BUY B15 Steadily Rising 21-day MA for 40 or more Straight Days

December Peerless 2013 version - December 9, 2013

(C) 2013 William Schmidt, Ph.D.

There have been 24 of the December Peerless-2013 Buy B15s. All were profitable.

Their average gain from 1928 to 2013 was 10.8%. The biggest gains generally

came in the 2nd and 3rd Years in the Presidential 4-Year cycle. The smallest gains

came in the year after the Presidential Election, only 7.6%. Except for August, there

are no Buy B15s from May to October.

Size of Gains

>10% 9 5% - 9.99% 5 2% - 4.99% 9 0% - 1.99% 1 Losses 0

BUY B15s: 1928-2013 19360120 B15 144.1 .084

1.002 .331 92 -12 411 .08 100 .046 .067

X 19360806 B15 161.9 .143

19430302 B15 126.7 .124

1.01 .393 94 -22 480 .131 107 .246 .123

------------------------------------------------------------------------

19451121 B15 189.5 .051 fell to 187.8

1.005 .265 90 -3 411 .163 85 -.032 .149

------------------------------------------------------------------------

A19470327 B15 179.2 sell 184.4 fell to 163.6

1.014 .135 91 58 381 .11 55 .215 .01

------------------------------------------------------------------------

19580211 B15 442.4 .470 fell to 436.9

.986 .072 122 -27 387 .035 144 -.032 .007

------------------------------------------------------------------------

19580820 B15 504 .290 no paper loss

.998 .215 67 4 214 .138 22 .241 .105

------------------------------------------------------------------------

19590126 B15 592.4 .098 fell to 574.5

1.004 .526 137 2 406 .112 164 .416 .088

------------------------------------------------------------------------

X 19610118 b15 634.1 .106

------------------------------------------------------------------------

19610207 B15 643.9 .089 fell to 637.00

1.008 .364 134 -20 390 .117 180 .148 .094

------------------------------------------------------------------------

19610315 B15 662.9 .058 no paper loss

1.005 .468 113 15 328 ,19 92 .331 .085

------------------------------------------------------------------------

X19650325 B15 813.2 .045

------------------------------------------------------------------------

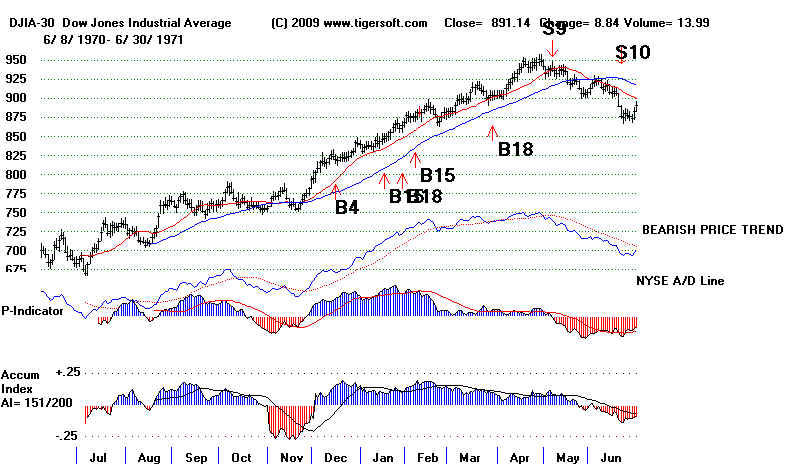

19710118 B15 847.82 .106 no paper loss

1.016 .411 308 17 653 .087 1 .456 .111

------------------------------------------------------------------------

19710329 B15 903.48 .038 no paper loss

.999 .136 60 10 127 .131 0 .237 .158

------------------------------------------------------------------------

A19760226 B15 728.1 .188 no paper loss

1.012 .588 114 .47 217 .097 1 .195 .196

------------------------------------------------------------------------

19750316 B15 764.0 .132 fell to 742.88

1.01 .435 89 -9 169 .053 0 .192 .301

------------------------------------------------------------------------

19760227 B15 972.61 .038 no paper loss

1.001 .261 151 -8 280 .024 2 .232 .15

------------------------------------------------------------------------

X19790315 B15 847.02 .046

19800826 B15 953.41 .035 fell to 924.49

1,007 .352 80 -10 155 .104 2 .112 .116

---------------------------------------------------------------------

19860116 B15 1230.68 .048 no paper loss

1.02 .542 245 11 485 .101 9 -.027 .04

---------------------------------------------------------------------

X19860403 B15 1766.40 .034

19870227 B15 2223.99 .082 no paper loss

1.012 .329 102 -4 201 .065 7 .078 .166

-------------------------------------------------------------------

A19870313 B15 2258.66 .065 fell to 2248.44

1.009 .462 63 -32 125 .046 8 .167 .178

-------------------------------------------------------------------

19890821 B15 2647.00 .047 no paper loss

.997 .195 36 -11 62 .085 8 .155 .073

-------------------------------------------------------------------

19920210 B15 3245.08 .033 fell to 3181.35

1.001 .168 75 39 146 .027 0 .025 .068

--------------------------------------------------------------------

A19950125 B15 3871.45 5549.21 fell to 3832.08

1.00 .117 74 -2 102 .061 -5 -.151 -.006

--------------------------------------------------------------------

19950417 B15 4159.38 .333 no paper loss

1.009 .362 111 -30 154 .064 9 .324 .087

--------------------------------------------------------------------

A19970124 B15 6696.48 .024

1.005 .311 188 -60 230 .091 12 .195 .104

-------------------------------------------------------------------

19980327 B15 8796.08 .043 no paper loss

1.012 .419 161 -43 246 .122 24 .148 .124

------------------------------------------------------------------

19990514 B15 10913.32 .02 fell to 10490.51

1.008 .497 15 -106 214 .06 11 .243 .189

-----------------------------------------------------------------------

20061031 B15 12080.73 .026 fell to 11986.28

1.009 .409 531 17 489 .207 47 .342 .08

Note S19 on 1/5/2007.

-----------------------------------------------------------------------

20120229 B15 12952.07 .013 fell to 12759.15

.988 -.095 -85 -204 -85 .037 -92 .052 .059

unique negative readings here.

--------------------------------------------------------------------

No.= .108

PE 6 .093 PE+1 6 .076 PE+2 4 .211 PE+3 8 .120 January 6 .093 February 6 .121 March 5 .077 April 2 .184 May -- ---- June -- ---- July -- ---- August 4 .129 September-- ---- October -- ---- November 1 .051 December - --- 1-10 4 .100 11-20 6 .157 21-30 12 .079 |

=====================================================

Steady Momentum Up, Shown by 40 or More Straight Rising

Days for 21-day MA and/or 65-Day ma.

Updated 9/7/2009

The Peerless Buy B15 brings

gains on average about 6%. There have been XXX of B15s

since 1928. Only one produced a

small loss, about 1%, at the time the signal was reversed.

That would have been prevented watching for the

development of a head and shoulders

pattern. In only 2 cases did the

DJI fall as much as 6% after a Buy B15, but never more

than 7% before rallying. So,

B15 rallies are quite reliable.

What stands out, is how the DJI nearly always rallies past the first tagging of the upper

band after

a Buy B15. Only a Sell S9/S12 or a

head and shoulders pattern seems to prevent such a bullish outcome.

Do

nor employ a Buy B15 within 10 trading days of another Peerless Sell.

Examples: 2/16/1946 . There

had been a Sell S8 on 2/5/1946.

9/25/1967. There had been a Sell S12 on 9/14/1967.

3/11/2005. There had been a Sell S15 on 3/4/2005

Do not employ a Buy B15 unless the DJI is less than 2.3% over the 21-day ma but not more

than .

2% below the lower band.

Example - 9/1/33 CL/MA = 1.045 ... In this case a Sell S9 would have

closed out the trade with a 1.5% gain.

The P-Indicator bearishly stood at only +19 despite the DJI being

above the upper 3.5% band. If the

IP21 is below -.06, look for a pullback just below the 21-day ma and

expect only a small rally. See the

cases of 9/8/1936 and 3/8/1985. Another example - 9/9/1955.

There are a

few cases of Buy B15s where the DJI's 21-day ma has not been rising 40 straight days.

See 9/23/42 for example. In these

cases, the 65-day ma has been rising more than 40 straight days AND

the 21-day ma is above its levels five,

10, 15, 20, 25 and 30 days before. In this case, note that the IP21 was a very

high +.163

and the Opct was +.283 .

Eliminate

Buy B15s in late September, after the 23rd. Too often there is a steep decline in

October.

The case of 9/27/1951 is an example.

occurs when the DJI's 21-day ma rises 39 days in a row with reasonably good internals. In the table

below you can see the internals we look at. They are:

1) CL/MA - the DJI's close divided by its 21-day ma value.

2) ANN ROC - the annualized rate of change of the 21-day ma.

3) P-Indicator - based on NYSE advances and Seclines

4) Daily chamge of P-I.

5.) Current Accumulation Index value - also originally called "IP21"

6) V-Indicator - based on Adjusted NYSE Up volume minus Down Volume.

7) OPct - base don daily OBV.

Buy B15s 1929-2009

Date DJI Gain

LA/MA Ann.Roc P IP21 V-I OPct.

----------------------------------------------------------------

9/5/1935 +4.6% Gain = +2.9%

129.3 1.014 .346 46 19 .024 -11 .345|

Immediate rally to upper band.

------------------------------------------------------------

(9/8/1936 169.69 +1.9%

1.021 .115 11 -9 -.126 -51 .171

DJI fell back to 165.20 before rallying to upper band S9/S12

0n 10/5/1936 at 172.80.)

------------------------------------------------------------

9/23/1942 108.30 +30% approximately.

1.015 .112 23 9 .163 -2 .283

DJI immediately rallied to 6/7/1943 with the DJI at 141.80

-----------------------------------------------------------

3/3/1943 130.00 +9.1%

1.019 .43 102 7 .157 135 .197

DJI immediately rallied past first tagging of the upper band.

------------------------------------------------------------

9/23/1949 Gain +18.8%

181.3 1.006 .165 86 8 .127 51 .145

Immediate strong rally up to Sell S9 at 215.30 on 4/14/1950

------------------------------------------------------------

2/17/1950 Gain +6.0%

203.20 1.007 .219 15 16 .189 -75 .21

Immediate rally up to Sell S9 at 215.30 on 4/14/1950

-----------------------------------------------------------

2/26/1951 Gain +6.6%

253.20 1.006 .417 33 3 .142 62 .203

Not reversing signal.

DJI fell to 243. Paper loss of 4%.

------------------------------------------------------------

3/2/1954 Gain = +0.7%

297.50 1.017 .208 63 -3 .135 0 .034

Not reversing signal.

------------------------------------------------------------

9/2/1958 511.80 +20% approx.

1.008 .15 31 -5 .096 -94 .334

Immediate rally. S8 should not have been taken in September

as this was an all-time high. DJI rallied to 624.1 on 4/17/1059

------------------------------------------------------------

3/17/1959 Gain +6.1%

611.8 1.013 .487 104 3 .115 83 .546

DJI declined to 601.70 on 3/31/1959 and then rallied to S9 at upper band.)

start here

---------------------------------------------------------------

2/7/1961 643.9 +7.4%

1.008 .364 134 -20 .117 180 .143

Declined to 637 on 2/13/1961 and then rally beyond firsttagging of upper band,

-----------------------------------------------------------

3/1/1961 663 +7.9%

1.019 .227 115 -23 .131 130 .1836263

Declined only to 662.90 on 3/15/61 and then rallied past first tagging of the upper band.

-----------------------------------------------------------

2/27/1963 670.8 +10.4%

.985 -.211 -43 -24 .06 -367 .099

Declined to 659.70 on 3/1/1963 and then rallied past first tagging of the upper band.

-----------------------------------------------------------

(4/8/1963 706.00

1.035 .588 91 6 .097 99 .48

DJI declined to 687.80 on 7/23/1964 and then rallied. )

-----------------------------------------------------------

2/17/1964 796.20 +6.3%

1.013 .311 1 1 .013 -305 .336

Immediately rallied...

-----------------------------------------------------------

3/23/65 898.70 +4.5%

1.001 .174 23 -11 -.02 0265 .407

DJI declined to 809.10 on 3/30/65 and rallies to Sell S9.

-----------------------------------------------------------

(3/23/67 876.67

1.029 .456 56 15 .005 9 .335

DJI declined to 847.66 on 4/11/67 and then rallied to upper band and S12.

This B15 occurred just four days after Sell S12.)

------------------------------------------------------------

(9/25/67 943.08

1.03 .582 78 16 .06 8 .45

DJI declined to 849.57 on 11/8/67.

This B15 occurred a week after a Sell S12.)

------------------------------------------------------------

1/18/1971 847.82 +10.6%

1.021 .326 243 -24 .096 1 .464

Immediately rallied past first tagging of the upper band.

-----------------------------------------------------------

2/5/1971 876.57 +6.9%

1.022 .539 253 4 .162 2 .51

DJI declined to 870 on 2/23/1971 and rallied past the first tagging of the upper band.

-----------------------------------------------------------

3/2/72 933.77 +1.0%

1.018 .416 56 -2 .038 0 .177

DJI rallied to upper band and S4.

------------------------------------------------------------

2/26/75 728.1 Big Gain!

1.012 .588 114 -47 .097 1 .19

DJI immediately rallied to 877.42 on 7/1/75

------------------------------------------------------------

3/24/75 743.43 Big Gain!

.982 -.10 -6 -70 .03 -1 .024

DJI immediately ra;;ied.

------------------------------------------------------------

3/1/1976 975.36 +3.5%

1.003 .081 116 -36 -.004 1 .214

DJI immediately ra;;ied to upper band and S9/S127475

-----------------------------------------------------------

4/11/1979 871.71 +1.0%

1.01 .342 99 -39 -.008 2 .095

DJI declined to 822.33 on 5/31/1979 and then rallied past recent high.

Note the completion of a head and shoulders pattern gave warning to the coming of

this decline. So did the NYSE A/D Line trend-break. 6% decline first.

-----------------------------------------------------------

9/2/1980 940.78 +4.8%

.993 .117 16 25 .047 2 .101

DJI went sidewise until reversing sell. The lowest close in this period

was 817.75 on 10/30/1980.

-----------------------------------------------------------

3/23/1983 1140.87 +9.0% Rallied to S9 on 7/26/1983

1.015 .642 146 53 .07 6 .277

DJI declined to 1130.49 on 4/6/1983and then rallied past the first tagging of the upper band.

-----------------------------------------------------------

3/6/1985 1280.37 +6.5% Rallied to 1354.73 S9 on 10/14/1985

.997 -.09 7 -46 -.062 -1 -.111

DJI declined to 1242.05 on 5/1/1983 and then rallied past first tagging of the upper band.

3% decline first

------------------------------------------------------------

(2/26/85 1696.9 +7.6%

1.041 1.169 270 =11 .259 17 .424

DJI declined to 1686.66 on 3/5/1986 and then rallied.)

-----------------------------------------------------------------

2/27/1987 2223.99 +5.3%

1.012 .329 102 -4 .065 7 .076

DJI immediately rallied rallying past false S8 (which cannot occur at or near an all-time high)

and was reversed by Sell S9/S12 on 5/6/1987 with DJI at 2342.19.

--------------------------------------------------------------------

3/2/1987 2220.47 +5.5%

1.009 .327 105 3 .066 8 .091

DJI immediately rallied rallying past false S8 (which cannot occur at or near an all-time high)

and was reversed by Sell S9/S12 on 5/6/1987 with DJI at 2342.19.

--------------------------------------------------------------------

4/18/1989 2379.40 Big Rally - to 2771.09 on 10/4/1989

1.036 .453 83 85 .084 9 .249

DJI declined to 2376/47 on 5/8/1989 abd then rallied to 2771.09 on 10/4/1989

--------------------------------------------------------------------

9/1/1989 2752.09

1.02 .418 48 10 .158 13 .311

DJI declined to 2659.19 (4% paper loss) and then rallied to Sell S9 at upper band.

--------------------------------------------------------------------

3/12/1991 2922.52

1.003 .376 139 -39 -.015 13 -.154

DJI declined to 2858.91 and went sidewise for 9 months.

--------------------------------------------------------------------

2/10/1992 3245.0 +1.9%

1.001 .168 75 39 .027 0 .025

DJI went sidewise, falling to a low of 3224.96 before rallying to a Sell S9 at the upper band.

--------------------------------------------------------------------

3/2/1993 3400.53 +2.9%

1.01 .32 142 20 .101 -4 .181

DJI declined to 3379.19 on 4/5/1993 and rallied beyond Sell S15 at 3500.03 on 5/19/93.

The B15 might be assumed to be too strong to use the S15.

--------------------------------------------------------------------

3/26/1993 3439.98 +1.7%

1.001 .26 104 -20 .09 0 .162

DJI declined to 3379.19 on 4/5/1993 and rallied beyond Sell S15 at 3500.03 on 5/19/93.

The B15 might be assumed to be too strong to use the S15.

--------------------------------------------------------------------

9/1/1993 3645.10 +9% approx.

1.012 .277 151 03 .116 8 .252

DJI fell to 3537.23 on 9/21/1993 and rallied to 3967.66 on 2/3/1994.

--------------------------------------------------------------------

4/3/1995 4168.41 +31% gain ... 5458.53 S1 on 2/29/1996199

1.022 .523 67 11 .117 9 .419

DJI immediately rallied. Note that the S8s do not count when the DJI is near an

all-time high. The next Sell, a Sell S1, was at 5458.53 on 2/28/1996

--------------------------------------------------------------------

9/22/1995 4764.15 Big Gain 6468.53

1.014 .455 125 -15 .135 2 .118

DJI fell to 5703.82 on 10/26/1995 and then rallied to 6468.53 on 2/28/1996

---------------------------------------------------------------------

2/13/1996 5492.12 -0.6%

1.049 .825 158 37 .302 28 .336

DJI rallied 5% but the next sell was a Sell S1. on weakness below Buy point.

-----------------------------------------------------------------------

2/24/97 7008.20 -2.5%

1.022 .429 99 35 .097 -7 .043

DJI declined to 6391.69 after completing a head and shoulders top with no

Peerless Sell signal and then rallied stongly, but had to be sold because

of an errant S89 on 4/22/97 at 6833.59.

----------------------------------------------------------------------

3/26/1998 8846.83 +3.8%

1.019 .535 204 -51 .159 34 .23

DJI fell to 8782.12 on 3/30/1998 and then rallied past the first tagging of the upper band.

---------------------------------------------------------------------

9/2/2003 9523.27 +2.9%

1.024 .474 402 134 .177 101 .41

DJI fell to 9275.06 on 9/30/2003 and then rallied past the upper band and Sell S4

on 10/15/2003. The P-Indicator stood at 305 then, which should have made the S4

dubious.

---------------------------------------------------------------------

3/1/2004 10678.14 -1.1%

1.007 .189 270 120 .039 -18 -.03

Fell to 9906.91 on 5/17/2004. The B15 should not be used only two weeks after a

Sell S9. The program will add this condition. 7% decline first

---------------------------------------------------------------------

3/11/2005 10774.36

.997 .122 22 16 -.002 -83 .045

DJI fell to 10012.36 on 4/20 and then rallied. This B15 occurred a week

after a Sell S15 and so should not be allowed or have been taken.

---------------------------------------------------------------------

3/7/2006 10980.69 +5.4%

.999 .203 64 -41 .047 -115 .064

DJI immediately rallied to upper band and S9 on 5/5/2009.

---------------------------------------------------------------------

9/1/2009 9310.60 No closed out.

.993 .031 78 -194 .031 -8 .077

=========================================================================

=========================================================================

Number of Completed Trades = Avg. Gain= %

BAD or ELIMINATED B15s

9/14/1933 Gain = +0.6%

104.70 1.031 .953 7 .23 -61 .177

Not a reversing signal. No Paper Loss

This was reversed a day later.

-------------------------------------------------------------

3/3/1936

156.20 1.026 .525 38 13 .014 -109 .022

------------------------------------------------------------

3/1/1945 160.70

160.70 1.023 .501 148 9 .263 197 .568

This was not a reversing Buy45

This occurred near short-term top. DJI fell 5% to 152 before rallying.

-------------------------------------------------------------

9/9/1955 474.6

1.026 (Too high) .627 1-3 3 .119 69 .225

DJI rallied past the upper band but then fell to 438.60 on

Eisenhower's heart attack.

------------------------------------------------------------

--------------------------------------------------------------------

2/10/1992 3245.0 +1.9%

1.001 .168 75 39 .027 0 .025

DJI went sidewise, falling to a low of 3224.96 before rallying to a Sell S9 at the upper band.

--------------------------------------------------------------------

3/2/1993 3400.53 +2.9%

1.01 .32 142 20 .101 -4 .181

DJI declined to 3379.19 on 4/5/1993 and rallied beyond Sell S15 at 3500.03 on 5/19/93.

The B15 might be assumed to be too strong to use the S15.

--------------------------------------------------------------------

3/26/1993 3439.98 +1.7%

1.001 .26 104 -20 .09 0 .162

DJI declined to 3379.19 on 4/5/1993 and rallied beyond Sell S15 at 3500.03 on 5/19/93.

The B15 might be assumed to be too strong to use the S15.

--------------------------------------------------------------------

9/1/1993 3645.10 +9% approx.

1.012 .277 151 03 .116 8 .252

DJI fell to 3537.23 on 9/21/1993 and rallied to 3967.66 on 2/3/1994.

--------------------------------------------------------------------

4/3/1995 4168.41 +31% gain ... 5458.53 S1 on 2/29/1996199

1.022 .523 67 11 .117 9 .419

DJI immediately rallied. Note that the S8s do not count when the DJI is near an

all-time high. The next Sell, a Sell S1, was at 5458.53 on 2/28/1996

--------------------------------------------------------------------

9/22/1995 4764.15 Big Gain 6468.53

1.014 .455 125 -15 .135 2 .118

DJI fell to 5703.82 on 10/26/1995 and then rallied to 6468.53 on 2/28/1996

---------------------------------------------------------------------

2/13/1996 5492.12 -0.6%

1.049 .825 158 37 .302 28 .336

DJI rallied 5% but the next sell was a Sell S1. on weakness below Buy point.

-----------------------------------------------------------------------

2/24/97 7008.20 -2.5%

1.022 .429 99 35 .097 -7 .043

DJI declined to 6391.69 after completing a head and shoulders top with no

Peerless Sell signal and then rallied stongly, but had to be sold because

of an errant S89 on 4/22/97 at 6833.59.

----------------------------------------------------------------------

3/26/1998 8846.83 +3.8%

1.019 .535 204 -51 .159 34 .23

DJI fell to 8782.12 on 3/30/1998 and then rallied past the first tagging of the upper band.

---------------------------------------------------------------------

9/2/2003 9523.27 +2.9%

1.024 .474 402 134 .177 101 .41

DJI fell to 9275.06 on 9/30/2003 and then rallied past the upper band and Sell S4

on 10/15/2003. The P-Indicator stood at 305 then, which should have made the S4

dubious.

---------------------------------------------------------------------

3/1/2004 10678.14 -1.1%

1.007 .189 270 120 .039 -18 -.03

Fell to 9906.91 on 5/17/2004. The B15 should not be used only two weeks after a

Sell S9. The program will add this condition. 7% decline first

---------------------------------------------------------------------

3/11/2005 10774.36

.997 .122 22 16 -.002 -83 .045

DJI fell to 10012.36 on 4/20 and then rallied. This B15 occurred a week

after a Sell S15 and so should not be allowed or have been taken.

---------------------------------------------------------------------

3/7/2006 10980.69 +5.4%

.999 .203 64 -41 .047 -115 .064

DJI immediately rallied to upper band and S9 on 5/5/2009.

---------------------------------------------------------------------

9/1/2009 9310.60 No closed out.

.993 .031 78 -194 .031 -8 .077

=========================================================================

=========================================================================

Number of Completed Trades = Avg. Gain= %

BAD or ELIMINATED B15s

9/14/1933 Gain = +0.6%

104.70 1.031 .953 7 .23 -61 .177

Not a reversing signal. No Paper Loss

This was reversed a day later.

-------------------------------------------------------------

3/3/1936

156.20 1.026 .525 38 13 .014 -109 .022

------------------------------------------------------------

3/1/1945 160.70

160.70 1.023 .501 148 9 .263 197 .568

This was not a reversing Buy45

This occurred near short-term top. DJI fell 5% to 152 before rallying.

-------------------------------------------------------------

9/9/1955 474.6

1.026 (Too high) .627 1-3 3 .119 69 .225

DJI rallied past the upper band but then fell to 438.60 on

Eisenhower's heart attack.

------------------------------------------------------------