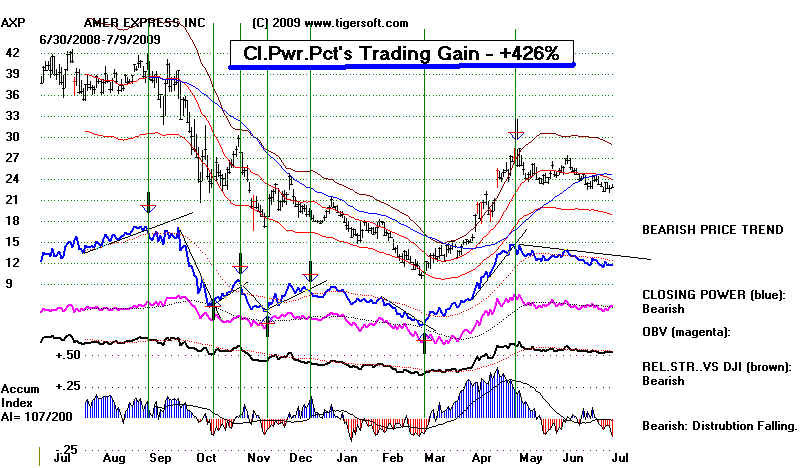

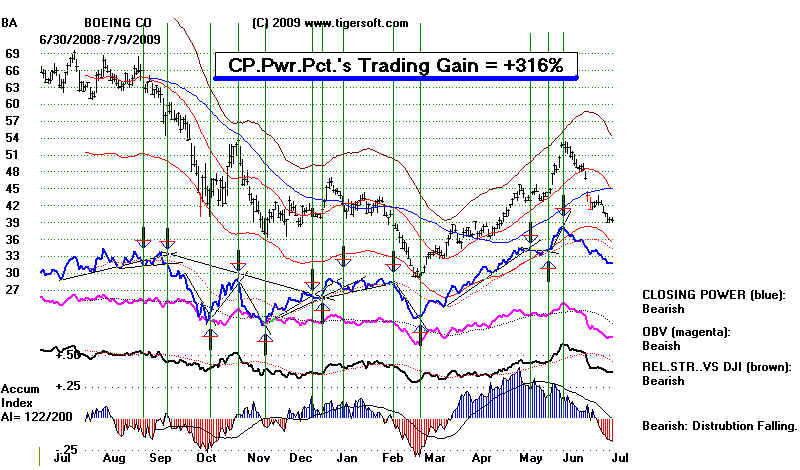

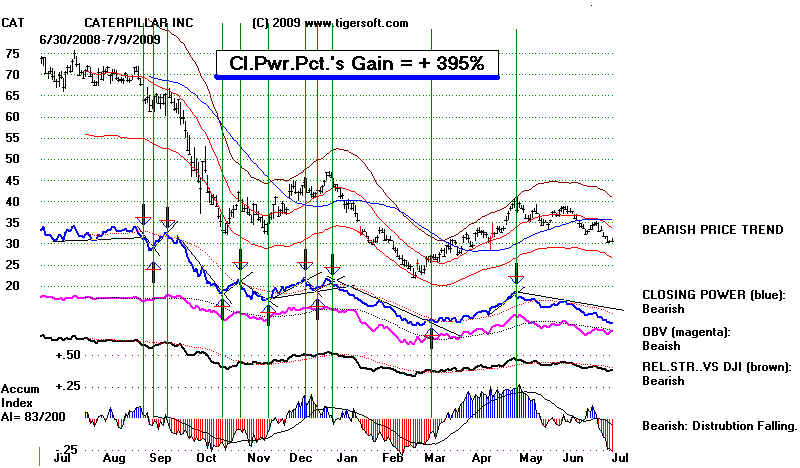

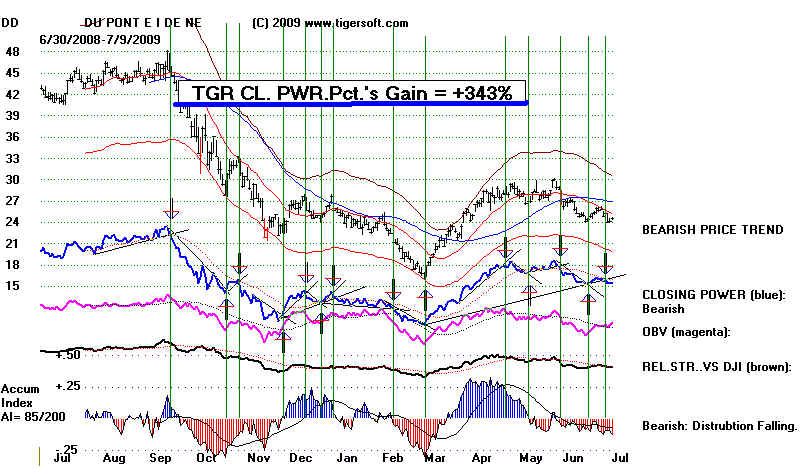

TigerSoft's Closing Power Percent

(C) 2009 William Schmidt, Ph.D.

March 12, 2009 from MW, Phoenix - a Professional Money Manager.

"Bill, your work is solid and that's why I took the trade. I know you deeply care about what the accuracy

of the information you print. What I respect most about you Bill is your hard work, your a very good market

technician-at times brillant, and most importantly your a man of conscience...Tiger Software has some great

strengths: your work on closing power was a game changer for me. Also, the 4 combinations: Accumulation,

OBV, Closing Power, and Relative Strength work was most helpful

Simply trade the trend-changes. The rules are simple.

A break in a rising Closing Power trend is a Sell. A break in a falling

Closing Power trend is a Buy. This simple approach catches

nearly all significant moves in whatever you trade. Here are some

examples: Crude Oil, Gold, Silver....

The gains even with DJIA-30 stocks are amazing. Below are

charts of the five stocks DJIA-30, taken randomly....

The simple rules keep you in position to ride each significant

trend. Of course, you will want to pick the best stocks to Buy

using TigerSoft's Accumulation Index and Power Ranker.

The returns here are based on the assumption that one starts

with $10,000 and fully invests all proceeds with each Buy and Sell.

Short positions are taken on Sells. It is further assumed that the

cost of each closed out position is $40 and that positions are taken

at the opening on the day after the Buy or Sell.