TASR from 2003-2008

Updated 11/21/2008 (C) www.tigersoft.com

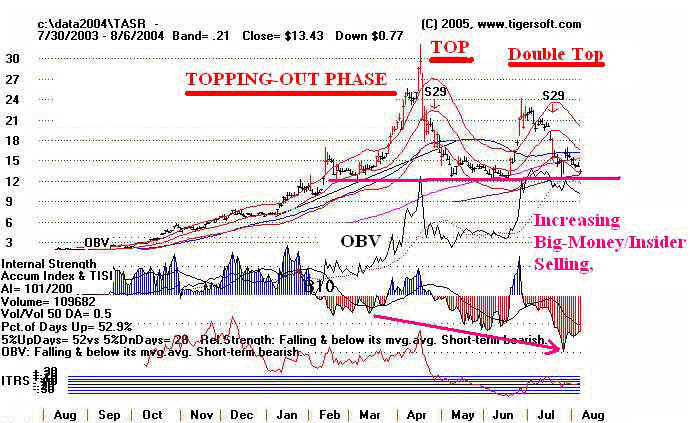

TASR is a smaller speculative stock. Its rise and fall were more exaggerated.

We call stocks like these "piffle stocks". They bubble up under promotion and

speculation. Then the bubble breaks and they come back down, often back to

very low prices, where they stay for years and years.

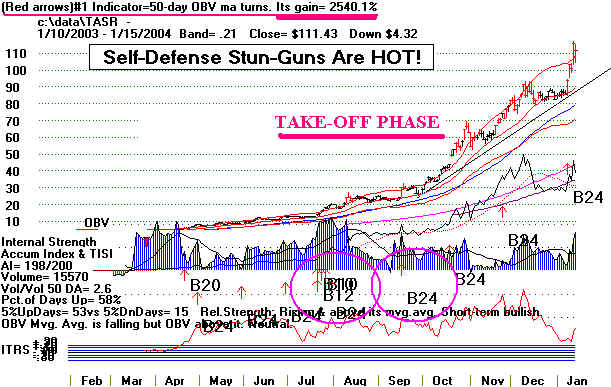

Tiger's Major Buy and Sell

Signals show you how to trade such a stock at:

1: Take-Off - Note Bullish Blue

Accumulation from Insiders & Big Money. (2003)

Positive

(blue) Accumulation. Note major TigerSoft Buys B10, B12, B20 and B24

2: Tops Out. See how Blue Accumulation

turns to Red Distribution. (2004)

Head

and shoulders top. Sell S29. Accumulation turns from very positive to negative

(red).

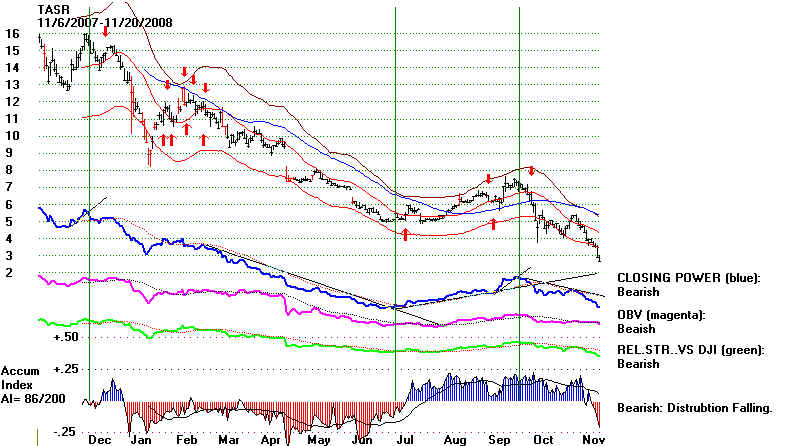

3: Collapses. Red Big-Money

Selling and Distribution Dominates. (2005)

Downtrending

Closing Power. Red Distribution.

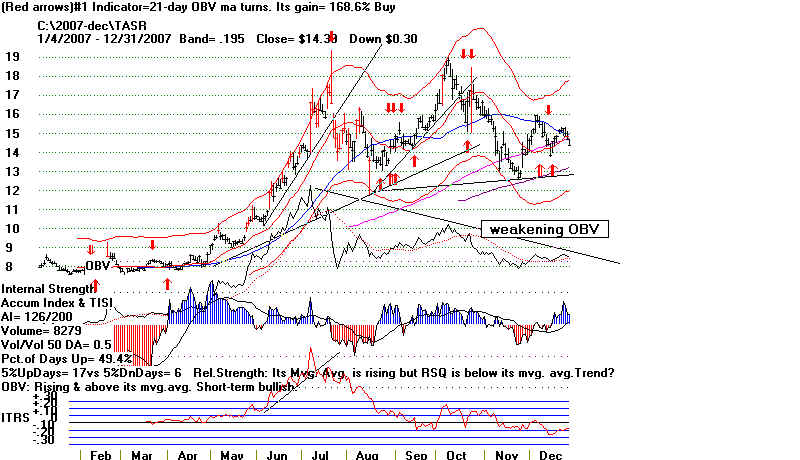

4. Base-Building lets Professionals Scalp It, Trading It Very Short-Term. (2007)

Use

TigerSoft Buys and Sells and Closing Power trend-breaks.

Alternating

Accumulation and Distribution.

See below how the 2007-2008 charts repeat in miniature the Stages 1-3.

This 4 stage

Note major TigerSoft Buys B10, B12, B20 and B24

2: As is Tops Out. See how Blue Accumulation turns to Red Distribution. (2004)

============================================================================

4. Base-Building lets Professionals Scalp It, Trading It Very Short-Term. (2007)

Use TigerSoft Buys and Sells and Closing Power trend-breaks.

Alternating Accumulation and Distribution

From 2006 to 2007, the stock was controlled by professionals who scalped

a living out of it by short-term trading. TIgerSoft quickly alerted users to how to trade

the stock. Note how Accumulation started to rise, as new rally developed.