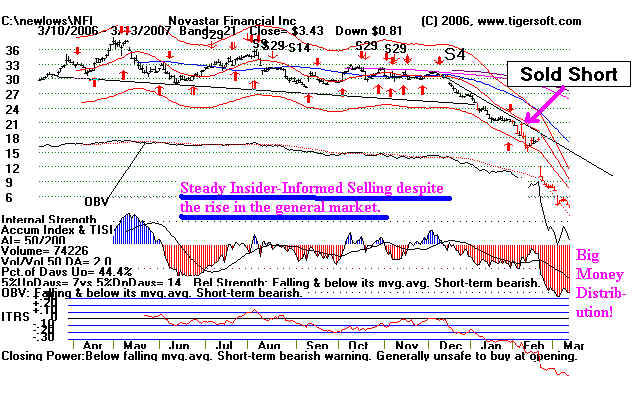

Prices make a new short-term high and the Tiger Accum.Index

is negative.

A Short-Seeling "Setup" occurs when minor low is made with Accum. Index dipping

below -.25 and a ralliy produces a red Sell from the 5-day Stochastic K-Line rising above

80 and turning down.

DHOM - September.

1. Prices fail to make a new high and then turn down.

CRY, CQB, DSCO

2. A head and shoulders pattern appears and the neckline is violated.

Red, negative Distribution appears on the right shoulder.

CHNL, CQB, DSCO

3. The Violation of the neckline coincides with a break in the

50-day ma and a break in the uptrendline support.

CHNL, CQB, DSCO

4. A Bearish Setup takes place. The Accumulation Index falls below

-,25 after a failure to make a new high and with the 50-day ma falling.

In this environment, initiate short sales at the declining red 21-day ma.

CRY - Sept-October.

5. Support failure with red high volume in context of heavy

red distribution warnings from consistently negative Accum.Index.

CVR

4. The rally up to the top takes place on consistently

negative readings from the Accumulation Index.

DSCO

5. The Accumulation dips to under -.20. It then turns positive and rises. When the

Accumulation Index then turns down below its own moving average ("ma"), it often

an excellent point to SELL SHORT.

AFR, CHNL, CQB, DLX, DSCO

6. Price gap down below earlier lows, where expected support

might be expected, on high RED volume. Tiger charts show

price bars as RED when volume is high. High RED volume

confirms the price move. The gap also adds to the bearishness.

It shows haste and desperation to sell.

CHNL, CQB, CTHR, DSCO

7. Additional short sales should be taken on the next rally or

two back to the falling red 21-day ma, provided the Accumulation

index is negative (red) and the blue 50-day ma is falling.

CQB, CTHR, CVR, DHOM, DLX

8. Additional short sales should be taken rallies back to the declining 50-day ma,

especially when they fail or fall back below it. This should be done when the

Accumulation index has been negative (red)

for most of the previous two months. AFR

Cover when stock closes back above 50-day ma. by 1%.

CRY, CVR, CTHR, DHOM

|