(C) 2011 www.tigersoft.com

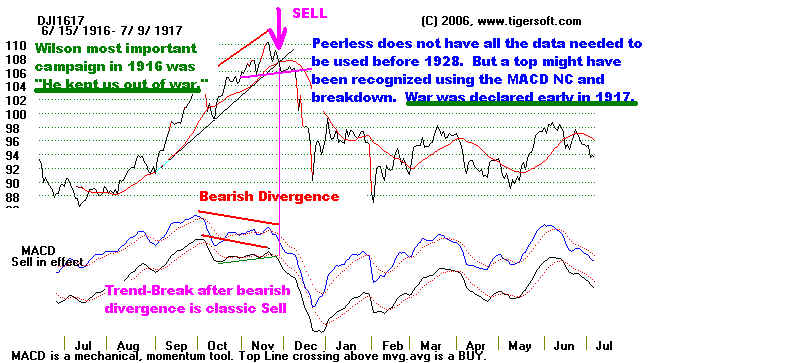

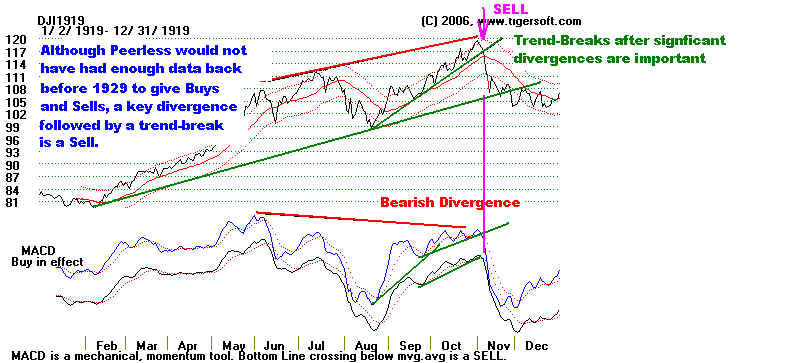

Peerless uses divergences. The MACD is NOT one of our key indicators. But readers

can see how the 1917and 1919 tops might have been called by the MACD divergence

from prices.

The necessary data is not available for the period before 1929 to let Peerless

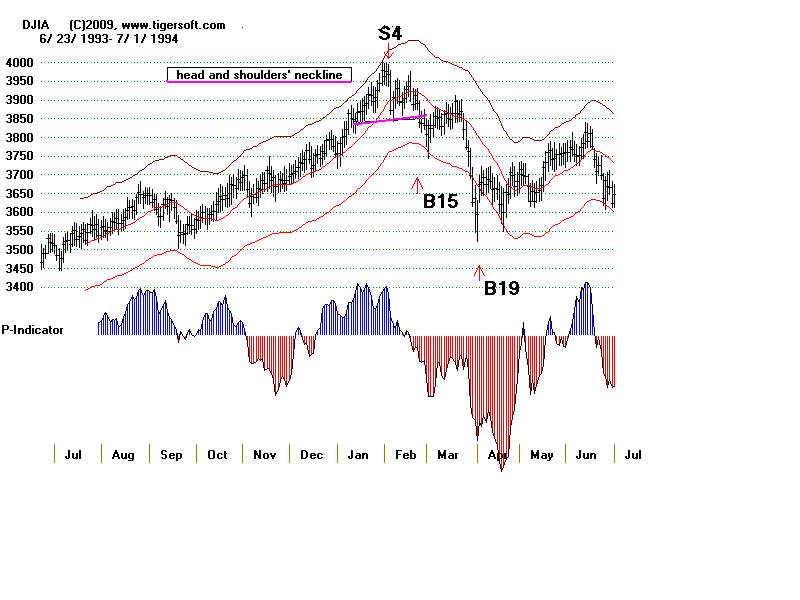

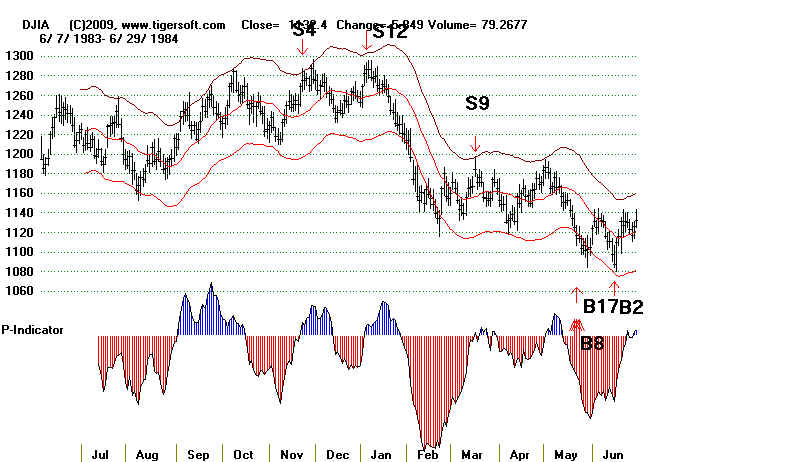

produce automatic Buys and Sells. Also shown on this are some more recent

tops and the automatic Peerless Sells they produced to warn traders to sell out.

The tops in 1971, 1984 and 1994 did not bring bear markets, only big corrections.

But if you were trading back then, the difference was negligible. You would have

wanted to sell and sell short when these Peerless Sells occurred.

1917 TOP

to Nixon taking US off gold standard and instituting

a 3 month freeze on prices in the middle of Vietnam War.

SELL

SELLS

SELL