TigerSoft's Elite Stock Professional Report

9/14/2007 -

(C) 2005 Wm. Schmidt, Ph.D.

It's disturbing that more stocks are bot above

their 50-day ma. It is probably best to wait for

a pullback to buy.

===========================================================

---- BUYS:----

HEW 34.03 AI/200 = 197 IP21=.35

Hewitt Associates Inc.Lincolnshire, IL 60069 http://www.hewitt.com

24,000 employees.

Hewitt Associates, Inc. provides human resources outsourcing

and consulting services worldwide.

BBL 60.3 AI/200 = 195 IP21=.32

BHP Billiton plc London, SW1V 1BH UK

Oil, mineral, and energy resource industries worldwide.

Buy on 5-10% retreat

FMS 51.5 AI/200 = 191 IP21=.40

Yahoo has no infiormation. FRESENIUS MEDICAL CARE AG & CO. KGAA Financials

FNDT 16.53 AI/200 = 191 IP21=.24

Fundtech Ltd.Ramat-Gan, Israel 670 employees

Web Site: http://www.fundtech.com

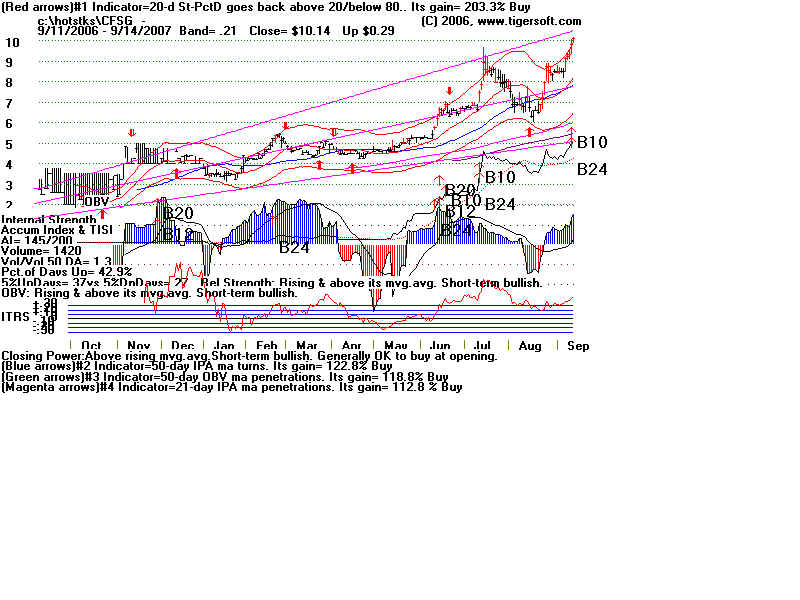

CFSG 10.14 AI/200 = 145 IP21=.35 B24 February bulge of Accum.

China Fire & Security Group, Inc. Buy on 5-10% retreat from now.

Beijing, 101304 320 employees

fire safety products for the industrial fire safety market

in the People's Republic of China.

Web Site: http://www.sureland.com

GHM 42.67 AI/200=162 IP21=55 A

Upper band seems to stop stock. But massive Accumulation (BUY)

Graham Corp. 265 employees Batavia, NY http://www.graham-mfg.com

Engaged in design, manufacture, and sale of vacuum and heat

transfer equipment used in the chemical, petrochemical, petroleum

refining, and power generating industries worldwide.

Buy on 5-10% retreat from now.

==============================================================================

---- SHORT SALES: ---- IMN 25.79 -.53 67 -.12 Very weak. JBSS 8.32 -.26 101 -.52 Very weak. NLS 8.28 -.27 80 -.12 IP21<TISI Friday breakdown. OCR 29.57 -.24 68 -.20 Breaking downtrending support line. PEIX 10.77 -.29 57 -.12 IP21<TISI SHOO 18.76 -.91 116 -.06 Weak dollar making weakness greater. TWP 11.34 -.85 46 -.12 Steadily down. __________________________________________________________________ Abbreviations: price versus 50 day ma AR = Above rising (Bullish) BF = Below Falling Current IP21 vs (TISI) 21-day ma of IP21 A = above U = Under (Bearish) SS = Sell Short BO = Breakout ..........................................

| Highest AI/200

Stocks It can't be a good sign that so few of this group of stocks are below their 50-week ma. Accumulation Index=>185 High-lighted in blue are stocks above their rising 200-day ma with an IP21>.25 C:\1-highai Days back= 50 7 / 5 / 2007 - 9 / 14 / 2007 Rank Symbol Name Price Pct.Gain % over 50dma AI/200 OpenUP% CloseUp% --------- ----------------------------------- ---------- ------------ ----------- --------- ----------- ------- AI/200=200 1 DUC --- 10.75 -3% .8% 200 23% 57% 2 FCM Franklin Telecommuns Corp 16.38 -12% -3.6% 200 30% 55% 3 USA --- 8.16 -10% -3.7% 200 25% 60% 4 CAFE Host America Corporation 2.05 -5% -5.7% 200 23% 51% AI/200=199

5 NBG --- 12.15 0% 2.2% 199 45% 53%

IP21=.27

AI/200=198

6 CNU Continucare Corporation 2.52 -18% -10.8% 198 31% 44%

AI/200=197

7 BBNK --- 22 -8% -2% 197 41% 53%

8 EWZ ISHARES MSCI BRAZIL INDEX 64.1 0% 3.3% 197 57% 59%

9 HEW --- 34.03 4% 5.8% 197 28% 61%

IP21=.35

10 ISIG Insignia Systems 4.79 6% -.8% 197 37% 52%

11 MTMD --- 6.2 38% 13.6% 197 35% 50%

not traded now.

12 OME Omega Protein Corporation 8.99 -9% -2.6% 197 36% 49%

AI/200=196 13 CRNT --- 14.39 14% -4.3% 196 47% 51% AI/200-195

14 ASG Lib.All Star Growth Fund 5.64 -3% -1.9% 195 23% 61%

15 BBL --- 60.3 1% 4.3% 195 54% 58%

IP21=.32

16 BORL --- 4.41 -26% -13.1% 195 30% 53%

17 ROFO --- 2.09 -7% -.2% 195 29% 49%

18 TRNS Transmation 6.87 -3% -2.9% 195 33% 47%

AI/200=194 19 IMA --- 48.63 -6% 1% 194 48% 51% AI/200=193 20 ISRL Isramco 44.03 -1% 1.8% 193 33% 45% 21 KWIC Kennedy-Wilson 40 34% 12.7% 193 38% 17% 22 MFI MicroFinancial Inc. 5.82 -7% -3.8% 193 41% 51% AI/200=192

23 CYCL Centennial Cellular Corp. 9.51 -9% -.6% 192 40% 59%

24 ILE --- 2.3 -45% -17.4% 192 37% 50%

25 ILF ISHAR-S&P-LATIN AMERICA-40 216.3 -3% 2% 192 57% 59%

IP21=.35

26 MCZ --- 1 -28% -12.6% 192 24% 43%

27 ZCOM --- 1.55 -32% -25.5% 192 25% 20%

28 TNE Tele Norte Leste Partic. 21.04 0% -.8% 192 51% 52%

AI/200=191

29 FMS Fresenius Medical Care AG 51.5 11% 6.9% 191 48% 58%

IP21=.40

30 MICC Millicom Int'l Cellular 72.71 -23% -13% 191 49% 55%

31 RIO --- 27.25 -43% -42.2% 191 57% 56%

IP21=.32

32 FNDT Fundtech Ltd. 16.53 10% 8.6% 191 41% 50%

IP21=.24

AI/200=190 33 ONVI --- 8.7 0% .9% 190 28% 62% 34 RC Grupo Radio Centro 12.46 -5% -6.4% 190 43% 55% 35 GGB Gerdau S.A. 23.16 -13% -5.6% 190 55% 53% AI/200=189 36 JHFT --- 17.39 -9% -1.9% 189 43% 52% AI/200=188 37 AMAC American Medical Alert 9.11 -1% -1.8% 188 45% 48% 38 CNRD Conrad Industries 15.8 22% 8% 188 33% 36% 39 SGB Southwest GA Fincl. Corp. 18.8 -4% -1.7% 188 25% 47% 40 CMO Capstead Mortgage Corp. 9.94 0% 3.4% 188 27% 57% 41 EPEN --- 14.05 -1% -.7% 188 39% 40% 42 EVT --- 27.25 -9% -1% 188 45% 59% AI/200=187 43 ATX A.T. Cross Company 9.7 -22% -11.5% 187 40% 52% 44 NRCI National Research Corp. 25.14 0% -.9% 187 40% 39% 45 TI Telecom Italia S.p.A. 30.01 7% 8.4% 187 45% 58% 46 TWN TAIWAN FUND 20.87 -2% -1.9% 187 46% 55% 47 BCF Burlington Coat Factory 15.99 -3% 2.1% 187 42% 49% AI/200=186 48 ADRE BLDRS-EMERGING-MARKET-50-ADR 47.84 2% 3.9% 186 65% 49% 49 ARKR Ark Restaurants Corp. 36.56 -2% -.6% 186 42% 50% AI/200=185 50 PMU --- 1.01 -13% -1.4% 185 19% 47% 51 SJR Shaw Communications 24.15 13% 4.8% 185 53% 50% 52 ITU --- 43.11 -5% -2.3% 185 53% 55% 53 SY --- 22.38 -9% -5.1% 185 39% 50% |

| New

Highs

NYSE / NASDAQ / ASE Stocks highlighted in Blue might well be considered for purchase. ========================== NYSE ============================================================ ANW 25.95 +3.36 IP21=.22

new issue OBV NH and ITRS>.30

Aegean Marine Petroleum Network Inc.

MT Arcelor Mittal $68.25

APB 29.72 +.50 IP21=.10 OBV NC

Asia Pacific Fund, Inc. (The)

BDE 19.65 +.35 .25 breakout was at 18. Bois D'Arc Energy, Inc. CHL ***CHL 172 70.02 +1.82 China Telecomm

Shows how first out of the gate in mid-August succeed.

China Mobile (Hong Kong) Ltd.

EDO 51.51 +.54 .40 Close to B12 also B20 Up from 39 breakout in August, EDO Corporation FFH 244.13 +10.56 .28 Fairfax Financial Holdings Ltd FTI 55.28 +1.63 .32 Shows importance of keeping track of earlier Accum bulges.

FMC Technologies, Inc. Breakout here was at 48.

GSC new issue Goldman Sachs Group, Inc. $54.66 GCH 38.25 +1.46 .35 AI/200=109 Target=48. Greater China Fund, Inc. HHV 29.78 +.12 <0 HealthShares Exchange-Traded Funds K 56.15 +.68 .10 AI/200=101 OBV NC Kellogg Company MCD AI/200-150 55.45 +1.15 .17 Breakout past 4 or 5 previous tops.

Had been number 1 AI/200 DJI stock, now #2.

McDonald's Corporation

MON 73.50 +1.13 .16 OBV NC Monsanto Company NTG 52.88 +.50 .28 OBV NC NATCO Group Inc. $52.88 $52.71 $26.89 NVO 120.82 +1.52 .28 OBV NC AI/200=116 Novo Nordisk A/S PG 67.81 +.35 .35 AI/200=123 Procter & Gamble Company (The) SXE 23.85 +1.63 .02 AI/200=79 Stanley, Inc. SLF AI/200=150 50.71 +.37 .18 OBV NC Sun Life Financial Incorporated TDF AI/200=124 29.69 +.32 .40 (Buy) Templeton Dragon Fund, Inc. VR too new Validus Holdings, Ltd. WAT 65.55 +1.34 .18 OBV confirming. Waters Corporation =========== NASDAQ ============ JRJC China Finance Online Co. Limited $14.99 $14.37 $3.95 *** CFSG 10.14 +.29 .35 B24 February bulge of Accum. China Fire & Security Group, Inc. CMED 38.59 +2.43 .05 China Medical Technologies, Inc. ***CLDA 171 34.50 +.12 .27 Breakout was at 24. See story. Clinical Data, Inc. DTSI 29.72 +1.70 .10 OBV NC Datron Systems DTS, Inc. FWLT 127.48 +1.74 .34 OBV NC Foster Wheeler Ltd. ***FWLTZ 8.53 +.14 .60! New B24 Very strong Foster Wheeler Ltd. (BUY)

GLDN 73.11 +3.36 .02 perfect flat topped breakout

but OBV is lagging. Instructive to watch.

Golden Telecom, Inc. $73.11 $71.62 $29.04

GSIC 25.39 +.59 .02 flat topped breakout on Friday. AI/200=125 GSI Commerce, Inc. $25.39 HCBK 14.74 +.17 .12 AI/200=105 Hudson City Bancorp, Inc. $14.74 PODD Insulet Corporation $21.50 IVGN 81.68 +.56 .20 AI/200=136 OBV NC

Invitrogen Corporation

Invitrogen Corporation engages in the development, manufacture,

and marketing of research tools in reagent, kit, and applications

forms for the life sciences research, drug discovery, and diagnostics

customers, as well as biological products manufacturers.

http://www.invitrogen.com Full Time Employees: 4,835

...Presenting to UBS 2007 Global Life Science Conference, September 25th, 2007

see also http://www.fool.com/investing/high-growth/2007/08/31/a-stem-cell-primer.aspx

ISIS 14.13 +.83 .10 OBV NC Isis Pharmaceuticals, Inc. KTEC 29.72 +.15 .25 Lots of insider buying. (BUY) Key Technology, Inc. NBSC too thinly traded... Buy out. New Brunswick Scientific Co., Inc. $11.43 NUVA 34.85 +.82 .20 AI/200=160 OBV confirms BUY

NuVasive, Inc.

NuVasive, Inc., a medical device company, engages in the design,

development, and marketing of products for the surgical treatment of spine

disorders. Its products are used in applications for spine fusion surgery.

4545 Towne Centre Court

San Diego, CA 92121

Phone: 858-909-1800

Web Site: http://www.nuvasive.com

Full Time Employees: 233

PCLN 158 86.66 +.49 Running up and awaay. IP21=.25

This ll started with a bulge of high

Accumulation in September a year ago.

Priceline.com Incorporated

SGMO 12.01 +.93 .00 AI/200=85 Sangamo BioSciences, Inc. SLAB 40.23 +.53 .20 AI/200=109 Silicon Laboratories, Inc. SMBL 11.83 +.38 .25 AI/200=141 recent spikes of insider buying (BUY) Smart Balance Inc SMBLU too new. Smart Balance Inc SMBLW 5.65 +.46 .25 AI/200=112 Insider buying evident last November.

high volume on Friday NH CHECK THIS.

Smart Balance Inc

SYNA 44.80 +.89 .12 AI/200=154 OBV confirming Synaptics Incorporated WRLS 6.87 +.11 .20 AI/200=180 OBV confirming (BUY)

Frequent past episodes of insider buying.

Telular Corporation

VMEDW Virgin Media Inc. $0.80 ============ AMEX =============== CHN ***CHN 132 47.69 .84 Nice breakout past 4 previous tops. China Fund, Inc. (The) SKN Citigroup Inc. $12.39 CGV Compagnie Generale de Geophysique-Veritas $59.25 CAM Cooper Cameron Corporation $89.24 EWH iShares MSCI Hong Kong Index Fund $20.09 MUB iShares Trust $101.01 FXI IShares Trust FTSE-Xinhua China 25 Index Fund $156.04 JFC JF China Region Fund, Inc. $28.75 $27.93 $16.06 LVS Las Vegas Sands Corp. $120.69 Manulife Financial Corp $39.47 BIK =============================================================================================== ------------------------ Buy B12 ------------------------------------------------------------- =============================================================================================== GHM Graham Corp 42.67 +.10 .55 AI/200=162

Upper band seems to stop stock. But massive Accumulation (BUY)

|

BEARISH STOCKS =============================================================================================== ------------------------ NEW LOWS ------------------------------------------------------------ =============================================================================================== Best - short Only Stocks also with an IP21<-.09 and over $5. Close Change AI/200 IP21 Comments BOW 14.7 -.40 89 -.09 Vulnerable but IP21 still over rising TISI.(SS)

BRN 14.95 -1.04 108 -.28 Breakdown was at 17. IP21<TISI.

CLDN 13.73 -.29 130 -.04 Breakdown was at 14.5

FAC 5.05 -2.7 166 -.65 Down 2.7 on Friday. Previously solid accumulation.

But blue accumulation when stock is declining is

not reliable. Study this.

FUN 23.84 -1.32 125 -.21 Down 1.32 on Friday. Breakdown was below 26.

GEHL 20.64 -.82 138 -.17 Red Buy on Friday.

IMN 25.79 -.53 67 -.12 Very weak. (SS)

JBSS 8.32 -.26 101 -.52 Very weak. (SS)

LCRY 6.74 -.36 67 -.30 Better not to short as there was a big buyer in May.

MGPI 12.66 -.72 58 -.18 IP32=Tisi. Breaking downtrending support line. (SS)

NLS 8.28 -.27 80 -.12 IP32<TISI Friday breakdown. (SS)

NYT 19.80 -.44 48 -.12 IP21<TISI New York Times

OCR 29.57 -.24 68 -.20 Breaking downtrending support line. (SS)

PEIX 10.77 -.29 57 -.12 IP21<TISI (SS)

SHOO 18.76 -.91 116 -.06 Weak dollar making weakness greater. (SS)

TWP 11.34 -.85 46 -.12 Steadily down. (SS)

|

|

_______________________________________________________________________________________

___________________________________________________________________________

....... END OF REPORT .....................