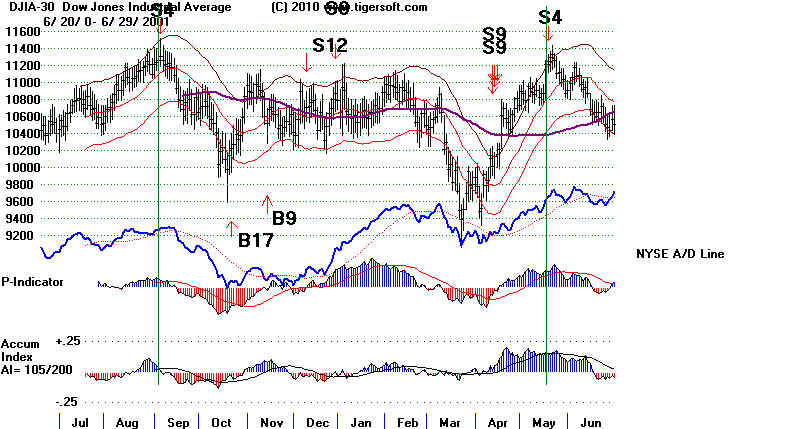

Sell S9 occurs when the Accumulation breaks below its 21-day ma

after a rally of more than 9% from a 65-day low or 7% from a two-month low.

The average gain = 9.1%. There were 33 cases since 1928. The buggest declines

generally took place from the 11th to the 20th of the month, +.24 and in year of

Mid-Term Elections, + .146. The smallest declines occurred in the 3rd year of

the Presidential 4-Year cycle.

>10% 11

>5%-9.99% 11

>2%-4.99% 8

>0%-1.99% 3

losses 0

Study just the IP21 crossings below its 21-day ma in June and July to see the

importance of these months and negative readings by the V-Indicator. This is

shown further below and was the subject of the 6/12/2014.

http://www.tigersoftware.com/11HL5522/index.htm

19370311 S4 192.2 .139

19370803 S4 185.9 .365

19401003 S4 135.1 .025

19410711 S4 127.9 .135

19430702 S4 143.7 .052

19460611 S4 209.1 .22

19470711 S4 184.8 .027

19471022 S4 184.4 .025

19510917 S4 275.1 .053

19570711 S4 518 .166

19610518 S4 701.1 .014

19660110 S4 985.41 .213

19730109 S4 1047.11 .114

19761222 S4 984.54 .051

19800116 S4 865.19 .101

19831122 S4 1275.81 .031

19850208 S4 1289.97 .033

19870826 S4 2701.85 .052

19890209 S4 2323.04 .031

19900102 S4 2810.15 .075

19940203 S4 3967.66 .074

19970207 S4 6855.8 .036

20000111 S4 11511.08 .13

20000906 S4 11310.64 .095

20010517 S4 11248.58 .268

20031015 S4 9803.05 .018

20050308 S4 10912.47 .076

20071005 S4 14066.01 .09

20080421 S4 12825.02 .112

20090105 S4 8952.89 .081

20090603 S4 8675.24 .041

20120921 S4 13579.47 .056

-------------------------------------------------

no. = 33 Avg. = .091

11 11 8 3 PE 8 .071 PE +1 13 .115 PE +2 4 .146 PE +3 8 .044 January 6 .119 February 4 .044 March 2 .108 April 1 .112 May 2 .141 June 2 .135 July 4 .095 August 2 .209 September 3 .068 October 4 .040 November 1 .031 December 1 .051 1-10 15 .079 11-20 12 .24 21-31 6 .055 |

================================================================================

revised 4/11/2013

Sell after a rally of more than 9% from a 65-day low

or 7% from a two-month low

when the

Accumulation breaks below its 21-day ma at the specified times

(see below)

during each of the years in the 4-year Presidential cycle. These

specified

times have multiple successes. What seemed like a good Sell S4

may have

failed at other times.

Based on

this level of refinement, there have been 25 closed out cases.

None

produced a loss. The DJI should close more than 1.4% over the 21-day

ma, except

in June, a month that often starts declines. The annualized rate

of change

can be as high as .977. The annualized rate of change was above

.60 in a

quarter of the 24 cases. One sixth of the time the DJI was up more than

8% from 65

days earlier. The IP21 was as high as .189. The adjusted P-Indicator

So, many of

the Sell S4s reversed strong momentum.was as high as +800.

The

critical component of all these Sell S4 was the Accumulation (IP21)

broke below

its 21-day ma.

It is

important to take future signals Sell S4 signals at about the same time

in the year

that successful Sell S4 signals have occurred in the past. These

are shown

in blue. Avoid those periods when unsuccessful red indications

occurred

unless there are many more successful Sell S4s. The Peerless

program

eliminate most of these unsuccessful periods automatically.

For those

months having no successful S4 signals and no contrary indications,

my advise

is be careful: the Sell S4s at this time are unproven.

During Presidential Election Year:

1928, 1932, 1936...2012, 2016...

Best month is April.

January

1/4/1996 bad

1/20/1932 good

1/25/1976 good

1/26/1972 bad

February

2/1/1988 bad

2/13/1936 bad

2/13/1976 good!

2/13/1992 bad

2/10/1964 bad

2/19/1964 bad

2/20/2004 bad

2/21/1936 bad

2/27/1992 bad

March

3/1/1976 bad

3/4/1936 good

3/10/1936 bad

3/12/1936 bad

3/18/1976 bad

3/20/1936 good

3/22/2012 good

April

4/6/1976 good

4/7/1988 good

4/16/1956 good

4/30/2008 good

May none

June

6/5/1968 good

6/29/1944 good

July

7/15/1980 bad

7/20/1944 good

7/25/1980 bad

August

8/14/1940 bad

8/21/2012 bad

8/28/1940 bad

8/30/1984 bad

September

9/5/1984 bad

9/19/1984 good

9/25/1980 good

October

10/4/1940 good

10/8/1928 bad

10/26/1928 bad

November

11/18/1940 good.

December

12/4/2008 bad

12/26/1996 bad

12/29/2008 bad

During Year after a Presidential

Election: 1929, 1933, 2009, 2013...

Best months are January, June and

August.

January first half:

1/12/1973 good

1/4/2001 good

1/4/2005 good

1/7/2009 good

1/8/1997 bad

January second half:

1/30/1929 good

February

2/20/1985

2/28/1985

March

3/18/1929 good

3/19/1997 bad

April

4/3/1961 bad

4/24/1981 good

May

5/14/2009 bad

5/17/2001 good

June

6/5/1945 good

6/19/1945 good

6/15/2001 good

6/17/2009 good

6/24/1929 bad

July

7/30/1937 good

7/17/1941 good

August

8/10/1937 good

8/18/1937 good

8/6/1941 good

8/26/1941 good

September

9/2/2009 bad

October

10/21/2009 bad

November

11/13/2009 bad

December

12/23/1937 good

12/6/1949 bad

During Second Year after a Presidential

Election: 1930, 1934, 2006, 2010...

Best month is June.

January

1/7/2002 good

1/17/1930 bad

1/14/1986 bad

February

2/24/1930 bad

2/1/1934 good

March

3/5/1930 bad

3/13/1934 bad

3/2/1934 bad

3/14/1930 bad

April

4/15/1986 bad

4/25/1930 good

May

5/6/1938 good

5/9/1978 bad

5/14/1986 bad

5/16/1938 good

5/18/1978 bad

5/24/1938 bad

5/26/1978 bad

5/30/1978 bad

June

6/4/1970 good

6/12/1978 good

July

7/3/1942 bad

August

8/1/2002 bad

8/13/1970 bad

8/20/1930 bad

September

9/18/1930 good

9/18/1962 bad

9/22/1982 bad

October

10/15/1958 bad

10/25/1934 bad

10/15/1974 good

November

11/7/1974 good

11/13/2010 bad

11/15/1974 good

11/22/1982 bad

December

12/1/1982 good

12/3/2002 good

12/7/2002 bad

12/9/1942 bad

12/11/1958 bad

12/13/1934 bad

12/23/2010 bad

12/31/1962 bad

During Third Year after a Presidential

Election: 1931, 1935, 2007, 2011...

Best month is May.

January

1/6/1955 bad

1/12/1983 good

1/17/1955 bad

1/24/1935 bad

February

2/24/1958 good

March

3/6/1939 good

3/8/1991 good

3/13/1951 bad

3/23/1999 bad

3/25/1983 bad

3/27/1967 good

April

4/21/1987 bad

4/22/1987 bad

4/25/1991 bad

4/28/1943 bad

May

5/13/1963 good

5/14/1975 good

5/22/1963 good

5/26/1939 good

5/28/1935 good

June

6/6/1935 bad

6/5/1975 bad

6/7/1999 bad

6/7/2007 bad

6/15/2007 bad

6/17/1935 bad

6/25/1999 bad

6/26/1935 bad

6/30/2003 bad

July

7/7/1931 good

7/14/1939 good

7/14/2003 bad

7/23/1931 good

7/24/2003 bad

August

8/1/1955 bad

8/3/1931 bad

8/6/1947 good

8/18/1955 bad

8/19/1935 bad

8/27/1935 bad

September

9/9/1987 bad

9/20/1935 bad

9/22/1955 bad

October

10/3/1939 bad

10/28/1963 good

November

11/8/1939 good

11/19/1931 good

11/19/1999 bad

11/24/1939 bad

11/25/1935 good

December

12/5/2011 bad

12/7/1955 good

12/8/1999 bad

12/28/2011 bad

12/31/1997 good

The average

decline at the time of the next Peerless Buy was 9.7%.

9 of the 23

Sell S4s would have allowed short sale gains on the DJI

of 9% or

more.

Below are

the S4s In order of the magnitude of the resulting decline before

a reversing

Peerless Buy signal. Sell S4s are important to Peerless because

they

sometimes occur when there are no other Peerless Sells and there was

also no A/D

Line non-confirmation warnings: notably in 1941 and 2001.

7/30/1937 35.8%

There was a Sell S9 two weeks later at final high.

The A/D Line failed to confirm the next DJI set of highs.

6/11/1946 22.0%

There was a Sell S5 two weeks before the S4.

The A/D Line confirmed the last DJI highs.

1/10/1966

21.3% A Sell S9, S12 and a Sell S15 occurred at about same time.

The A/D Line failed to confirm the next DJI set of highs.

5/17/2001 19.3% There were no other Peerless

Sells

The A/D Line confirmed the last DJI

highs.

7/17/1941 13.0% There were no other Peerless Sells

The A/D Line confirmed the last DJI

highs.

1/11/2000 13.0% There was a Sell S9 two

weeks later at final high.

A/D Line failed to confirm the next DJI set of highs.

4/21/2008 11.2% A Sell S9, S11 and a Sell

S15 occurred at about same time.

The A/D Line failed to confirm the next DJI set of highs.

1/16/1980 10.1% A Sell S9,

S121 and a Sell S15 occurred at final top 3 weeks later..

The A/D Line failed to confirm the next DJI set of highs.

10/5/2007 9.0% There

was a Sell S2 two weeks before the final high.

The A/D Line failed to confirm the next DJI set of highs.

Paper

losses averaged less than 1%. In 10 of the 22 cases, there was no paper loss.

The biggest

paper loss was 4.5%. All the rest were under 2.4 %. Users may

want to

work with a closing stop loss of 2.5%, but prepared to go short again

on a

subsequent major Sell.

Many of the Sell

S4s quickly led to a bear markets: 1937, 1940-1942, 1946, 1959-1960,

1966, 1977, 1987,

2000-2003 and 2007-2009.

Mid-year

Sell S4s are, by far, the most bearish.

7/30/1937

35.8%

2.9%

7/17/1941

13.0%

2.3%

6/11/1946

22.0%

none

5/17/2001

19.3%

0.5%

-------------------------------------------------

Avg. 22.5% 1.4%

The potency

of a Sell S4 varies a lot depending on which of the 4 years

in the

Presidential Election four-year cycle it occurs. The least bearish is

the year

before the Presidential Election. Sell S12s in the two years after

a

Presidential Election are the most bearish, averaging 22.7% and 12.2%

declines.

Presidential Election Year: Sell S4s

Gain Paper Loss

-------------------------------------------------------

10/3/1940

3.4% 1.1%

12/22/1976

5.1%

1.9%

1/16/1980 10.1%

4.5%

1/11/2000

13.0% 1.8%

9/6/2000

5.4% none

4/21/2008

11.2%

1.8%

9/21/2012

3.5%

0.2%

-------------------------------------------------

Avg 7.4%

1.9%

Year after Presidential Election Year:

Sell S4s

Gain

Paper Loss

-------------------------------------------------------

7/30/1937 35.8%

2.9%

7/17/1941

13.0%

2.3%

5/17/2001

19.3%

0.5%

-------------------------------------------------

Avg 22.7% 1.9%

2 Years after Presidential Election Year: Sell S4s

Gain

Paper Loss

-------------------------------------------------------

1/19/1938 5.3%

none

6/11/1946

22.0%

none

1/10/1966

21.3%

1.0%

1/3/1990

4.9%

none

2/3/1994

7.4%

none

-------------------------------------------------

Avg 12.2% 0.2%

3 Years after Presidential Election Year: Sell S4s

Gain

Paper Loss

-------------------------------------------------------

7/2/1943

5.2% 1.5%

7/11/1947

2.7%

1.2%

10/22/1947

2.5%

none

9/17/1951

5.3%

none

9/22/1955

5.7%

none

8/3/1959

6.0%

none

11/22/1983 2.4%

0.9%

8/26/1987 5.2%

none

10/15/2003 1.8%

0.4%

10/5/2007

9.0% 0.7%

-------------------------------------------------

Avg

% %

Sell S4s:

1928-2013

---------------------------------------------------------------------------------------------------------------------

la/ma

21-dma P-I P-I

Adj

IP21 V-I

Opct. 65-day

ann-roc change

PI

Pct Change

X

2/7/1930

declined only to ma 1.04 .839

67 -14

339 .

042

71 .306

.022

high

-----------------------------------------------------------------------------------------------------------------------

(1)

7/30/1937

35.8% 2.9% 1.022

.976 93 -15

415 . .14

73 .282 .075

highest

up 13% from 65-day low.

------------------------------------------------------------------------------------------------------------------------

(2)

1/19/1938

5.3% none 1.022

.019 -40

-19

209 . -.061

-159 -.077 -.042

8.8% gain if Extreme Bearish Mode B7 on 6/20/1938 at 118.6 was used to reverse the Sell.

up 13% from 65-day low.

-----------------------------------------------------------------------------------------------------------------------

(3)

10/3/1940

3.4% 1.1% 1.024

.262 60 -13

304 .053

48 .032

.105

up 21% from 65-day low.

----------------------------------------------------------------------------------------------------------------------

(4)

7/17/1941

13.0% 2.3% 1.014

.381 75 -21

404 .098

68 .328 .065

7/24/1941 13.7% 1.2% 1.015

.509 102

6 546

.126 91

.31

.099

up 10% from 65-day low.

-----------------------------------------------------------------------------------------------------------------------

(5)

7/2/1943

5.2% 1.5%

1.018 .076 26

-7 136

.076 -37

.177 .049

Best to wait a few days to sell when signal occurs right before July

4th.

---------------------------------------------------------------------------------------------------------------------

(6)

6/11/1946

22.0% none 1.001

.114 0 -48

1

.143 -55

.21 .073

up 12% from 65-day low

OK for

June

-----------------------------------------------------------------------------------------------------------------------

(7)

7/11/1947

2.7% 1.2% 1.037

.677 191 -6 799

.167

161 .409

.062

highest but A/D data in '47-'48 seems questionable

-----------------------------------------------------------------------------------------------------------------------

(8)

10/22/1947 2.5%

none 1.025 .424 72

0 303

.084 42

.321 .004

up 12% from 5-month low

-----------------------------------------------------------------------------------------------------------------------

(9)

9/17/1951

5.3% none 1.018

.424 96 -25

292

.137 69 .24

.081

up 13% from 65-day low

-----------------------------------------------------------------------------------------------------------------------

(10)

9/22/1955

5.7% none 1.024

.719 94 -14

270 .07

32 .298

.08

note modification in B17 at end of Sept.

Disallowed because of sharpness of decline.

up 17% from 4-month low

-----------------------------------------------------------------------------------------------------------------------

(11)

8/3/1959 6.0%

none 1.02

.418 4 -9 13

.068 -196 .434

.078

up 17% from 5-month low

-----------------------------------------------------------------------------------------------------------------------

X

911/1963 -0.9% 2.7%

1.021

.493 78 -10 221

.024

-26 .455

.032

too high

up only 12% from 6-month low

-----------------------------------------------------------------------------------------------------------------------

(12)

1/10/1966 21.3% 1.0% 1.02 .443

37 4

96 .01

6

.097 .049

up only 17% from 6-month low

-----------------------------------------------------------------------------------------------------------------------

11.21

what about?

5/11/1971

.997 .134 -87

-5 -184

.073 -1

.115 .065

5/14/1971

.995 -.027 -120

-17 253 .07

-2 -.101

.058

low low

-----------------------------------------------------------------------------------------------------------------------

(13)

12/22/1976 5.1% 1.9% 1.02

.354 214 -7

396

.066 2

.292 -

.011

up only 7% from 2-month low

-----------------------------------------------------------------------------------------------------------------------

what about?

4/6/1979

1.02 .428 147

-26 280

..003 3

.169 .056

----------------------------------------------------------------------------------------------------------------------

what about?

8/27/1979

1.02 .627 192

6 364

.201

5 .085 .054

high

------------------------------------------------------------------------------------------------------------------------

(14)

1/16/1980 10.1%

4.5% 1.025

.317 67 -19

129 -.016

2 .026

.03

up only 10% from 2-month low

low

-----------------------------------------------------------------------------------------------------------------------

(15)

11/22/1983 2.4%

0.9% 1.028

.258 42 34 84

.044 -2

.268 .057

up 10% from 65-day low

low

-----------------------------------------------------------------------------------------------------------------------

(16)

8/26/1987 5.2%

none 1.023

.824 96 -21 190

.189 17

.231 .148

up 22% from 65-day low

low

-----------------------------------------------------------------------------------------------------------------------

(15)

1/3/1990 4.9%

none

1.027 .27 36 -15 71 .08

-4 -.093 .041

up 9.5% from 65-day low

-----------------------------------------------------------------------------------------------------------------------

(17)

2/3/1994 7.4%

none

1.019 .517 146 -23 231

.151 9

.333 .067

up 12% from 65-day low

-----------------------------------------------------------------------------------------------------------------------

(18)

1/11/2000

13.0% 1.8% 1.017

.302 -30 -57 -30

-.06 68 .239

.074

low

-----------------------------------------------------------------------------------------------------------------------

(19)

9/6/2000 5.4% none

1.017 .476 103 -12 103

.013

-6

.392 .043

up 10% from 65-day low

Should

a B2 reverse in late September of a Pres Election year.

-----------------------------------------------------------------------------------------------------------------------

(20)

5/17/2001 19.3% 0.5% 1.039 .698

327 -15

318 .136 34

- .005 .03

up 10% from 65-day low

-----------------------------------------------------------------------------------------------------------------------

(21)

10/15/2003 1.8% 0.4% 1.025 .294

305 -102

295 .016 -30 .026

.068

up 9% from 65-day low

-----------------------------------------------------------------------------------------------------------------------

(22)

10/5/2007 9.0% 0.7% 1.027 .612

270 40

243 .05

54 .258

.035

up 10% from 65-day low

-----------------------------------------------------------------------------------------------------------------------

(23)

4/21/2008 11.2% 1.8% 1.024 .442

281 -92

253 .027

4 -.011 .027

up 9% from 65-day low

low

-----------------------------------------------------------------------------------------------------------------------

(24)

9/21/2012 3.5%

0.2% 1.021

.365 331 55

331 .014

23 .205 .055

up 12% from 65-day low

high

-----------------------------------------------------------------------------------------------------------------------

Number = 24

Avg.= 9.7% 0.9%

1.02

.43

107 -17 214

.06 4

.183 .052

1987 Top

Watch for Accumulation Index Breakings below its 21-dma

after a DJI rally of 9%, especially in the Summer

Even if

there is no Sell S4, you will want to watch the Accumulation Index on the

DJI.

Its dropping below its 21-day ma after a substanial DJI rally is a

often a

reliable

warning of a coming sell-off. This is especially true in the second half of

the

year before

a Presidential Election. In early 2011, I warned here that "2011 may see

a

signicant

top." That was because 10 of the 23 completed Sell S4s took place in the

second half

of the year BEFORE a Presidential Election Year.

Sell S4s

occur most frequently between August and February. February gains are

somewhat lower than average. Paper losses are most likely from December to February.

Sell S4s and Month of the

Year

Gain

Paper Loss

January

1/10/66

+ 21.3%

1%

up `8% from

June low. Sell S12 followed..

1 970 breakout support held on one test and then was violated.

1/16/80

+10.1%

4%

up 10% from Nov

loq. S12, S9, S15. followed.

1/3/90

+4.9%

none

up 10% frpm Oct low. S15. followed.

1/11/2000

+13.0%

2%

up

14% frpm Oct low. S15. followed.

February

2/3/94 +7.4%

none

March

April

4/21/2008 +11.2%

3%

May

5/17/01

+19.3%

none

June

July

7/30/1937

35.8%

2.9%

7/17/1941

13.0%

2.3%

August

8/3/1959

6.0%

none

8/26/1987 5.2%

none

September

9/17/35

+5.1%

none Also S8 Up 38% from March low.

only declined to LB.

9/17/51

+5.3%

none Up 24% from June

low.

9/22/55

+6.3%

none Up 24% from March low.

9/6/2000 +5.4%

none

Up 16% from March low.

9/21/2012 +3.6%

none Up 12% from May low.

October

10/3/1940

+3.4%

1.1%

10/22/1947

+2.5%

none

10/15/2003 +1.8%

0.4% UP 30% from March low.

Declined only to 65-dma and to B10 breakout point/ ut

10/5/2007

+9.0%

0.7% UP 27% from March low.

November

11/22/1983

+2.4%

0.9% UP 11% from

August low.

December

12/22/1976

+5.1%

1.9% 1.02

-------------------------------------------------------------------------------------------------------------------------------

4/9/2013

Program Code for

testing the Sell S4 at any time of year

For i = 66 To RN

If la(i) / ma(i) > 1.0398 Then 33411

If newipxxx(i) > .19 Then 33411

If opma(i) > .45 Then 33411

minlow = 99999999

For J = i - 65 To i - 5

If la(J) < minlow Then minlow = la(J)

Next J

If (la(i) - minlow) / minlow < .09 Then 33411

If newipxxx(i - 1) > maip21(i - 1) And newipxxx(i) < maip21(i) Then s9(i) = 4: ms(i)

= 4: pi = i: s4arrows (pi): i = i + 5

33411 Next i

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Older Peerless

Versions

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

2011

Version Sell S4s:

1929-2010

Date DJI Gain Paper Loss 10% Downside Achieved?

----------------------------------------------------------------------

2/5/1930 250.60 +1.3% 7% YES ....After peak 10 wks later.

Leads to bear market

2/1/1934 108.50 + 4.8% none YES ....10% decline 3/27/34.

9/17/1935 133.10 + 3.8% none 4% decline 10/3/1963

10/3/1940 135.10 +11.2% none YES ....12% decline 2/14/34.

Leads to bear market

10/22/47 184.40 +4.2% none YES ....10% decline 11/30/49.

9/17/51 274.10 +5.3% none 7% decline 11/8/1952

9/22/55 486 +6.3% none YES ....10% decline 10/11/55.

8/3/59 678.10 +6.0% none 9% decline 9/21/1959

Leads to bear market YES ....10% decline 2/17/60

9/11/63 740.30 +3.9% 3% 4% decline 11/22/1963

1/10/66 985.41 + 11% 1% YES ....10% decline 5/10/66

Leads to bear market

12/11/72 1036.27 + 8% 2% YES ....10% decline 3/22/72

12/22/76 984.54 +5.1% none YES ....10% decline 8/8/77

Leads to bear market

1/16/80 865.19 +2.3% 4% YES ....10% decline 3/24/80

Leads to mini-bear market

11/22/83 1275.81 +11.8% none YES ....10% decline 2/22/84

Leads to mini-bear market

8/26/87 2701.85 +5.2% none YES ....10% decline 10/14/87

Leads to bear market

1/3/90 1809.73 +7.4% none YES ....10% decline 1/29/87

2/3/94 3975.54 +7.4% none YES ....10% decline 4/4/94

Leads to bear market

1/11/2000 11511.08 +4.8% 2% YES ....10% decline 2/14/2000

Leads to bear market

9/6/2000 11310.64 +9.6% none YES ....10% decline 10/12/2000

Leads to bear market

5/17/01 11249 +22.1% none YES ....10% decline 7/11/2001

Leads to bear market

10/15/03 9803.05 -0.6% -0.6% NO - only shallow decline.

10/5/07 14066.01 +6.0% 1% YES ....10% decline 1/8/2008

Leads to bear market

4/21/2008 12825.02 +11.2% 3% YES ....10% decline 6/26/2008

Leads to bear market

==========================================================

Number of trades = 23

Avg. Gain= 6.9 %

There was only 1 loss.

In 4 of the 23 cases the paper loss was 3% or more.

The biggest paper loss was 7.% (February 1930)

9 of the 23 brought short sale gains of more than 7.3%

at the time of next Peerless Buy.

16 of the 23 casaes saw declines of more than 4.7%

Sell S4s Are Signals Occur Only in Certain Months

of the 4-Year Presidential Cycle:

Sell S4s cannot and do not occur at any time in the year.

Presidential Election Years -

8 cases: January (2x), April, September (2), October and December (2)

The Year after a Presidential Election Year: Signal Excludes Januaries - March

1 case: May

(Why do not more Sell S4s occur in this year? Probably because this year

is often weak or rallies with very strong internals, as in 2009.)

Two Years after a Presidential Election Year: They can occur any month, on theory.

5 cases: January (2x) and February (3x)

Three Years after a Presidential Election Year: Signal Excludes Januaries - March

10 cases: August (2x), September (5x), October (3x), November

(Almost half of the signals occur in the third year of the Presidential Election,

a year when rallies are common.)

Normally the range of key values are:

LAST/MA 1.017 to 1027 .... near upper band

AnnRoc .25 to .70 ... rising

IP21 -.06 to +.19 ... weak and weakening.

V -68 to + 73 ... (Not much of a limiting factor.)

OPMA -.02 to +.46 ... (Not much of a limiting factor.)

Sell S4s in a Presidential Election Year. 1928, 1932, 1936...

2000, 2004, 2008. There have been 5 valid Sell S4s in a Presidential

Election Year. Each brought a decline below the lower band. They

averaged declines of 7.3% at the time of the next Peerless Buy.

1. 1940 10/3/40 <LB reversed by 2/28/41 B19 at 119.90 +11.2%

135.10 1.024 .262 60 .053 48 .029

2. 1972 12/11/72 <LB paper loss of and then +8.0% gain

1036.27 1.019 .558 152 .112 2 .357

3. 1976 12/22/76 +5.1% <LB This marked top before bear market.

984.54 1.02 .354 214 .068 2 .286

4. 1980 1/16/1980 <LB +2.3% 4% Paper Loss. This marked top before bear market.

865.19 1.025 .317 67 -,016 2 .026

5. 2000 1/11/2000 <LB

+4.8% Paper Loss 2%

11511.06 1.017 .302 -30

-.06

-68 .239

6. 2000

9/6/2000 <LB +9.6% gain Decline began

immediately

11310.64 1.017 .476 102

.013

-6 .391

7. 2008 4/21/2008 <LB +11.2%

Paper Loss 3%

12825.02 1.024 .442

282 -91 .025

5 -.012

8. 2012 9/21/2012 OPEN

13579.47 1.021 .365 +331 +55

-.014 .23 .216

--------------------------------------------------------------------------------------------------------

All seven went below the lower band

Avg. Gain = +7.4%

------------------------------------------------------------------------------------------------------------------------------------

Note that a Sell S4 is not allowed in February or March in a Presidential Election year.

The 4 such cases in these months are shown below.

BAD 1936 2/5/36 Gain = + 1.3%

150.60 1.025 .463 77 .022 73 .017

DJI rallied to 160 on 4/3/36. Paper loss = 7%.

DJI then fell below lower band.

BAD 1936 3/20/1936 Gain = +5.6%

157.40 1.019 .231 -34 -.043 -269 .088

DJI rallied to 160 on 4/3/36. Paper loss of 2%.

DJI then gell below lower band.

BAD 1972 3/9/72 Lloss for 3 months +3.3%

942.81 1.018 .349 101 .024 1 .064

Sell S4s in the first year after a Presidential Election.

1929, 1933, 1937... 2001, 2005, 2009.

1 2001 5/17/01 +22.1% <LB Decline began immediately

11249 1.039 .698 327 .136 34 -.005

4 1990 1/3/90 <LB +7.4% 10% decline started immediately.

1809.73 1.027 .27 36 .08 -3 .-093

4 1990 1/3/90 <LB +7.4% 10% decline started immediately.

1809.73 1.027 .27 36 .08 -3 .-093