,1970

1996

2010 (2008, 2002, 2000-2, 1999, 1971)

Sept

1

1

1975

------------------------------------------------------------------------------------------------

Oct 1

3

1

6

2002,1998

2010-2, 1966

2007

Nov 3

1 1

5

2010, 1996, 1995

2000 2010

Dec 2

3 2

7

2003, 1995

(1999, 1987,1982) 1997,1973

============================================

17

4

3

13

21

N=58

RAW Sell S9vs by Year

in The 4-Year

Presidential Cycle

The year before the Presidential Election year was generally

a bad year to employ an S9v. 11 of 22 brought losses.

Despite

this, a 4 S9vs in July and August in the year before a Presidential

Election Year would all been profitably traded by a short seller.

In 2 of the 4 cases the DJI fell below the lower band.

7/5/2011

12569.87 Declined to ma

8/23/1999 11299.76 Declined

below Lower Band

7/9/1999 11193.69

Declined to lower band

8/26/1971 906.10

Rose another week and then Declined below Lower Band.

The year after

a Presidential Election was the best. There was only one loss

and 5 of the 11 brought declines below

the lower band.

----------------- Decline to -------------------

Loss MA (MA+LB)/2 LB Below LB

N (total)

Pres. Elect.

Year (PE) 2

1

2 7

12

PE +1

1

2

2 5

10

PE +2 4

1

5 4

12

PE +3 11

2

4 5

22

--------------------------------------------------------------------------------------------------

18 4 3

13 21

N=58

RAW Sell S9vs

59 Sell S9vs - 1965-2001

(As I remember the necessary data only started being

available in Barrons in September 1965. Some of the 1965

signals should probably be left out. This will have to be

checked. )

Date DJI la/ma ann-roc P Pch IP21 VI Opct Outcome

--------------------------------------------------------------------------------

7/21/2011 12724.41 1.025 .513 269 -16 .085 -51AR .005 ?

(1-5)

7/5/2011 12569.87 1.037 .412 239 57 -.034 -48AR .08 declined to ma

4/27/2011 12690.96 1.025 .475 307 69 .142 0 .311 Decline below LB

2/8/2011 12333.15 1.027 .559 297 57 .166 -7 .381

1 wk higher, then decline to LB

8/9/2010 10698.75 1.025 .572 477 -19 .246 -15 .047 decline to LB

7/26/2010 10542.43 1.041 .459 442 170 .166 -11 .037 1 wk higher,

then decline to LB

(6-10)

11/16/2009 10406.96 1.039 .489 26 135 .001 -146 .173 2 mo up and

then Decline below LB

10/22/2009 10081.31 1.026 .404 155 92 .073 -101 -.115 declined 1/2(ma+lb)

10/14/2009 10015.86 1.027 .406 246 11 .014 54 -.061 decline 1/2(ma+lb)

6/4/2009 8750.24 1.033 .478 316 92 .046 -73 .068 declined to LB

5/18/2009 8504.08 1.033 .54 335 63 -.005 -11 .045 decline to 21-dma

(11-15)

8/8/2008 11734.32 1.030 .529 91 70 .088 -81 .072 crash followed

Decline below LB

5/1/2008 13040.80 1.029 .405 178 36 .047 -28 .076 crash followed

Decline below LB

4/3/2008 12626.03 1.031 .401 3 77 .027 -144 .021 1 mo up,

then crash.Decline below LB

12/18/2007 13727.03 1.04 .416 33 50 .001 -82 .113

Decline below LB

10/2/2007 14047.31 1.032 .605 226 -87 .086 31 .257 1wk up.

Then Decline below LB

(16-20)

5/9/2006 11639.77 1.027 .547 110 94 .079 -6 .326 Decline below LB

12/16/2003 10129.56 1.029 .437 297 52 .039 -33 .204 LOSS.DJI rose to

10613.85 before falling below the LB to 10063.64 on 3/23/2003

3/17/2003 8141.92 1.04 .597 126 98 .117 -30 .207 LOSS..

1 wk rally, then declined to ma at 8145.77

10/18/2002 8322.40 1.066 .581 -167 79 .037 -190 .066 LOSS..

Rallied for 6 weeks before declined to LB at 8303.78 on 12/27/2002

8/16/2002 8778.06 1.042 .522 2 73 .134 -180 -.067 w wk higher

then Decline below LB

(21-25)

2/25/2002 10145.70 1.031 .424 52 18 .053 -162 .023 rallied 1 month and

then Decline below LB

4/17/2001 10216.73 1.041 .478 19 83 .115 -70 .175 rallied for 6 weeks

and then plunged in 9/11 panic.Decline below LB

11/6/2000 10971.21 1.049 .434 -89 58 .066 -77 .032 fell to the LB

8/22/2000 11139.15 1.027 .499 108 35 .023 -5 .389 rallied 1 wk more

and then Decline below LB

8/14/2000 11176.14 1.039 .403 32 18 -.004 -53 .22 rallied 2 weeks and

Decline below LB

(26-29)

1/14/2000 11722.98 1.03 .522 90 27 -.058 -28 .441 Decline below LB

12/28/1999 11476.71 1.026 .52 -315 1 -.052 -85 .157 fell to LB

8/23/1999 11299.76 1.04 .427 -292 66 .064 -74 -.041 Decline below LB

7/9/1999 11193.69 1.034 .555 69 39 .085 -6 .251 fell to lower band

(30-35)

A series of bad sells from October 98 to April 99.

4/29/1999 10173.03 1.026 .482 -7 5 -.008 -22 -.131 LOSS.. reached

11026.14 in a month before falling to LB at 10466.92 on 5/27

3/8/1999 9727.60 1.039 .539 -192 27 .052 -53 -.142 Big LOSS.

2/23/1999 9544.42 1.026 .543 -254 5 .065 -58 .04 fell to MA only.

10/22/1998 8533.14 1.061 .562 -4 -46 .06 -56 .204 Big LOSS.

12/3/1997 8032.01 1.04 .552 74 -63 .053 -16 .339 Fell to LB

2/18/1997 7067.46 1.035 .409 95 -5 .098 -3 .026 Decline below LB

(36-40)

1/10/1997 6703.79 1.035 .424 102 -11 .055 -5 .318 rise for 5 weeks and

then fell below LB to 6391.69 on 4/11/1997 Decline below LB

11/16/1996 6177.71 1.025 .417 45 62 .094 -3 .062 Big LOSS.

8/12/1996 5704.98 1.034 .42 76 8 .118 -7 .313 Decline to ma.

1/29/96 5304.98 1.029 .484 88 9 .198 -7 .183 Big LOSS.

11/16/95 4969.36 1.032 .475 -49 3 .11 -26 .215 Big LOSS.

3/24/95 4138.67 1.027 .40 -3 13 .137 -2 .327 Big LOSS.

(41-45)

12/27/1995 3861.69 1.028 .487 4 -36 .103 -12 .243 Big LOSS.

4/16/1992 3366.50 1.032 .41 -66 -11 .072 -11 .329 up slightly

for a month and then decline to LB

7/19/1990 2993.81 1.027 .41 0 -16 .065 -5 .274 Decline below LB

12/21/1987 1990.38 1.051 .599 26 55 .147 -1 .306 Fell to LB

1/7/1987 1993.95 1.033 .426 -1 157 .149 -3 .094 Big LOSS.

(46-50)

12/28/1982 1058.87 1.029 .597 17 -34 -.114 -1 -.057 Fell to LB

8/20/1982 869.29 1.074 .55 -1 46 -.06 -1 -.191 Big LOSS.

7/16/1982 828.67 1.025 .469 1 16 .119 -2 .166 Fell to LB

2/13/1980 903.84 1.028 .478 -26 1 -.01 -1 .202 Decline below LB

9/14/1975 838.31 1.026 .411 -61 44 -.023 -2 .193 Fell to LB

(51-55)

4/11/1975 789.50 1.033 .403 -46 37 .088 -1 -.05 LOSS.

1/2/1975 632.04 1.057 .579 -72 105 .017 -2 .247 Big LOSS.

12/27/1973 851.01 1.034 .482 -84 63 .016 -2 -.048 rose another week

and then Decline below LB

8/26/1971 906.10 1.041 .467 24 33 -.105 -1 .176 rose another week and

then Decline below LB

8/24/1970 759.58 1.048 .483 43 44 .111 -1 .102 Big LOSS.

There is a decline to (MA+LB)/2 or 747.47

(56-59)

7/17/1970 735.08 1.053 .52 -56 34 -.011 -2 .269 Fell to LB

10/27/1966 809.57 1.045 .44 -17 44 -.023 -6 .131 Fell to (MA+LB)/2

(9/17/1965 928.90 1.026 .455 85 -8 .065 -8 .282 Big LOSS.)<1>

<1>This case is excluded because ot was not based on acceptable data.

Superior results can be obtained for the period 1966-2011 by

1) only allowing Sell S9Vs between May and Augist.

2) requiring that the LA/MA be under 1.0425

This eliminates 2 losses (8/20/1982 and 8/24/1970) and 1 decline to the LB (17/1/70)

When IP21 was above .14, a decline only to the LB was likely.

8/9/2010 10698.75 1.025 .572 477 -19 .246 -15 .047 decline to LB

7/26/2010 10542.43 1.041 .459 442 170 .166 -11 .037 1 wk higher, then decline to LB

S9vs here occur when:

1) the DJI is 2.45% to 4.26% over the 21-dma

2) the V-Indicator 0 or less

3) and the annualized is .40 to .575

and only between May and September.

The level of the P-Indicator, IP21 or ObvPct are not

factored in here. Seasonality, however, is very important in

making this signal useful for profitable short sales and

taking profits.

Results in 19 cases:

1 decline to MA and then a 2.3% paper loss.

1 decline to MA (The final outcome here is not decided.

8 declines to LB (+42.1%)

9 declines below LB (+47.4%)

Conclusion:

Sell S9vs add little to the Peerless system of intermediate-term signals since 1966,

but they are a very useful supplemental Sell signal for traders. It may be, however that

the 2011 S9vs will play out so well, that the signals should be included

On an intermediate-term basis, adding them would have produced a +2.3% loss and

new gains of +2.6% and 5.2%. Perhaps, the 2011 S9vs will make this signal worth adding to

the regular Peerless system. The new gains from it, over and above the regular Peerless

still are only marginally convincing. But for traders, who want one more way to spot a

short-term reversal, the results are quite good. There is only 1 loss in 19 cases, 2.3%,

and only 6 of the 19 cases had a paper loss of more than 2%.

Paper Losses:

There was one +3% paper loss, five +2% paper losses and one 1% paper loss.

In 12 of 19 cases, the DJI fell immediately or so quickly that there was no paper loss

of more than 1/2%.

Date DJI la/ma ann-roc P Pch IP21 VI Opct Outcome

----------------------------------------------------------------------------

7/21/2011 12724.41 1.025 .513 269 -16 .085 -51 .005 ?(1-5)

(1-5)

7/5/2011 12569.87 1.037 .412 239 57 -.034 -48 .08

declined to ma NO PAPER LOSS Still open...

5/2/2011 12807.36 1.028 .467 212 -50 .147 -17 .33

Decline below LB in six weeks. NO PAPER LOSS

There was no other Peerless sell here. Peerless Gain = +5.9%

8/9/2010 10698.75 1.025 .572 477 -19 .246 -15 .047 decline to LB

There was no regular Peerless here. then decline to LB in 6 weeks.

It would have gained an additional +4.0% NO PAPER LOSS

7/26/2010 10542.43 1.041 .459 442 170 .166 -11 .037 1 wk higher,

There was no regular Peerless here. then decline to LB in 5 weeks..

It would have gained an additional +2.6% PAPER LOSS = 1%

6/4/2009 8750.24 1.033 .478 316 92 .046 -73 .068

Also a regular S9. declined to LB in 5 weeks..NO PAPER LOSS

(6-10)

5/18/2009 8504.08 1.033 .54 335 63 -.005 -11 .045

Peerless gave a better Sell S9 on 6/4/2009 at 8750.24

Initially declined to 21-dma

and then to lower band in 5 weeks PAPER LOSS = 3%

8/8/2008 11734.32 1.030 .529 91 70 .088 -81 .072 crash followed

Peerless was already on a Sell S9 from 7/30/2002.

Decline below LB in 6 weeks, but fell much further. NO PAPER LOSS

5/1/2008 13040.80 1.029 .405 178 36 .047 -28 .076 crash followed

Also a regular S15. Decline below LB in 5 weeks,but fell much further.NO PAPER LOSS

5/9/2006 11639.77 1.027 .547 110 94 .079 -6 .326 Decline below LB

Also a regular S9. Decline below LB in 5 weeks,but fell further.NO PAPER LOSS

8/16/2002 8778.06 1.042 .522 2 73 .134 -180 -.067 w wk higher

Peerless was already on a Sell S9 from 8/12/2002.

Decline below LB in five weeks PAPER LOSS = 2%

(11-15)

8/22/2000 11139.15 1.027 .499 108 35 .023 -5 .389 rallied 1 wk more

and then Decline below LB in four weeks PAPER LOSS = 2%

This would have reversed the existing Peerless Buy

slightly lower and earlier than Sell S4 right at the top.

8/14/2000 11176.14 1.039 .403 32 18 -.004 -53 .22 rallied 2 weeks and

This would have reversed the existing Peerless Buy

slightly lower and earlier than Sell S4 right at the top. PAPER LOSS = 2%

Decline below LB in five weeks

8/23/1999 11299.76 1.04 .427 -292 66 .064 -74 -.041

Also a regular S9. Decline below LB in four weeks NO PAPER LOSS

7/9/1999 11193.69 1.034 .555 69 39 .085 -6 .251

Peerless was already on a Sell. Fell to lower band in 3 weeks.NO PAPER LOSS.

Using Peerless to reverse this S9V would have brought a 7.1% gain.

8/12/1996 5704.98 1.034 .42 76 8 .118 -7 .313

Decline to a little below ma.

Using Peerless to reverse this S9V would have brought a 2.3% loss.

Here the DJI refused to breakdown and instead made a classic flat-topped

breakout into all-time high territory. This is a bullish situation.

The V-Indicator also turned positive for 3 weeks. This is bullish.

(16-19)

7/19/1990 2993.81 1.027 .41 0 -16 .065 -5 .274

Also a regular S9. Decline below LB NO PAPER LOSS

7/16/1982 828.67 1.025 .469 1 16 .119 -2 .166

Also a regular S9. Fell to LB NO PAPER LOSS

9/14/1975 838.31 1.026 .411 -61 44 -.023 -2 .193

Also a regular S9/S12. Fell to LB NO PAPER LOSS

8/26/1971 906.10 1.041 .467 24 33 -.105 -1 .176

Rose another week and then Decline below LB in 8 weeks. PAPER LOSS = 2%

Also an S9 on 8/17/71 and regular S12 on 8/23/1971 and 8/31/71.

Eliminated because of DJI being too far above the 21-dma:

LA/MA

8/20/1982 869.29 1.074 .55 -1 46 -.06 -1 -.191 Big LOSS.

8/24/1970 759.58 1.048 .483 43 44 .111 -1 .102 Big LOSS.

There is a decline to (MA+LB)/2 or 747.47

7/17/1970 735.08 1.053 .52 -56 34 -.011 -2 .269 Fell to LB

(16-19)

7/19/1990 2993.81 1.027 .41 0 -16 .065 -5 .274

Also a regular S9. Decline below LB NO PAPER LOSS

7/16/1982 828.67 1.025 .469 1 16 .119 -2 .166

Also a regular S9. Fell to LB NO PAPER LOSS

9/14/1975 838.31 1.026 .411 -61 44 -.023 -2 .193

Also a regular S9/S12. Fell to LB NO PAPER LOSS

8/26/1971 906.10 1.041 .467 24 33 -.105 -1 .176

Rose another week and then Decline below LB in 8 weeks. PAPER LOSS = 2%

Also an S9 on 8/17/71 and regular S12 on 8/23/1971 and 8/31/71.

Eliminated because of DJI being too far above the 21-dma:

LA/MA

8/20/1982 869.29 1.074 .55 -1 46 -.06 -1 -.191 Big LOSS.

8/24/1970 759.58 1.048 .483 43 44 .111 -1 .102 Big LOSS.

There is a decline to (MA+LB)/2 or 747.47

7/17/1970 735.08 1.053 .52 -56 34 -.011 -2 .269 Fell to LB