(C) 2005-2011 www.tigersoft.com

August 1, 2005 (newer Closing Power chart added at bottom)

Watch the Housing Stocks closely now.

They will Tell You When a Break is Coming.

Housing Stocks at top of price channel

WHY ELSE IS FNM SO WEAK-LOOKING,

IF THIS IS NOT A HOUSING BUBBLE ABOUT TO BREAK?

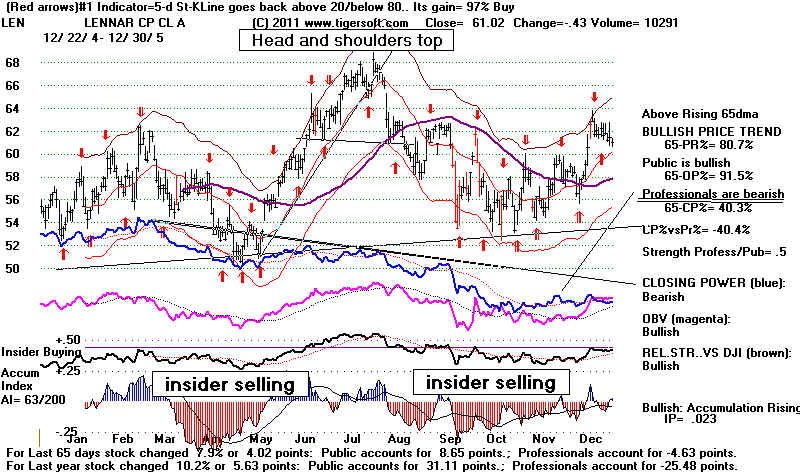

Fannie Mae is a leading indicator. And when housing stocks like Lennar, Pulte Home or

Fideility Housing break, they will likely fall very fast. And the negative repercussions

will be very broad and far-reaching.

"Trouble at Fannie Mae and Freddie Mac. They are now being forced to tighten

up sloppy lending. This means they are not going to keep buying very low-quality

loans from banks, and the total money available for buying houses is

falling. Fannie Mae recently announced a $9 billion loss and its mortgage

portfolio shrank at an annualized 16.8 percent rate in January 2005, on top of a 10.1

percent decline in December 2004." Business Week

Cynics note that booms A L W A Y S end badly in busts. Whether its the

Internet Stock Bubble of 1999-2000, Silver in 1980 at $50/ounce,

Dutch Tulips in the early 1600's, the South Sea Speculation of 1711, Florida Real Estate

Craze of 1920's, Canals, Railroad stocks, the little guy is usually the last one in, the

last out and the one who's hurt the most. To survive the pull of the passions of mass greed,

you must get out of these bubbles before the free-fall!. This takes advance preparation to

build up your knowledge, and even more, to shore up your resolve. When the

break comes, there will be no bargains, quite possibly, for years!

A recent survey showed that a whopping 23% of homes purchased in 2004

were for specualtive investment. The Economist now estimates that it would take 12 years

of flat prices to move prices back in line with historical averages.

The ZERO-DOWN, interest only loans that many speculators have used greatly increased

the volatility of the market. Just as low-margin rates made the stock market soar in the 1920s, ZERO-DOWN loans have made housing specualtion reach DANGEROUS levels. The

Bush Administration is not interested in losing favor with home owners.

Two years ago the London Economist warned:

"Housing is just as prone to irrational exuberance as is the stockmarket.

Property is increasingly viewed as an easy way to make money. People buy

a home in the expectation that its price will continue to rise strongly over time.

Such expectations lie at the heart of all bubbles. Given the boom in the property

market over the past few years, at the very least house-buyers betting on further

rapid house-price gains are likely to be disappointed. Worse, there is a risk that

house prices will take such a tumble that they take whole economies with them..."

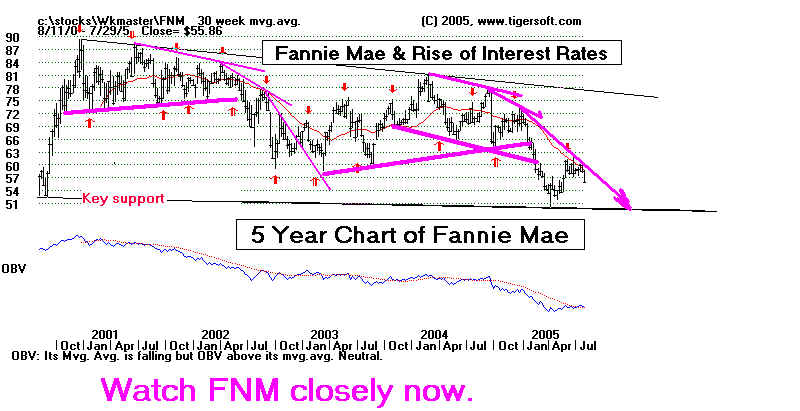

Fannie Mae's stock (below) is no longer rising. Actually, it is now heading for a vital test of

support. The housing stocks are still rising. PHM's rise is hyperbolic. Watch them closely

for the bearish price patterns thay typically appear at major tops. Already trading volume

is not matching their price rises. This we see in the failure of Lennar's OBV (aggressive

buying volume) to make new highs as the stock price does. This is usually another early warnng

sign. Subscribe to TigerSoft's services and we'll tell you the other signs. In particular, we

recommend Tiger's 160 page Book: "SHORT SELLING: Killer Profts in Any Market"

How much higher can they go?