Much Abbreviated Elite Report from Tiger Software

8/19/2007

Necessarily this is a very brief review of only two methods for pickling stocks to

buy, if you think the Fed will be able to hold up the market. That is their intent.

Amd they usually try to do this in the year before a Presidential Election with a

Republican in the White House. See lengty Blog on this subject.

APAGF Apco Argentina 99.96 earlier big bulges of Accumulation. OBV is lagging now.

AI/200=179 Thin

ARDNA Arden Group 161.00 +9.95 Recent High Accumulation Bulge. OBV is lagging.

ARJ Arch Chemicals 42.55 OBV confirms NH but IP21<.10

BRKB 3948 +156.5 OBV NC

EXPO Exponent 25.31 +.20 OBV NC Earlier bulge of Accumul;ation AI/200=137

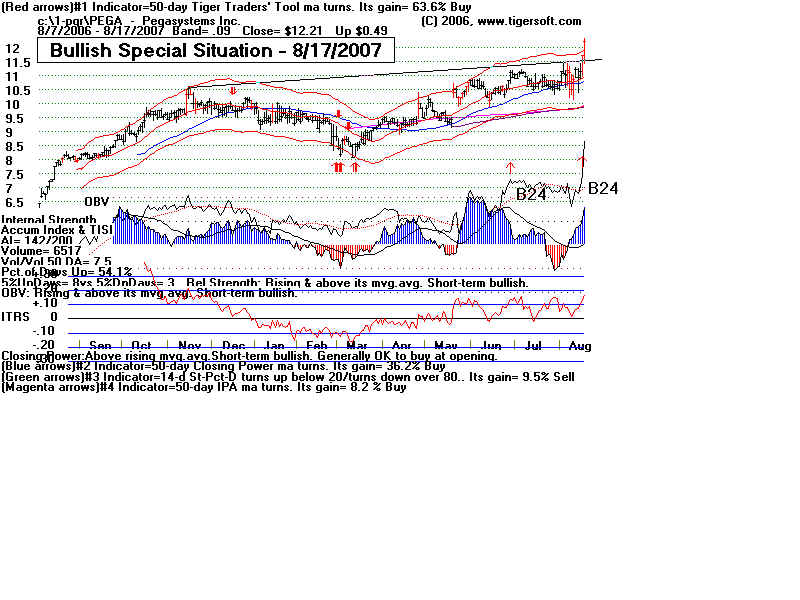

PEGA Pegasystems Inc. 12.21 +.49 (BUY) See below.

RADS Radiant Systems 16.10 +1.10 (BUY) See below.

SURW 31.30 +2.12 OBV NC

ALTR 76,9 AI/100=111 ... Just below 50-day ma. Should bounce to 24.75.

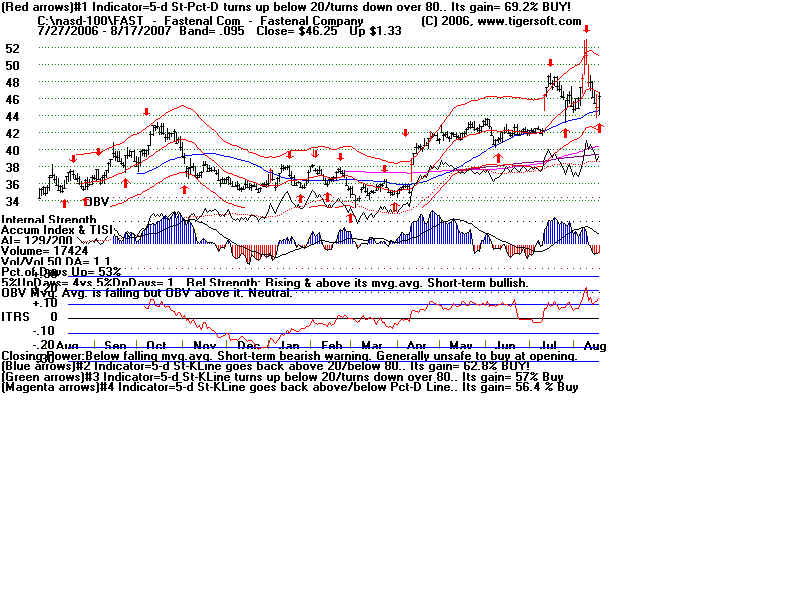

FAST 46.25 AI/200=129 ... up on Friday nicely from rising 50-day ma. (Buy) see Below

48 is target because of potential head and shoulders pattern.

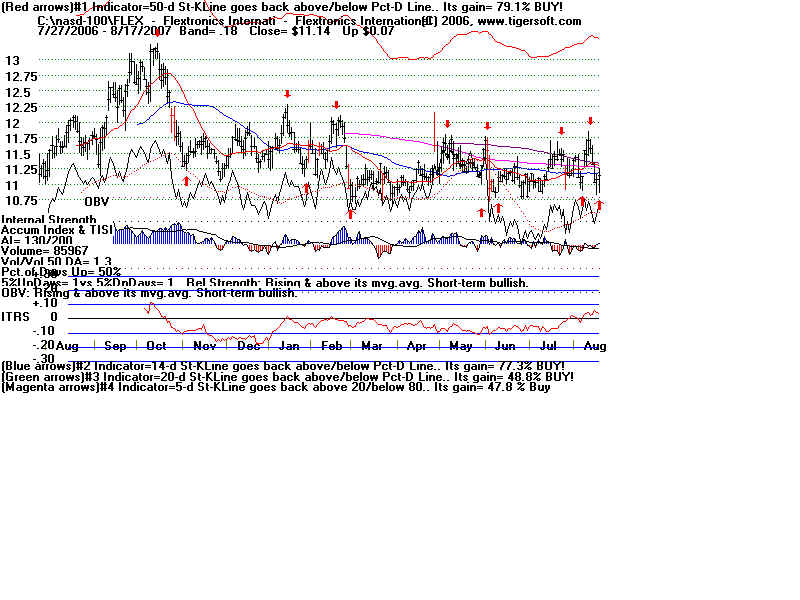

FLEX 11.14 +.07 Use 14 day Stochastic... This system has gained 77.3%

MCHP 37.84 +.90 up from rising 200-day ma. AI/200=114

SIRI 2.79 AI/200=43... Too much distribution!

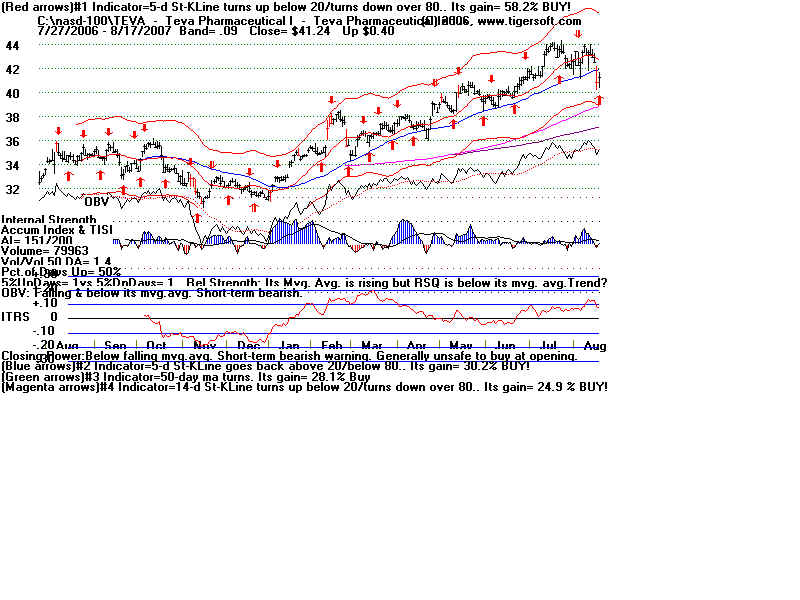

TEVA 41.24 +.40 up from lower band. AI/200=151. (Buy) See below