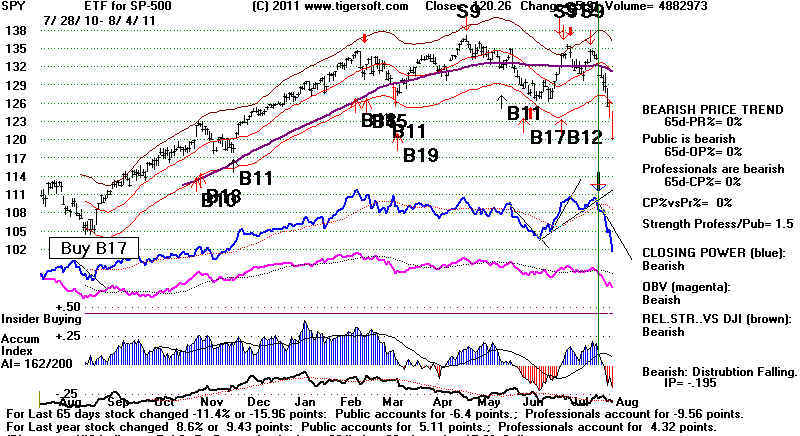

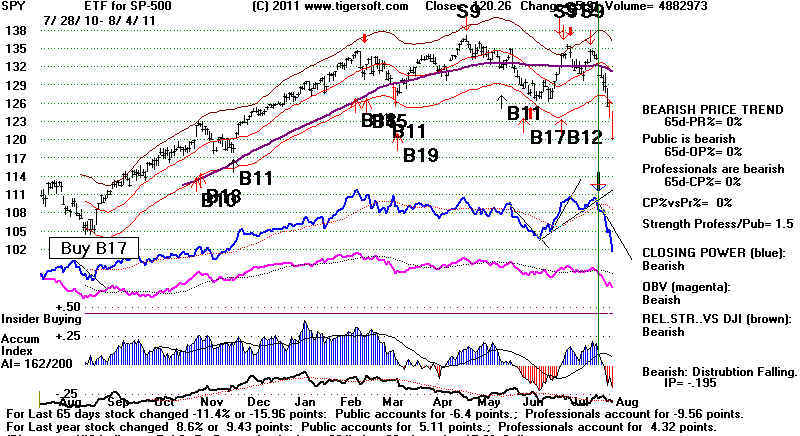

TigerSoft SPY CHART (ETF for SP-500)

Peerless Buys and Sells,

with Automatic Optimized red Buys and Sells,

Blue Closing Power trends show Professional Buying/Selling

and red OBV, TigerSoft Accum. Index and brown Rel.Str.

PAGE 2

TIGERSOFT www.tigersoft.com (C) 2013 Wm. Schmidt, Ph.D.(Coumbia University) WHERE THE BIG MONEY STILL IS.

WHERE THE BIG MONEY STILL IS.CALLING ALL

TOPS!Peerless Stock Market Timing: 1915-2011

Do you

Trade ETFs?

Do you

Trade ETFs?

Our new Peerless manual will show all signals and year's charts since

1915.

Peerless

Stock Market Timing's automatic Buys and Sells have averaged more than 17% since 1966,

trading only "long". Peerless works even

better with with ETFs

TigerSoft SPY CHART (ETF for SP-500)

Peerless Buys and Sells,

with Automatic Optimized red Buys and

Sells,

Blue Closing Power trends show

Professional Buying/Selling

and red OBV, TigerSoft Accum. Index and brown Rel.Str.

6/30/2011 SPY and Closing Power Trend-Changes.

TigerSoft Makes The Stock Market Simple, Easy Safe Profitable!

TigerSoft Makes The Stock Market Simple, Easy Safe Profitable!

> Highly

Profitable Nightly Hotline Predictions Subscribe to

Our Nightly HOTLINE - $350/year

Peerless

Stock Market Timing: 1915-2011

The SP-500 rose 30% from the Peerless reversing Buy

The SP-500 rose 30% from the Peerless reversing Buy

in June 2010 to the major reversing Sell in July 2011. We got our Sell

and now in October 2011, we are on a Buy again and must look for

our next Sell.

Readers here should

want to know when Peerless gives its next Sell Signal.

> 4/29/2011

SAFER, HIGH

Peerless Investing Returns on SPY, DIA, QQQ and EWC (Canada).

Which Country ETFs

Have Worked Best with Peerless Automatic Buys and Sells since 1996?

$1,000 would have

become $100,000 in 15 years.

Which Sectors Work Best

Trading with Peerless Automatic Buys and Sells?

Peerless Fidelity

Sector Funds' Performance: 1986-2011

FSLBX Gained 26% per

year. $1,000 Becomes $340,000.

PEERLESS TRADING of FIDELITY SELECT BROKERAGE FUND (FSLBX)

7/9/86 - 3/23/11

1986

$1000

1990

$1416

1994

$3722

1998

$10,266

2002

$32,542

2006

$87,093

2010

$283,509

2011

$340,200 (This is about

26% per year)

31 Years of Automatic Peerless General Market Buys and Sells applied to SP-500 Stocks

Turn $1000 in to $200,000 in 30 years.

ORDER NOW Peerless

Stock Market Timing Software, Data and Hotline for 3 months $395.

> Our TigerSoft Insider

Trading Software $295. Includes Nightly Data on 6000 Stocks/Commodities for 3

mo.

4/4/2011 - 31 Years of Automatic Peerless General

Market Buys and Sells applied to SP-500 Stocks

Here's how to

succeed in the stock market:

1. Subscribe to our On

Line Nightly Hotline to learn

when Peerless finally says to SELL

2. Always Buy the highest Accumulation stock in DJI-30 when

Peerless gives

a reversing Buy. Buy TigerSoft and ubscribe to

our On Line Nightly Hotline.

3. Always Sell

or Hedge when Peerless gives a Sell.