BUY B17 - Rising Trend Cases

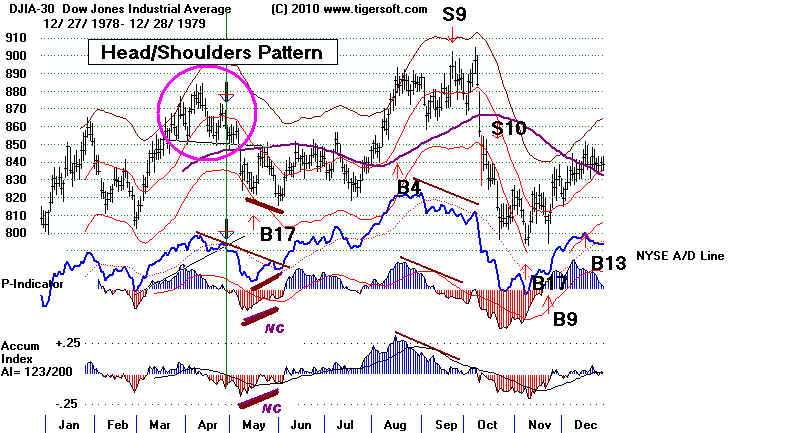

Includes Judged Head and Shoulders Pattern

Rules.

(C) 2011 William Schmidt, Ph.D. - 6/17/2010

The Buy B17 signal takes place

when the DJI falls sufficienlty below the 21-day mvg.avg.

but still shows a nearly positive (or even positive Accumulation Index) and a fairly high

reading from the P-Indicator. There should be improvement from the previous low

readings for these indicators. The IP21 standards generally loosen as the DJI moves

down

from the 21-day ma. The DJI can be as much as 6.7% below the 21-day ma, but must be

at least 1.7% below it. Seasonal considerations are built into these

parameters which

make it easier to get a Buy signal in late October and November. B17s cannot appear

less than 12 trading days after a Sell S9.

There have been 52 cases of B17s in rising markets, occuring not more than 13.5% below

bull market's previous peak. The average gain was 8.8% and the median gain was

7%. There

were 3 losses and 3 gains of more than +20% and 18 gains of more than 10%.

There was only 1 June B17 signal and it was at the end of the month.

In 50 closed out Buy B17s, there were 19 cases of paper losses greater than 1%.

11 of these were more than 3% and 4 were more than 5%.

Buy B17 Paper Losses =>3%

Not included +2 (1% - 1951). 1953 (1.6%), 1959 (2%), 1976 (2%), 1986 (2%),

1990 2 (1% and 2%), 1999 (2%),

3/5/1935 3%

1/ 12/ 1939 7% loss

3/21/1939 5% loss

8/10/43 5% loss

2/13/46 7% loss

9/26/55 4% loss

2/5/57

3%

loss

9/9/59

4% loss

2/11/60

3% loss

12/9/80

3% loss

Where a head and shoulders (H/S) pattern appears, it seems best to wait for the neckline

to be tested and hold, or if is broken to wait for the DJI to have some headroom

before buying. If you see a potential head and shoulders pattern developing, the

judged Peerless Right Shoulder Apex rule should be applied. This involves selling

when the A/D Line turns down or its recent steep uptrendline is violated.

When the H/S neckline is violated, the minimum downside objective was usually reached.

This is calculated by taking the height of the pattern at its maximum and subtracting that

number from the point where the neckline is violated. In such cases, the simplest

and safest approach is to wait for the A/D Line downtrend to be broken after the

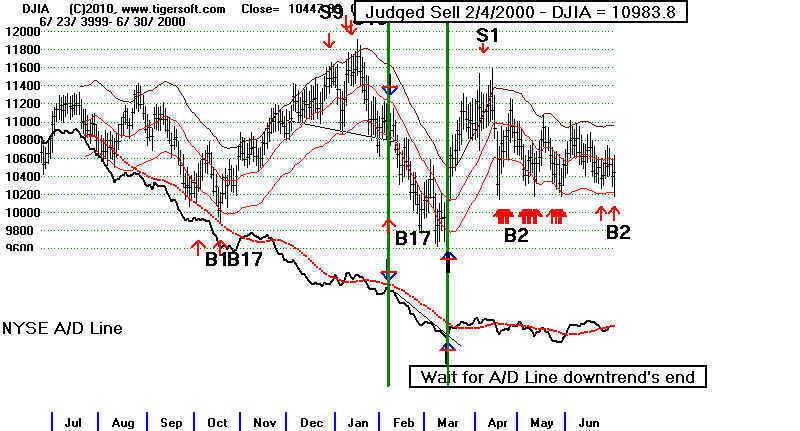

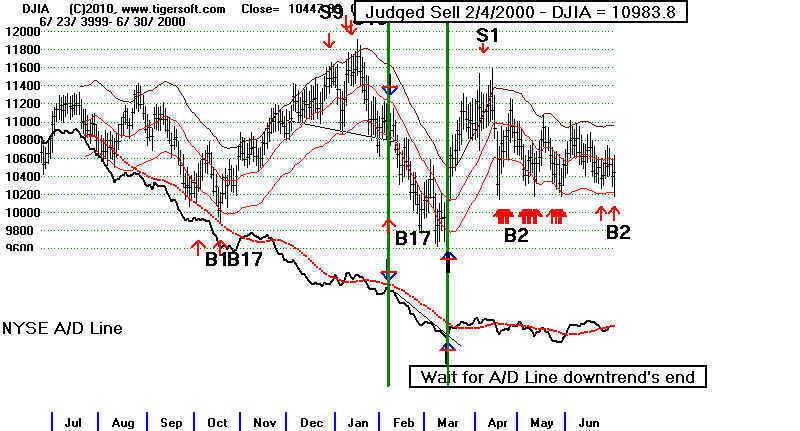

minimum downside objective has been reached. This usually occurs in a market

that is ready to rise quickly. So, hesitation can be somewhat costly.

All the cases of head and shoulders tops with rising market Buy B17s have their graphs

shown below.

The average gain is still 8.7% if only the automatic signals are used. There were 3

losses.

Using the judged head and shoulders pattern prevents all the bigger paper losses.

There were ten instances of B17s impacted by Head/Shoulders patterns. Study them

so that you can spot them.

Buy B17s by Month

No. Avg. Cases

Jan 2 5.6%

-2.0 13.2

Feb 9 5.6%

1.5 12.2 0.7 10.2

3.7 5.0 8.8 14.8 1.4

March 3 11.3%

18.6 -0.1 15.3

April 2 0.9%

-1.6 3.4

May 3 5.4%

6.6 5.9 3.7

June 1 11.3%

July 2

4.0%

2.3 5.7

Aug

3 7.2%

-0.5 9.2 14.0

Sept

9 10.4%

7.9 9.5 5.9

8.7 9.9 6.5 30.6 3.0 11.9

Oct

7 8.5%

5.3 12.0 10.3

4.6 6.5 7.5 13.4

Nov 6

16.0%

5.5 5.6 8.6

28.2 34.1 13.9

Dec 4

11.2%

18.5 3.5

14.4 8.4

Buy B17s: 1928-2011

=================

Date

DJIA

Gain

Paper Loss

at next Sell

1. 12/ 10/ 1928

263.9

+18.5%

none

la/ma = .94 21-dma roc=.119 P= -43 (+9) IP21= .01

V=-595 OP= .136 11% below top

2. 3/ 5/ 1935

100.1

+18.6%

3% loss

la/ma = .973 21-dma roc= -.185 P= -72 (-37)

IP21= -.042 10% below top

The Buy B17 occured as the DJI made a false breakdown below 5x tested support.

See chart below.

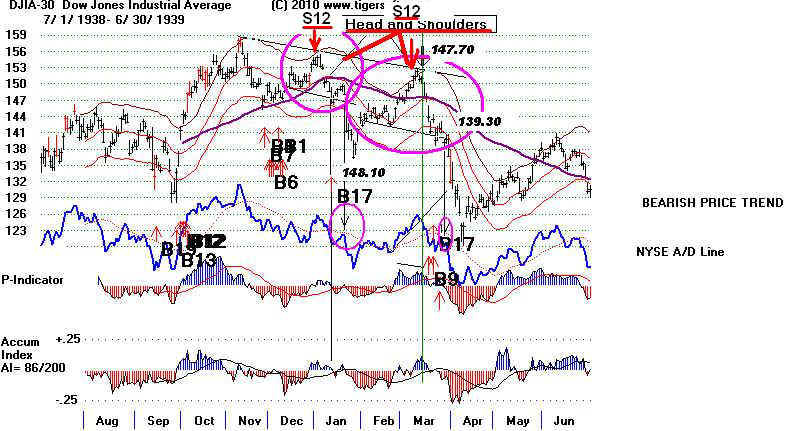

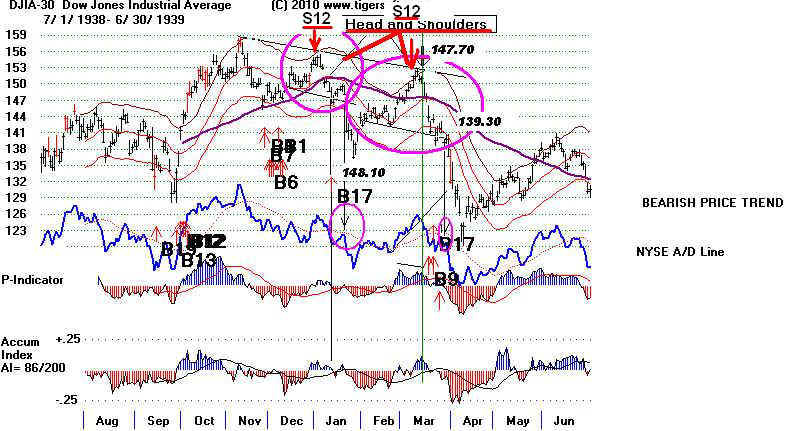

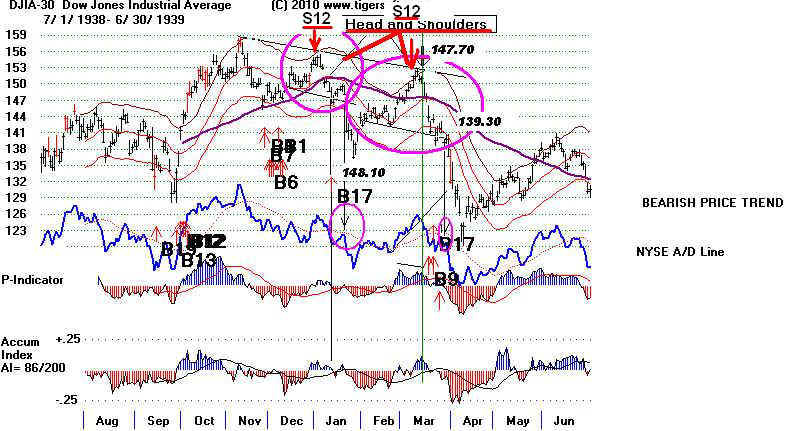

3. 1/ 12/ 1939

147.3

-2.0%

7% loss

Head/Shoulders

la/ma = .973 21-dma roc=

-.11 P= -12 (-25) IP21= .017 V= -45 OP =

.057 7% below top

Note the first head and shoulders in chart below. Using the rule

to sell on the right shoulder apex

of the head and shoulders pattern when the A/D Line uptrend was broken would

have meant

selling at 148.10 or at the next day's week opening. This would have

avoided an 8% decline

after the head and shoulders pattern's neckline support failed.

4. 3/21/1939

143.40

-0.1%

15%

loss Head/Shoulders

la/ma = .975

21-dma roc= -.121 P= 11 IP21= .001

12% below top

Note the second head and shoulders in chart below. Using the rule

to sell on the right shoulder apex

of the head and shoulders pattern when the A/D Line uptrend was broken would

have meant

selling at 139.30 on 3/28/1939 or at the next day's week opening. This

would have avoided a 9% decline

after the head and shoulders pattern's neckline support failed.

Note head and shoulders in chart.

5. 8/10/43

136.20

-0.5%

5% loss

la/ma = .971 21-dma roc= -.711

P= -38 IP21= -.202 7% below top

Using right shoulder HS apex rule and A/D Line

trend-break the position

should have been reversed at 138.50 on 11/1/1943. This woul dhave meant a small 1%

gain.

Head/Shoulders

6. 2/13/46

198.7

+1.5%

7% loss

la/ma=.98 21-dma roc- .188 P= -35 IP21=

.115 Non-symmetrical HS Pattern followed.

In the chart below, note the minimum downside objective had been

reached when the

Buy B19 occurred.

7. 6/29/51

242.60 +11.3%

none

la/ma=.973 21-dma roc- .339 P= -140 IP21= .102

uncompleted

non-symmetrical HS Pattern

In the chart below, see that prices rose when the neckline held and A/D Line

downtrend ended.

8. 10/29/51

260.4 +5.3%

1% paper loss

la/ma=.962

21-dma roc= -.478 P= -73 (+22) IP21=.019 6% down from high

9. 11/5/51

259.8

+5.5%

1% paper loss

la/ma=.97

21-dma roc= -.692 P= -105 (-1) IP21= -.035 -286 -.172 6% down from high

10. 4/7/53

275.2 -1.6% 1.6% paper loss

la/ma=.964 21-dma roc=.40 P=-2

IP21=-.018

11. 9/26/55

455.6 +7.9%

4% loss

la/ma=.957 21-dma roc= -.143 P=

-26 (-59) IP21= .08 -300

.169 6% down from high

12. 10/11/55

438.6 +12.0%

none

la/ma=.934 21-dma roc= -.958 P= -95 (-20) IP21= .018 -494 - .042 6% down from high

13. 10/18/55

448.6 +9.5%

none

la/ma=.974 21-dma roc= -.906 P= -58 (+14) IP21= .007 -424 - .146 6% down from high

14. 2/5/57

470

+10.3%

3% loss

la/ma=.982 21-dma roc= -.132 P= 12 IP21=-.064 8% down from high

15. 2/13/57

462.1 +12.2%

none

la/ma=.977 21-dma roc= -.606 P= -112

IP21=-.067 12% down from high

16. 9/9/59

637.6 +5.9%

4% paper loss Simultaneous H/S

la/ma=.974 21-dma roc=

-.294 P= 14 IP21=-.016

5% down from high

17. 9/15/59

630.8 +8.7%

2% loss Simultaneous H/S

la/ma=.971 21-dma roc= -.51 P= -172 IP21=-.045

5% down from high

18. 9/23/59

624

+9.9%

none Simultaneous H/S

la/ma=.972 21-dma roc= -.541 P= -203 IP21=-.085

8% down from high

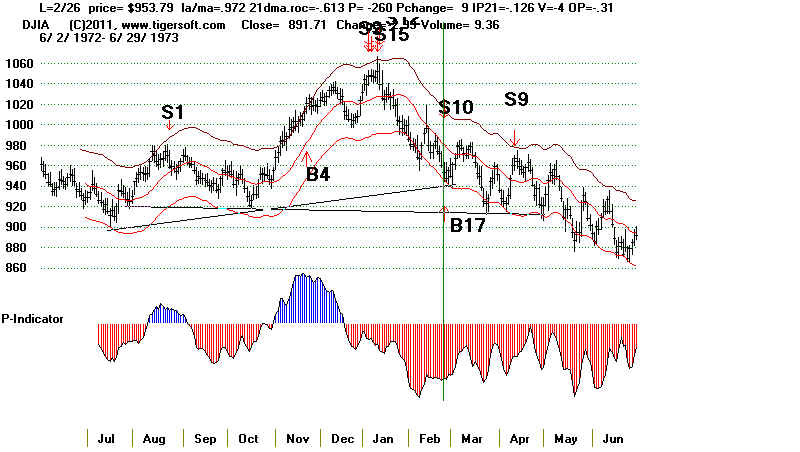

In the chart below, see that it would

have been safer not use a Buy B17 until the minimum

downside objective has been reached.

That was the bottom. One could also have waited

for the steep A/D Line downtrend to be

violated to the upside to Buy again.

19. 2/11/60

618.60 +0.7%

3% loss

la/ma=.972 21-dma roc= -.705

P= -124 IP21= -.172 13% down from high

20. 11/13/67

859.74 +5.6%

none

la/ma=.975 21-dma roc=

-.719 P= -232 (+10) IP21= -.218 V=-19 OP=-.515 10% down from high

21 2/14/68

937.38 +10.2%

none 13% down from high

la/ma=.971 21-dma roc=

-.762 P= -260 (+10) IP21= -.178 V=-22 OP=-.425 10% down from high

2% paper loss

22 2/20/69

916.65

+3.7%

none 10% down from high

la/ma=.974 21-dma roc=

-.167 P= -139 (-31) IP21= .016 V=-2 OP= .115

23 2/28/69

905.21 .

+5.0%

none H/S Shoulders

la/ma=.97 21-dma roc=

-.423 P= -264 (-1) IP21= -.056 V=-3 OP= .041 10% down from high

-----------------------------------------------------------------------------------------------------------------------------------------------------

This signal should be considered void,

because there was a simultaneous Sell S10.

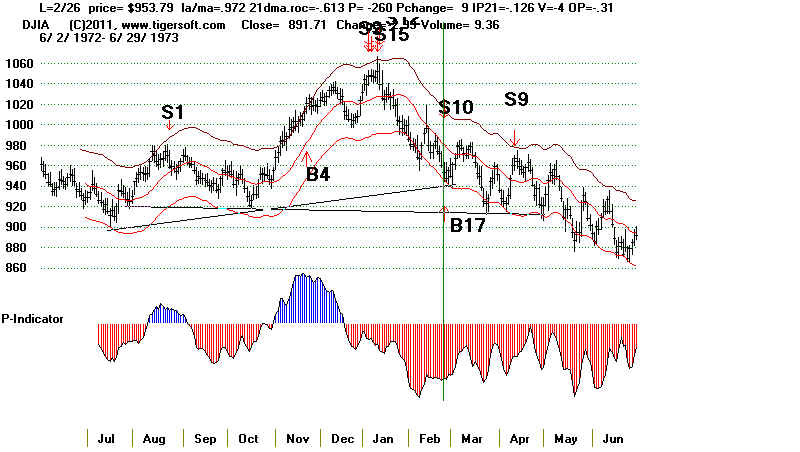

X 2/26/73

959.79

+1.4%

4% paper loss

la/ma=.972 21-dma roc= -.613

P=-260 (9) IP21= -.126 V= -4 OP= -.31

-----------------------------------------------------------------------------------------------------------------------------------------------------

24 9/16/75

795.13

+6.5%

none incomplete H/S

Shoulders

la/ma=.974 21-dma roc=

-.444 P=-160 (-50)

IP21= -.133 V= -3 OP= -.232

25 10/8/76

952.38

+4.6%

2%

Paper Loss

la/ma=.964 21-dma roc=

-.415 P=-150 (-12)

IP21= -.042 V= -3 OP= -.374

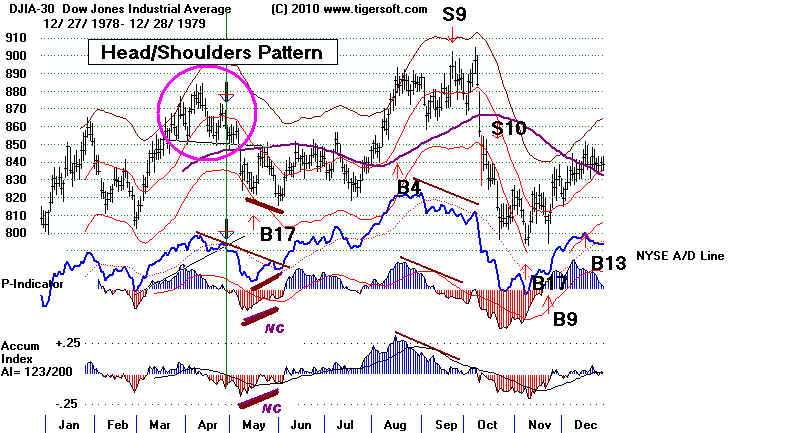

26 5/15/79

825.88

+6.6%

none H/S Shoulders

la/ma=.972 21-dma roc= -.484 P= -150 (+38)

IP21= -.107 V= -3 OP= .072

Minimum downside objective reached from

completed H/S Pattern.

27 11/7/79

796.67

+8.6%

none

la/ma=.972 21-dma roc=

-.882 P=-275 (+34)

IP21= -.101 V= -9 OP= -.573

28 12/9/80

934.04

+3.5%

3% Paper Loss H/S

pattern

la/ma=.96 21-dma roc= -.02

P=-123 (-7)

IP21= -.062 V= -1 OP= -.152

Minimum downside objective reached from completed H/S Pattern.

DJI still needed to test best support line.

29 2/2/81

932.25

+8.8%

none H/S pattern

la/ma=.971 21-dma roc=

-.501 P= -120 IP21= -.005

Minimum downside objective reached from

completed H/S Pattern.

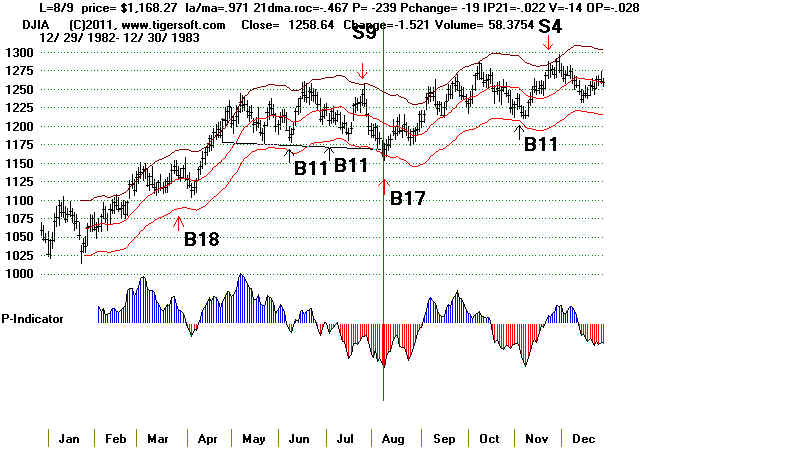

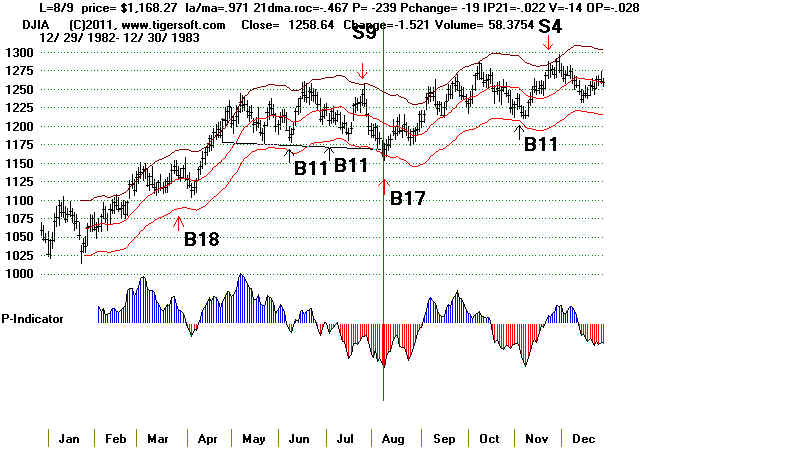

30 8/9/83

1168.27 .

+9.2%

none

la/ma=.971 21-dma roc=

-.467 P--239 (-19) IP21- .022

V= -14 OP= -.028

Supoprt line held after B17 and fifth test.

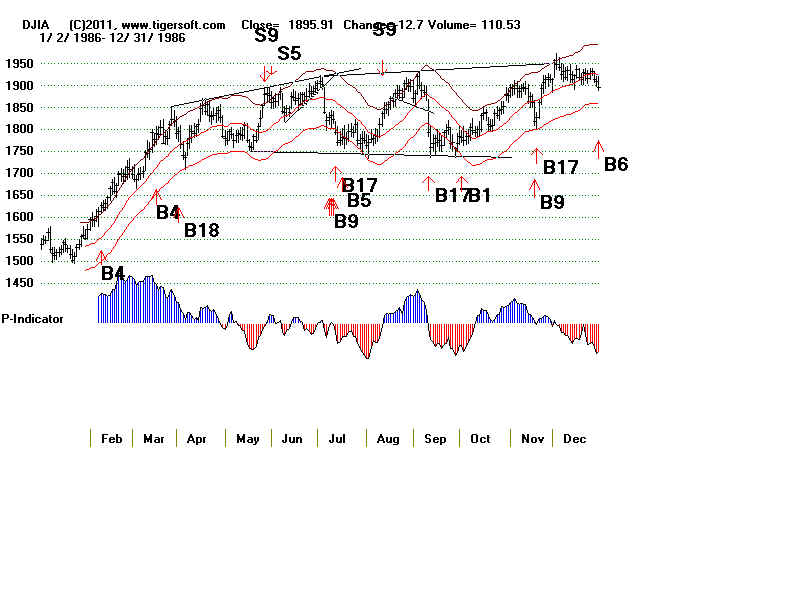

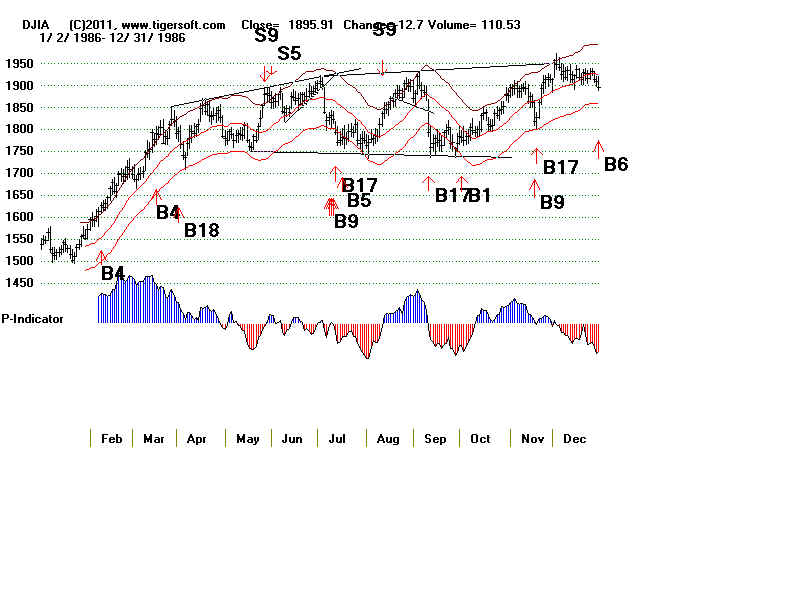

31 7/14/86

1973.45

+2.3%

2%

6% down from high

la/ma=.962 21-dma roc=

-.285

32 9/11/86

1792.89

+30.6%

none

la/ma=.955 21-dma roc= -.27

33 11/19/86

1826.63

+28.2%

none

la/ma=.98 21-dma roc= .134

34 5/19/87

2221.28

+5.9%

none

la/ma=.97 21-dma roc=

-.256

35 9/4/87

2561.38

+3.0%

none

la/ma=.963 21-dma roc=

-.147

36 11/11/88

2067.03

+34.1%

none

la/ma=.963 21-dma roc=

-.367

37 10/17/89

2638.73

+6.5%

1%

la/ma=.974 21-dma roc=

-.214

38 10/26/89

2613.73

+7.5%

none

la/ma=.967 21-dma roc=

-.261

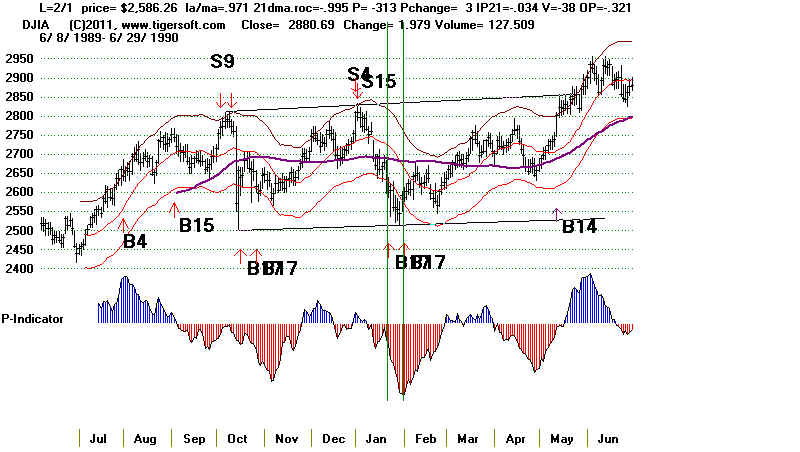

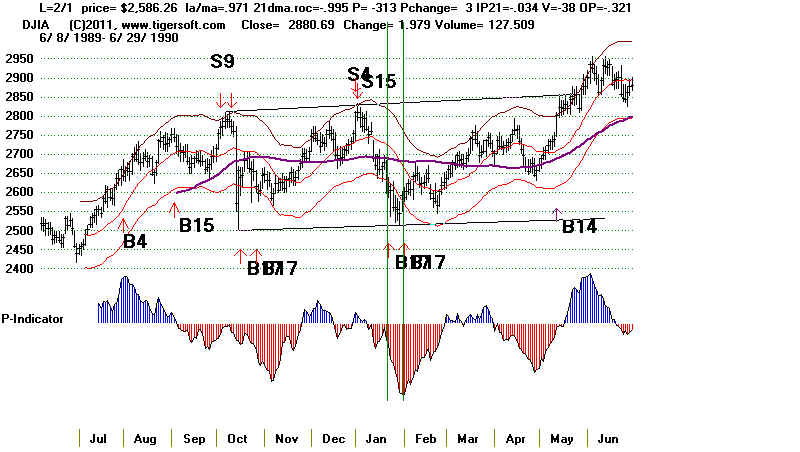

39 1/23/90

2615.32 .

+13.2%

2%

paper loss

la/ma=.961 21-dma roc=

-.331 P= -93 ( -24

) IP21= + .03 V= -19 OP= .02

40 2/1/1990

2586.26

+14.8%

1%

paper loss

la/ma=.971 21-dma roc=

-.995 P= -313 (+3 )

IP21= - .034 V= -38 OP= - .321

41 11/22/91

2902.73

+13.9%

none

la/ma=.962 21-dma roc=

-.447 P= -62

(-5 ) IP21= .055 V= -16 OP= - .123

42 12/5/91

2889.09

+14.4%

none

la/ma=.975 21-dma roc=

-.57 P= -128 (-15 )

IP21= .034 V= -23 OP= - .185

43 9/22/93

3547.02

+11.9%

none

la/ma=.98 21-dma roc=

-.194 P= +12 (+36 )

IP21= - .089 V= -13 OP= - .055

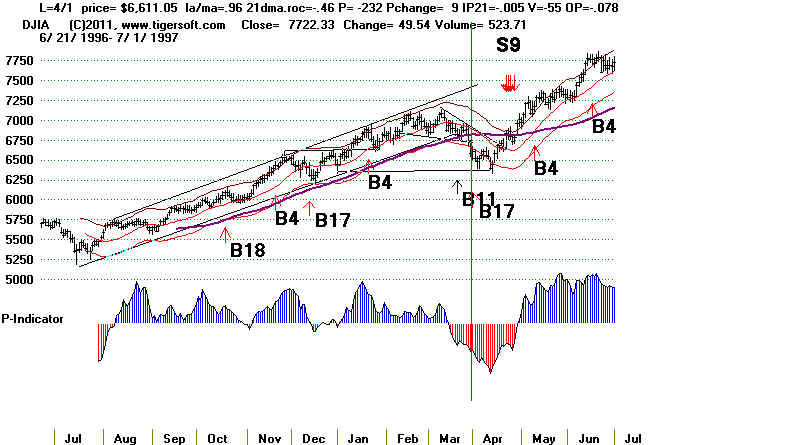

44 7/17/96

5376.88

+5.7%

none

la/ma=.959 21-dma roc=

-.585 P= -268 (+55 )

IP21= - .012 V= -62 OP= .009

45 12/12/96

6303.71

+8.4%

none

la/ma=.981 21-dma roc=

.07 P= 22 (-47)

IP21= .083 V= -20 OP= .055

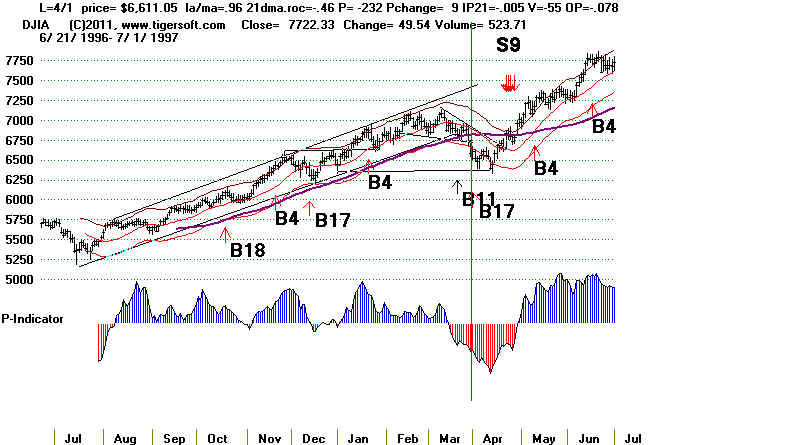

46 4/1/97

6611.05

+3.4%

none H/S pattern

la/ma=.960 21-dma roc=

-.46 P=-232 (+9)

IP21= -.005 V= -55 OP= -.078

47 5/27/99

10466.32

+3.7%

2% paper loss

la/ma=.963 21-dma roc=

-.414 P=-90 (-65)

IP21= -.019 V= -70 OP= -.194

48 10/18/99

10116.28

+13.4%

none

la/ma=.973 21-dma roc=

-.785 P= -505 (-60) IP21= -.075 V= -159 OP= -229

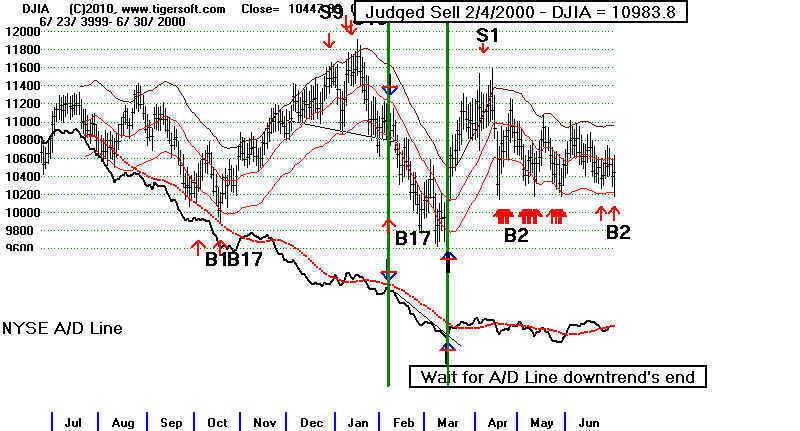

49 2/4/2000

10963.8

+1.4%

11% paper

loss H/S pattern

la/ma=.975 21-dma roc=

-.168 P= -53 IP21= -.102

See in the chart below that a judged Sell based on

the right shoulder apex being

clinched as A/D

Line turned down would have also have occurred on 2/4/2000.

This should have

negated the Buy B17. The DJI subsequently fell 11%

more with the

Head and Shoulders pattern playing out its minimum downside

objective.

Later buying when the A/D Line downtrend was broken would

have avoided the

11% paper loss and meant buying on 3/15/2000 at 10131.41

or at the next

day's opening.

50 3/2/07

12114.1

+15.3%

none

la/ma=.962 21-dma roc=

-.479 P= 77 (-82) IP21= -.022 V= -202 OP= -.089

51 8/20/10

10721.21

+14% 12045 on 6/8/2011 at H/S pattern

neckline.

la/ma=.983 21-dma roc= -.12 P= -36 (-77) IP21= .146 V= -108 OP= .002

52 6/8/11

12048.94

open

la/ma=.97 21-dma roc= -.608 P= -157 (-127) IP21= -.067 V= -203 OP= -.217

-----------------------------------------------------------------------------------------------------------------