---------------------------------------------------------------------------------------------------------------------------------------------------------

DJI Rockets Up Past Upper Band with either

Very Positive P-Indicator Readings or

Sharply Improving Accumulation Index Readings.

There have been 56 cases of a Peerless Buy B4 since 1928.

The average gain was 8.5%. 3 of the 56 would have resulted in a loss. The biggest

average gain for the Buy B4s occurred in the Year of Mid-Term Elections and

during the first 10 days of the month.

Size of Buy B4 Gains

>.10 16 28.6%

.05 - .10 12 21.4%

.02 - .0499 17 30.4%

0-.0199 8 14.3%

<0 3 5.4%

------------------------------------

56

Type-2 Buy B4s

In mid-2013, I discovered that DJI take-offs, as with stocks, often occur when

there is a rapid improvement in the Accumulation Index and the DJI surpasses

its normal 3.5% upper band. All the Buy B4s before 1942 were of this new type.

There have been 16 instances when this new Buy B4s (marked as "Type 2) would

have appeared. 11 of the 16 occurred since 1945. These Type-2 Buy B4s

averaged gains of 6.4%. Their trading results were held back a lot by allowing

between January and April. You can see below how low their trading gains were

compared to those Buy B4s in the 2nd year of the Presidential cycle or Novembers.:

Type-2 Buy B4s' Success Varies Widely

Jan 2 .019 low

Feb 1 .017 low

Mar 0 ----

Apr 1 .010 low

PE +2 4 .132

. Nov 5 .094

The Importance of Buy B4s

Buy B4s are important because they tell you when the DJI has probably

broken out above the resistance of the upper band. If Peerless is already

on a Buy, the Buy B4 will keep you bullish. If Peerless is on a Sell, the

Buy B4 warns you to switch to a long position. A reversing Buy B4 is not

common. But it would have worked out well in the 6 cases below. They

brought gains that averaged 7.6%. None of the reversing Buy B4s

would have brought a loss.

Reversing Buy B4s

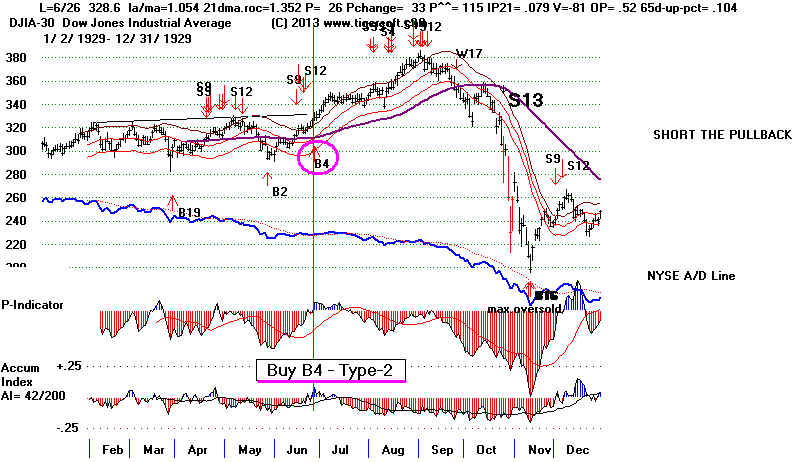

19290626 B4 328.6 .067 Type 2|

19341016 B4 95.3 .091 Type 2

19420528 B4 101.0 .041

19730925 B4 940.55 .049

19870622 B4 2445.51 .105

19970509 B4 7169.53 .105

-------------------------------------------------------------------

No. = 6 Avg.= .076

BUY B4 SIGNALS: 1928-2013 19290626 B4 328.6 .067 Type 2

19300123 B4 253.5 .125 Extreme Bearish Mode

19310210 B4 181.2 -.022 Extreme Bearish Mode

19321110 B4 65.5 .038 Type 2

19330821 B4 100.2 .022 ??????????

19341016 B4 95.3 .091 Type 2

19370120 B4 185.9 .019 Type 2

19390717 B4 142.8 .081

19400904 B4 132.2 .022 ?????

19410611 B4 122.2 .047 Type 2

19420528 B4 101.0 .041 ????

19420605 B4 104.4 .364

19420709 B4 108.8 .309

19421218 B4 118.9 .198

19450416 B4 162.4 .01 Type 2

19500809 B4 216.9 .195

19500915 B4 225.9 .147 Type 2

19521118 B4 278 .05 Type 2

19541115 B4 376.7 .244 Type 2

19551109 B4 473.9 .095 Type 2

19630408 B4 706 .33

19670118 B4 847.49 .047

19680906 B4 921.25 .061 Type 2

19701215 B4 819.62 .144

19721114 B4 1003.16 .044 Type 2

19721122 B4 1020.54 .026

19730925 B4 940.55 .049

19750205 B4 717.85 .205

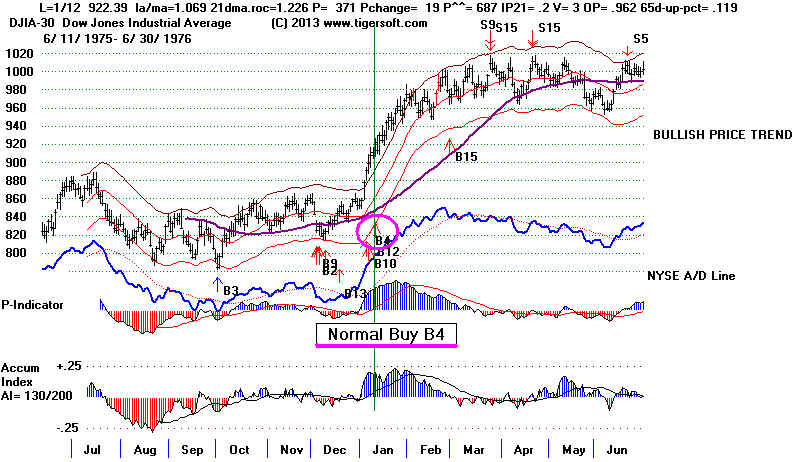

19760112 B4 922.39 .094

19780424 B4 826.06 .049

19780502 B4 840.18 .031

19780803 B4 886.87 .024

19790816 B4 884.04 .002

19821011 B4 1012.79 .044 Type 2

19821021 B4 1036.98 .019

(19840806 B4 1202.96 .072 Type 2 This signal is cancelled by simultaneous Sell S2)

19850129 B4 1292.62 -.002

19851118 B4 1440.02 .268

19860210 B4 1626.38 .123

19860318 B4 1789.87 .02

19870114 B4 2035.01 .182

19870622 B4 2445.51 .105

19890201 B4 2338.21 -.006

19890801 B4 2641.12 .049

19910204 B4 2772.28 .092

19911231 B4 3168.83 .058

19930205 B4 3442.14 .017 Type 2

19951130 B4 5074.49 .094

19960208 B4 5539.45 .002

19961120 B4 6430.02 .066

19970115 B4 6726.88 .019 Type 2

19970122 B4 6850.03 .001

19970509 B4 7169.53 .105

19970617 B4 7760.78 .021

19980210 B4 8295.61 .107

20031219 B4 10278.22 .033 Type 2

-----------------------------------------------

N0. = 56 .085

PE 10 .048 PE +1 15 .046 PE +2 18 .127 PE +3 13 .099 Jan 8 .061 Feb 8 .065 Mar 1 .020 Apr 3 .130 May 3 .059 Jun 5 .121 Jul 2 .196 Aug 6 .061 Sep 4 .070 Oct 3 .051 Nov 9 .103 Dec 4 .108 1-10 17 .116

11-20 24 .084

21-31 15 .049

Type 2 Buy B4s

19290626 B4 328.6 .067

19321110 B4 65.5 .038

19341016 B4 95.3 .091

19370120 B4 185.9 .019

19410611 B4 122.2 .047

19450416 B4 162.4 .01

19500915 B4 225.9 .147

19521118 B4 278 .05

19541115 B4 376.7 .244

19551109 B4 473.9 .095

19680906 B4 921.25 .061

19721114 B4 1003.16 .044

19821011 B4 1012.79 .044

19930205 B4 3442.14 .017

19970115 B4 6726.88 .019

20031219 B4 10278.22 .033

--------------------------------------------------

No.=16 .064

Buy B4s-Type 2 since 1945 No.= 11 .069)

>10% 2

5%-9.99% 5

2%-4.99% 5

0%-1.99% 4

losses 0

PE 4 .048

PE +1 6 .030

PE +2 4 .132

PE +3 2 .064

Jan 2 .019 low

Feb 1 .017 low

Mar 0 ----

Apr 1 .010 low

May 0 ----

June 2 .057

July 0 -----

Aug 0 -----

Sept 2 .104

Oct 2 .068

Nov 5 .094

Dec 1 .033

1-10 3 .078

11-20 11 .070

21-31 2 .043

Code for Regular Buy B4

For i = 22 To rn

r47 = 1.0294: explo = 5

If la(i) / ma(i) > 1.045 And v21(i) < 2 Then 43914

If mo(i) = 12 Then r47 = 1.0274: explo = 4

If mo(i) = 11 And da(i) > 15 Then r47 = 1.0274: explo = 4

If la(i) / ma(i) > r47 Then hm = hm + 1 Else hm = 0

If pvv(i) < 0 Or ipxxx(i) < .125 Then 43914

If yr(i) > 2000 And S9(i) = 0 And hm > explo And P21(i) > 367 Then hm = 0: S9(i) = 4

If yr(i) > 1964 And yr(i) <= 1999 And S9(i) = 0 And hm = explo And P21(i) > 200 Then hm = 0: S9(i) = 104

If yr(i) > 64 And yr(i) <= 99 And S9(i) = 0 And hm = explo And P21(i) > 200 Then hm = 0: S9(i) = 104

If yr(i) > 1964 And yr(i) <= 1999 And S9(i) = 0 And hm > explo And P21(i) > 180 Then hm = 0: S9(i) = 104

If yr(i) > 64 And yr(i) <= 99 And S9(i) = 0 And hm > explo And P21(i) > 180 Then hm = 0: S9(i) = 104

If S9(i) = 104 Then pi = i: mb(i) = 4: S9(9) = 104: buyB4arrows (pi): i = i + 20

43914 Next i

For i = 31 To rn

If (yr(i) + 2) / 4 <> Int((yr(i) + 2) / 4) Then 44454 ' Only Mid-Term Election Cases considered.

If mo(i) < 5 Or mo(i) > 8 Then 44454

If la(i) / ma(i) < 1.042 Or la(i) / ma(i) > 1.05 Then 44454

If roc(i) < .7 Then 44454

If P21(i) < 45 Then 44454

If newipxxx(i) < .1 Then 44454

If opma(i) < .18 Then 44454

If da(i) > 10 Then 44454

pi = i: mb(i) = 4: S9(9) = 104: buyB4arrows (pi): i = i + 20

44454 Next i

Code for Type 2 Buy B4

For i = 70 To rn

If ms(i) = 9 Or ms(i - 1) = 9 Or ms(i - 2) = 9 Then 6740

If ms(i) = 12 Or ms(i - 1) = 12 Or ms(i - 2) = 12 Then 6740

If mo(i) = 8 And ms(i - 3) = 12 Then 6740

If mo(i) = 8 And ms(i - 3) = 9 Then 6740

AROC = 250 * (ma(i) - ma(i - 1)) / ma(i - 1)

CHANROC = (la(i) - la(i - 65)) / la(i - 65)

If mo(i) = 8 And chan65 > .18 Then 6740

If mo(i) = 8 And AROC < .7 Then 6740

If opma(i) > .65 Then 6740 'Excludes 7/1959

If AROC < .86 And opma(i) > .55 Then 6740' Excludes 1959, 1960

If AROC < .8 And pvv(i) < 7 Then 6740' Excludes 1986

If ((lo(i - 1) - HI(i - 2)) / lo(i - 1)) > .045 Then 6740

If la(i) / ma(i) < 1.027 Then 6740

If la(i - 10) / ma(i - 10) > 1.01 Then 6740

If opma(i) < .32 And AROC < 1.1 Then 6740

chan65 = (la(i) - la(i - 65)) / la(i - 65)

If chan65 < -.045 Then 6740

If newipxxx(i) < .07 Then 6740

If newipxxx(i - 4) > .045 Then 6740

If newipxxx(i) - newipxxx(i - 4) < .08 Then 6740

pi = i: mb(i) = 4: : S9(9) = 104: buyB4arrows (pi): i = i + 20

6740 Next i

|

----------------------------------------------------------------------------

Peerless - 5/12/2011

Buy B4s have been part of the

Peerless system since 1981.

They show us when a trading market is switching

to an up-trending market and

sometimes, it is necessary to take a small loss to make a bigger gain.

There have been 29 B4s since 1929. All took

place between 1942

and 2000. The average gain

was 9.3%. 93% were profitable.

` 13 of the 29 trades brought gains of

more than 9%.

9 of the 29 brought gains of

less than 4%. The biggest gains tended to

come in the year before a

Presidential Election and from November to

February.

Reversing Buy B4s are very powerful

and so must be heeded. They average

a gain of 17.1% at the time of the

next Peerless Sell. Only 6 of the

29 Buy B4s were reversing and

switched the stance of Peerless from bearish to bullish.

But in this, they are essential,

because they prevent being short, or out of, a strongly

rising market. When they

reverse a previous Sell, they show the need to

accept a small loss to make a much

bigger gain. Each such case was profitable

and there were no losses.

Reversing Buy B4s since 1928

Gain Date

Previous Sell Signals' Gain at Time of Buy B4

-------- ------------

-------------------------------------------------------------------

+35.6% 6/7/1943

Sell S9 5/11/1942 -5.2%

+6.2% 8/9/50

Sell S9 4/14/50

-1.6%

+4.9% 9/2573

Sell S9 9/4/73

-5.0%

+0.5%

8/3/78

Sell S12 7/17/78 -5.7%

+10.5% 6/22/87

Sell S9/S12 6/8/87

-4.0%

+10.5% 5/9/97

Sell S9 4/22/97

-4.9%

-----------------------------

n = 6 Avg = 11.4%

Many of the biggest gaining

B4s did not pull back and never showed a paper loss.

Waiting for a pullback is not

advised, unless the DJI has risen a long way and the

new Buy B4 is one in a series

of Buy B4s.

Biggest Gainers (over 20%)

Pct Gain Paper Loss

6/5/1942

+35.8% 2%

2/5/1975

+22.2% no paper loss

11/18/1985 +26.8% no paper loss

2/4/1991 +21.0%

no paper loss

Lowest Gainers (under 3%)

Pct Gain Paper Loss

11/22/1972 + 2.6% no paper loss

8/3/1978 + 2.4%

no paper loss

8/16/1979 -0.4% 2%

10/21/1982 1.9%

5%

2/8/1996 0.2%

6%

1/22/1997 -0.2%

8%

6/17/1997 2.1% no paper loss

November to February account for 16 of the 29 signals.

February, June

and November. 10 of the 16

B4s in this period gained more than 9.3%.

August to October Buy B4s are

weaker, averaging only 4.8% in 6 cases.

BUY B4s by month

Pct Gains

Average Pct

Gain

-------------------------------------

--------------------------

Jan

9.4 4.8 18.2 -0.2

(4)

8.1%

Feb

22.2 12.3 18.5 21.0 0.2 10.7

(6) 14.2%

March 2,0 (1)

2.0%

April

4.9 (1)

4.9%

May

3.1 10.5 (2)

6.8%

June 35.8

10.5 2.1 (3)

16.1%

July

Aug

10.5 -0.4 4.9 6.7 (4)

5.4%

Sept

4.9 (1)

4.9%

Oct.

1.9 (1)

1.9%

Nov

2.6 26.8 9.4 6.3 (4)

11.3%

Dec. 14.4

4.3 (2)

9.4%

------------------------------------------------------------------------------

Totals

n=29

9.3%

BUY B4s by Year in

Presidential Cycle

Presidential Election year

B4s are weaker than others. They are also less common.

The year before a

Presidential Election produces the most powerful B4s. All but one

of the B4s gained more than

9.3%. They average +12.6% per trade.

Presidential Election (PE)

1972

+2.6% 1976 +9.4% 1996 +0.2% 1996 +6.3%

n=4 Avg = + 4.6%

PE + 1

1973

+4.9% 1985 +4.8% 1985 +26.8% 1989 18.5% 1989

4.9% 1997 -0.2% 1997 10.5%

1997

2.1%

n=8 Avg = + 9.1%

PE + 2

1942 +35.8

1950 +6.7 1970 +14.4 1978 4.9% 1978 3.1%

1978 0.5% 1982 1.9%

1986

+12.3% 1986 +2.0% 1998 +10.7%

n=10 Avg = + 10.2%

PE + 3

1975 +22.2% 1979 -0.4% 1987

18.2% 1987 10.5% 1991 21.0% 1991 4.3%

1995

9.4%

n=7 Avg = +12.6%

BUY B4s aince 1928

-----Major Buy B4 ------- ------------- Next Major Sell -----------

Date DJI Date Pct Gain Approx Days Elapsed

---------- ------------ -----------------------------------------

1. 6/5/1942 104.40 6/7/1943 +35.8%

1.046 .79 49 6 .107 19 .199

Reversing Buy.

Declined to 102.25 and rallied. 2% Paper Loss

===========================================================================

2. 8/9/1950 218.90 10/25/50 6.7%

1.047 .709 .159 19 .219 128 .254

Reversing Buy.

Rallied immediately.

===========================================================================

3. 12/15/1970 819.62 5/6/1971 14.4%

1.034 .902 193 20 .152 1 .627

Not a Reversing Buy.

Rallied immediately.

===========================================================================

4. 11/22/1972 1029.54 1/5/1973 2.6%

1.039 .842 220 -14 .131 2 .425

Not a Reversing Buy.

Rallied immediately.

========================================================================

5. 9/25/1973 940.55 10/26/73 4.9%

1.048 1.026 288 17 .295 2 .434

Reversing Buy..

Rallied immediately.

========================================================================

6. 2/5/1975 717.85 7/1/1975 +22.2%

1.07 1.367 350 7 .129 2 .392

Not a reversing Buy.

Rallied immediately.

========================================================================

7. 1/12/1976 922.39 3/24/1976 9.4%

1.069 1.226 371 19 .2 3 .588

Not a reversing Buy.

Rallied immediately.

========================================================================

8. 4/24/1978 826.06 6/13/1978 4.9%

1.061 1.068 204 21 .156 5 .41

Not a reversing Buy.

Rallied immediately.

========================================================================

9. 5/2/1978 840.18 6/13/1978 3.1%

1.049 1.331 236 25 .11 7 .474

Not a reversing Buy.

Pulled back to 820 and rallied immediately.

Paper Loss = 2.5%

========================================================================

10. 8/3/1978 886.87 9/11/1978 0.5%

1.055 1.154 279 52 .161 6 .409

Not a reversing Buy.

Rallied immediately.

Also:

8/7/1978 885.05 9/11/1978 0.7%

1.044 1.024 288 -14 .118 6 .334

Not a reversing Buy.

Rallied immediately.

=======================================================================

11. 8/16/1979 884.04 8/23/1979 -0.4%

1.038 .778 252 20 .262 5 .362

Not a reversing Buy.

Pulled back to 866 and rallied. Paper Loss = 3%

=======================================================================

12. 10/21/1982 1036.98 12/7/1982 1.9%

1.076 (highest) 1.359 279 0 .165 15 .196

Not a reversing Buy.

Pulled back to 983 and rallied. 5% Paper Loss

=======================================================================

13. 1/29/1985 1292.62 10/14/85 4.8%

1.049 .857 359 12 .126 17 .039

Not a reversing Buy.

Pulled back to 1242 and rallied. 4% Paper Loss

=======================================================================

14. 11/18/1985 1400.02 4/29/86 +26.8%

1.033 .609 191 -5 .196 13 .266

A reversing Buy.

Rallied immediately.

======================================================================

15. 2/10/1986 1626.38 4/29/86 12.3%

1.047 .868 193 21 .182 5 .259

Not a reversing Buy.

Rallied immediately.

======================================================================

16. 3/18/1986 1789.87 4/29/86 2.0%

1.044 .874 246 -8 .175 20 .313

Not a reversing Buy.

Rallied immediately.

======================================================================

17. 1/14/1987 2035.01 5/6/1987 18.2%

1.043 .751 193 54 .232 17 .401

Not a reversing Buy.

Rallied immediately.

======================================================================

18. 6/22/1987 2445.51 8/26/1987 10.5%

1.042 1.12 232 -7 .156 25 .525

A reversing Buy.

Rallied immediately.

======================================================================

19. 2/1/1989 2338.21 10/4/89 +18.5%

1.042 1.031 226 17 .187 31 .469

Not a reversing Buy.

Pulled back to 2244 twice and then rallied 7 weeks later.

Paper loss = 4%

======================================================================

20. 8/1/1989 2641.12 10/4/89 4.9%

1.032 .939 207 8 .183 21 .293

Not a reversing Buy.

Rallied immediately.

======================================================================

21. 2/4/1991 2772.28 1/28/1992 +21.0%

1.065 .946 222 43 .179 24 .282

Not a reversing Buy.

Rallied immediately.

======================================================================

22. 12/31/1991 3168.83 4/14/1992 4.3%

1.071 1.108 197 29 .138 17 .368

Not a reversing Buy.

Rallied immediately.

=====================================================================

23. 11/30/1995 5074.49 2/27/1996 9.4%

1.028 .772 183 19 .175 20 .511

Not a reversing Buy.

Rallied immediately.

=====================================================================

24. 2/8/1996 5539.45 2/27/1996 0.2%

1.052 1.151 245 86 .37 47 .445

Not a reversing Buy.

Fell back to 5250 and then rallied.

5% Paper Loss

=====================================================================

25. 11/20/1996 6430.02 4/22/1997 6.3%

1.043 .713 190 .135 20 .438

Not a reversing Buy.

Fell back to 6350 and then rallied.

1% Paper Loss

=====================================================================

26. 1/22/1997 6850.03 4/22/1997 -0.2%

1.031 .657 249 .174 26 .378

Not a reversing Buy.

Fell back to 6350 and then rallied.

8% Paper Loss.

=====================================================================

27. 5/9/1997 7169.43 10/7/1997 10.5%

1.046 1.098 206 38 .165 35 .268

A reversing Buy.

Rallied immediately.

====================================================================

28. 6/17/1997 7760.78 10/7/1997 2.1%

1.044 .91 428 22 .153 55 .241

Not a reversing Buy.

Fell back to 7630 and then rallied

2% Paper Loss.

====================================================================

29. 2/10/1998 8295.61 4/21/1998 10.7%

1.048 1.08 346 134 .165 68 .255

Not a reversing Buy.

Rallied immediately.

====================================================================

none since 1998.

====================================================================

------------------

AVG GAIN = 9.3%

93.1% were profitable.

revise ....

Nov to Feb account for 18 of 31 signals 4/12 of months missing 1 signal

4 - Nov 2 - Dec 4 - Jan 6 - Feb 1 - March 1 April 2 May 3 - June 0 - July 4 - August 1 - Sept 1 - Oct